LITTLETON, Colorado, Jan 22 (Reuters) – Judging by state and local filings alone, the U.S.’ data center computing capacity could jump by close to 1,000% if all projects currently planned come to fruition.

That’s a big “if,” however, as it is widely known that some of the plans filed by so-called hyperscalers are more aspirational than hard commitments and will likely be withdrawn if development or grid interconnection takes too long.

Other project estimates likely deliberately inflated the computing capacity that is expected to be constructed, in the hopes that large-scale projects may be eligible for local government support and attain leverage in zoning negotiations.

That said, it is clear that a huge swell in overall data center computing heft – and power consumption – can be expected across the country, which will have sizeable repercussions for local electricity markets, utilities and other businesses.

To help assess which states face the biggest potential impact from the data center build-out, here is a breakdown of where the planned capacity additions are due to be located – and how state electricity supplies and prices have been trending.

COAST-TO-COAST

One of the standout features of the data center capacity pipeline is how widely spread the development plans are across the country.

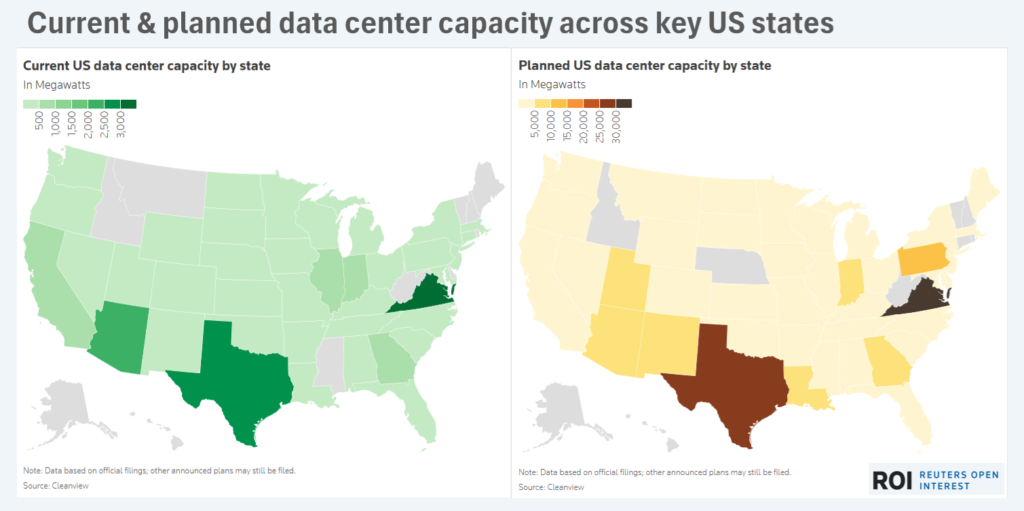

Current & planned data center capacity across key US states

In total, plans for just over 150 gigawatts (GW) of new data center power capacity have been filed nationally, with 24 different states planning or building at least 1 GW of new capacity, according to Cleanview, an energy data portal.

Given that total current U.S. data center capacity is just under 15 GW and that only three states – Virginia, Texas and Arizona – have more than 2 GW in current operation, the planned capacity building boom is potentially transformational.

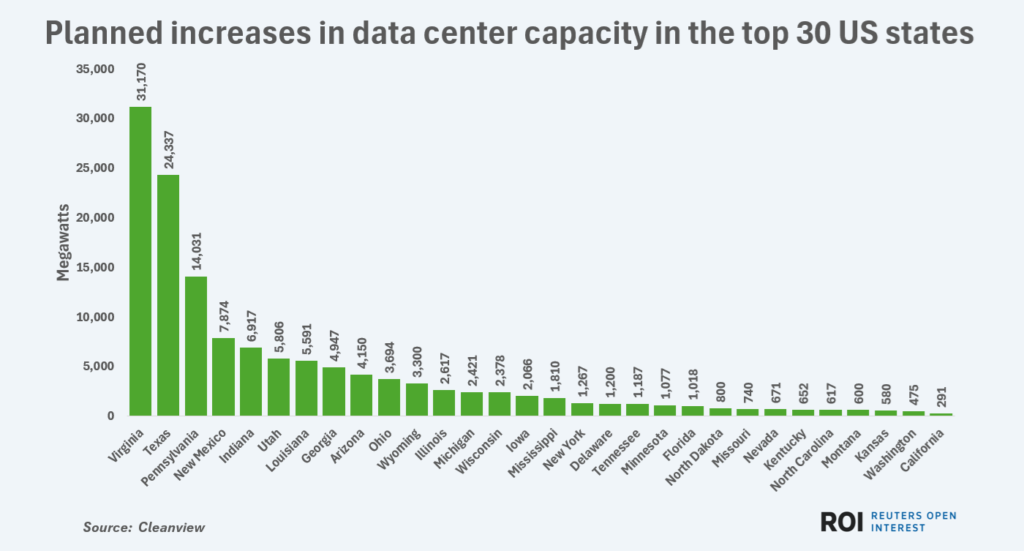

The proposed sites span from North Dakota to Alabama, but some states have chunkier development pipelines than others.

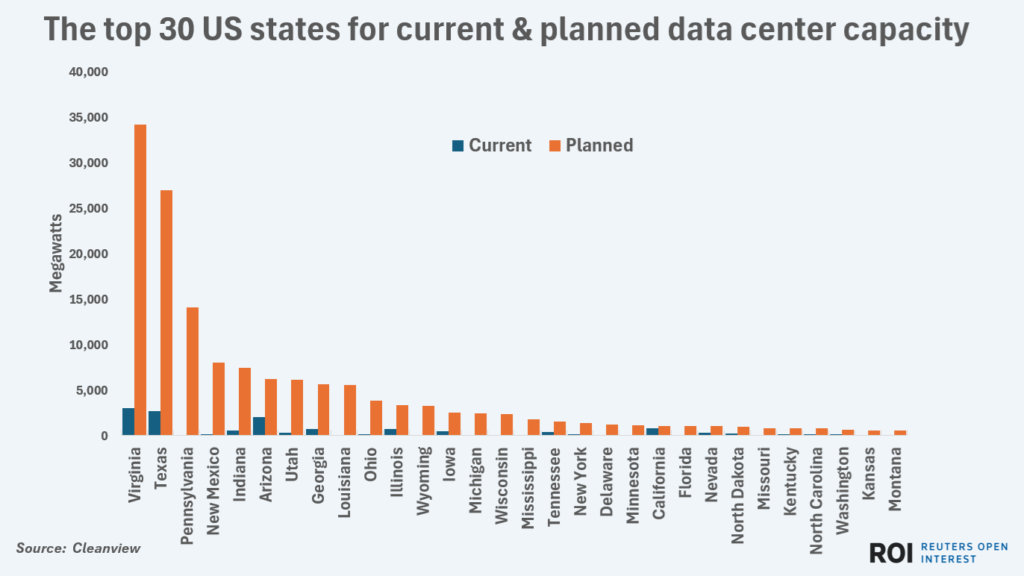

The top 30 US states for current & planned data center capacity

Virginia – already called the country’s data center alley – plans an eleven-fold rise in computing capacity, which will maintain the state’s lead in data center heft with close to 35 GW in development.

Texas ranks second with around 27 GW of capacity plans, while gas-rich Pennsylvania ranks third with a capacity pipeline of around 14 GW.

Outside of those already established hubs for energy-intensive industry, New Mexico, Indiana, Arizona and Utah also have hefty capacity plans in the works, with more than 25 GW of additional capacity planned between them.

Planned increases in data center capacity in the top 30 US states

Other notable states with plans to bring on massive new capacity include Georgia, Louisiana and Wyoming, which each plan to build more than 3 GW of new computing power.

POTENTIAL ROADBLOCKS

The mere prospect of a data center boom has already resulted in gridlock within utility planning systems and yearslong waiting lists for new power generating equipment, especially gas power turbines – before shovels have even hit the dirt.

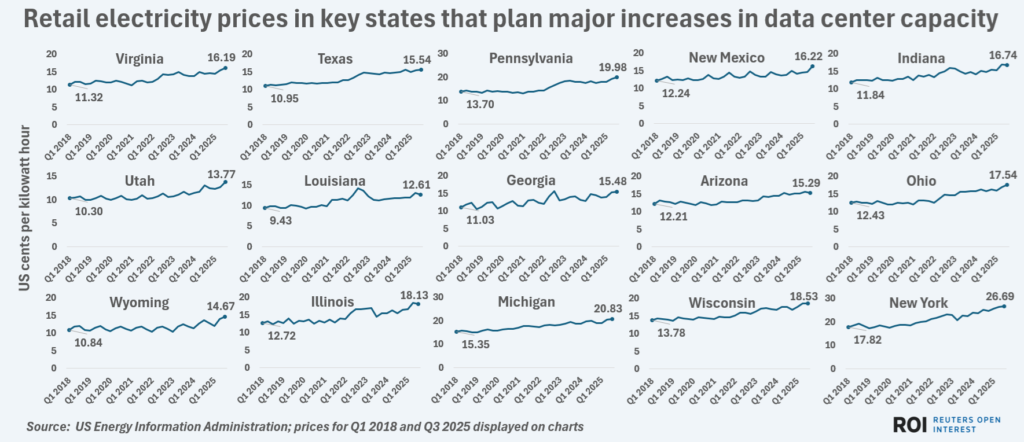

Electricity prices – already buoyed in nearly every market as utility systems upgrade grids and transmission networks – have also risen as data center chatter intensified in key markets.

Among the top 15 states for planned new data center capacity, electricity prices for residential customers have climbed by an average of 16% since the start of 2024, according to data from the U.S. Energy Information Administration.

That price gain compares to a 10% rise in national residential electricity prices over the same period and indicates that hefty data center capacity pipelines may come with a side of local rate inflation.

Retail electricity prices in key states that plan major increases in data center capacity

Thankfully for large energy consumers, utility-scale supplies of electricity have increased at an even faster rate across the country – especially in the states where large data center demand loads are set to emerge.

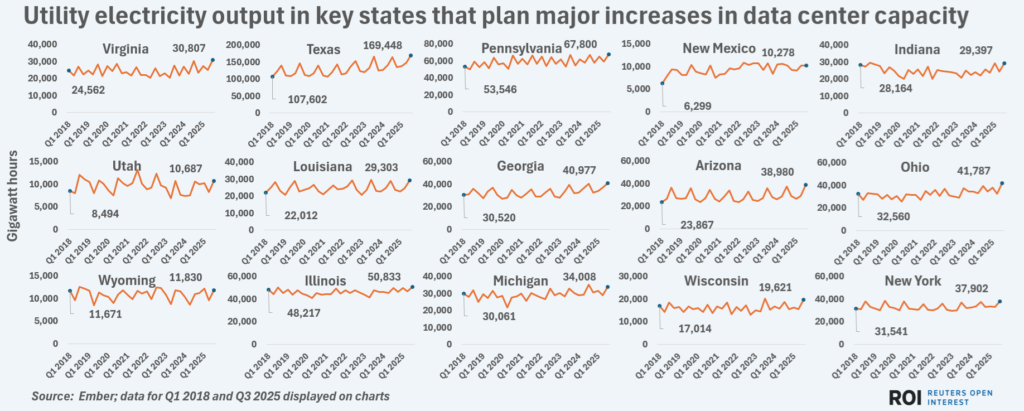

Total electricity output across the same 15 states with the largest data center capacity pipelines has increased by an average of 22% since the start of 2024, data from think tank Ember shows.

Utility electricity output in key states that plan major increases in data center capacity

That growth rate slightly exceeds the national electricity supply expansion of 21% over the same period and suggests that utilities in those states may be outworking their peers in an effort to make the data center capacity dreams a reality.

The opinions expressed here are those of the author, a columnist for Reuters.

Reporting by Gavin Maguire; Editing by Thomas Derpinghaus

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS