Dec 10 (Reuters) – Shares of GE Vernova (GEV.N) surged to a record high on Wednesday after the power-equipment maker forecast higher revenue for 2026 and raised its buyback program by $4 billion.

Surging electricity demand from artificial intelligence and other data-heavy industries is driving strong growth across the company’s grid and gas-turbine businesses.

The company’s investor day “fired on all cylinders,” William Blair analyst Jed Dorsheimer said.

He noted all available production slots for GE Vernova’s turbines are sold out through 2028 and expects visibility to extend to 2030.

GE Vernova estimated 80 gigawatts (GW) of signed combined-cycle gas-turbine contracts by the end of the year, it said in a separate filing.

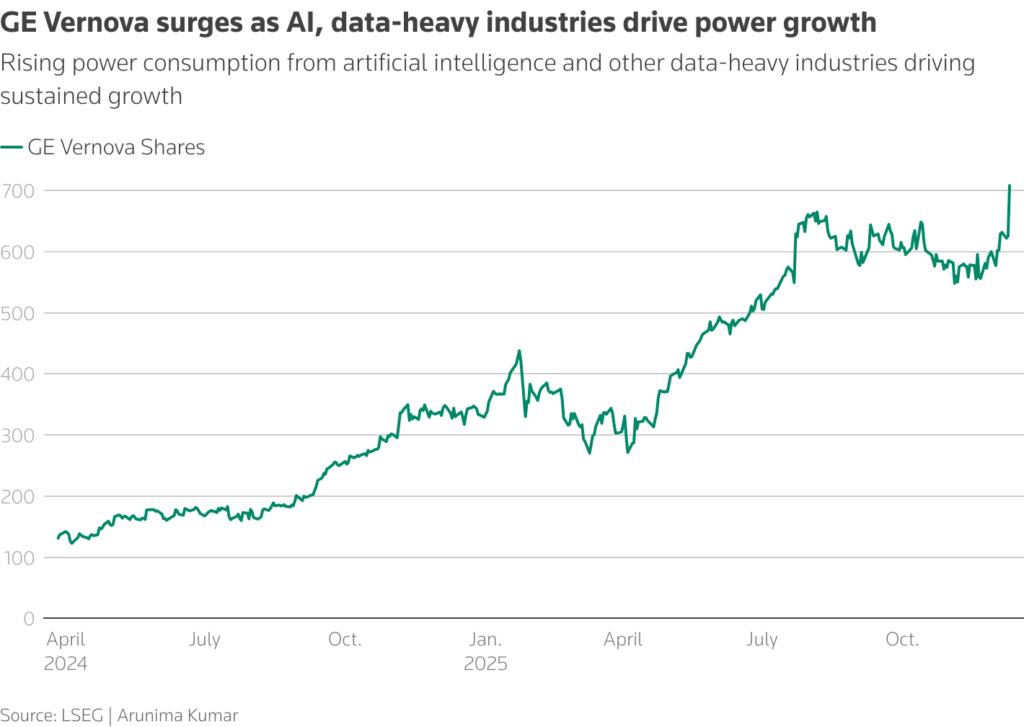

Shares of the company, which doubled its quarterly dividend to 50 cents per share, hit an all-time high of $725 earlier in the session. They were last up more than 12%.

The stock has climbed more than 430% since the company’s spin-off from General Electric (GE.N) in March 2024.

Share price of GE Vernova

At least six brokerages raised their price targets on the stock, with J.P. Morgan setting a Street-high $1,000 expectation.

GE Vernova, which raised its share repurchase authorization to $10 billion, expects annualized output of gas turbines to reach 20 GW by mid-2026, and about 24 GW in 2028.

Dorsheimer said the rise in deliveries was expected after rivals Siemens Energy (ENR1n.DE) and Mitsubishi Heavy Industries (7011.T) lifted their own targets.

GE Vernova expects 16% to 18% organic revenue growth in its power segment and 20% growth in its electrification business in 2026.

“The outlook leaves room for further outperformance,” analysts at RBC Capital said.

GE Vernova projected free cash flow of $4.5 billion to $5.0 billion next year, topping the $3.5 to $4 billion it expects in 2025.

The company is working with the U.S. government to boost yttrium stockpiles to reduce dependence on China for a rare earth used in energy, aerospace and semiconductor applications, CEO Scott Strazik said.

Reporting by Arunima Kumar and Yagnoseni Das in Bengaluru; Editing by Vijay Kishore, Leroy Leo and Sriraj Kalluvila

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS