By Javier Blas

John D. Rockefeller, the godfather of the modern oil industry, called his tactic of purposely crashing oil prices and sending the stocks of his rivals into a tailspin “a good sweating.” Soon after, he’d conveniently buy shares cheaply. For the following century, one of the few certainties of petroleum investing was that low crude prices are bad for Big Oil.

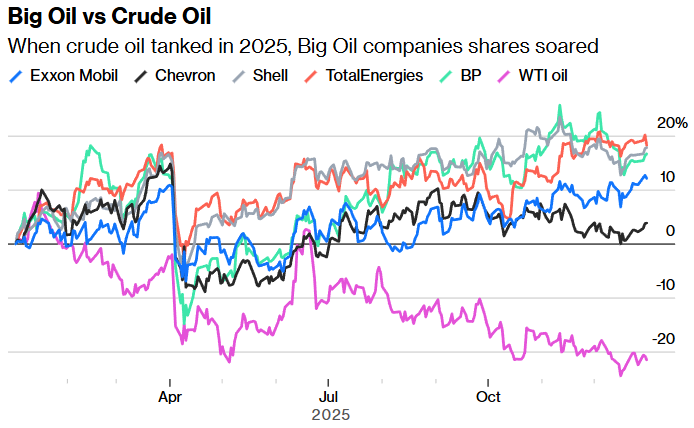

That remained true until last year, when oil company shares rose while the cost of a barrel of crude plunged. For some investors, it marked the beginning of a new paradigm. I was never 100% convinced, and now cracks are starting to appear: It doesn’t look like the sector can sustain its outperformance versus the commodity market. A reckoning likely looms in 2026.

Last year, West Texas Intermediate, the US oil price benchmark, and Brent crude, its European counterpart, dropped by about a fifth. But shares of the world’s largest international oil companies — including Exxon Mobil Corp., Chevron Corp, Shell PLC, TotalEnergies SE, and BP Plc — rose anywhere from 4% to 18%.

Source: Bloomberg

Data is normalized with percentage appreciation as of January 2, 2025.

Behind the breakaway performance is an industry that in many ways is being managed a lot more like Rockefeller’s Standard Oil Co. a century ago. The American oil tycoon had an infamous attention to strict cost controls, down to the very last cent. For example, his employees used machines that applied 40 soldering drops to seal the lids on five-gallon cans of kerosene. “Have you tried 38?,” Rockefeller asked during an inspection tour. While the number the boss suggested wasn’t enough — some cans would invariably leak — trial-and-error tests demonstrated that 39 always sufficed. That single drop of tin solder delivered cost savings of $2,500 in the first year — about $100,000 in today’s money.

Today’s oil executives are similarly focused on saving billions of dollars in recurrent spending, in some cases by firing a large chunk of the staff. In the most significant moves, Chevron and Shell have both announced plans to reduce their workforces by as much as 20%.

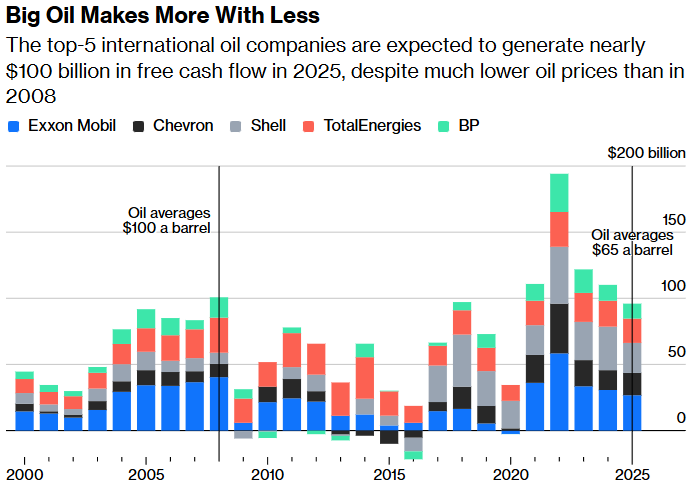

By reducing spending on both day-to-day operations and on new projects, companies have been able to offset the impact of lower commodity prices. Higher production has also helped. The data says it all: The top five international oil companies are expected to have generated free cash flow — the measure between cash generation and expenses — of nearly $96 billion in 2025, when WTI oil averaged just under $65 a barrel. That’s almost the same as in 2008, when WTI averaged more than $99 during the commodity boom.

Source: Bloomberg

Note: 2025 is Bloomberg consensus

As companies generate more free cash flow, executives are able to boost dividends and sustain multi-billion dollar buyback programs even when commodity prices weaken, as is now the case. The result? Investors are re-rating Big Oil’s shares. The timing couldn’t be better: Fossil fuels aren’t as unpopular today as they were five years ago, and that means more investors are willing to buy oil company stocks even while crude prices are depressed.

The sector has another cushion: The cyclical downturn comes after the oil majors used the commodity windfall of 2021-2023, after Russia invaded Ukraine, to reduce debt. With the exception of BP, all the top oil companies could re-leverage to sustain dividends and buybacks — to a point.

But capital discipline and debt reduction alone won’t sustain their shares forever. It’s early days, but so far this year WTI crude has averaged $58 a barrel, significantly lower than the nearly $75 a barrel of the first two weeks of 2025, suggesting further downside to the sector’s free cash flow. The problem is exacerbated by simultaneously lower natural gas prices, plus weaker refining and chemical margins. Put it all together and it’s difficult to see how Big Oil can sustain its outperformance this year if oil remains, as I expect, in the doldrums.

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS