By Ron Bousso

LONDON, Dec 1 (Reuters) – European countries are loosening their strict opposition to new oil and gas drilling, reversing years of climate-driven resistance to fossil fuels as governments seek to reduce a heavy reliance on costly energy imports, including from the U.S.

The change in tack in Greece, Italy and Britain reflects a new paradigm shaped by the 2022 energy price shock: an acceptance that fossil fuels – natural gas in particular – will remain a key part of the energy mix for decades, even as the region also builds out renewables capacity to slash greenhouse gas emissions.

The European Union depends on gas imports for 85% of its consumption, according to Eurostat, compared with a peak domestic production of 50% of demand in the 1990s.

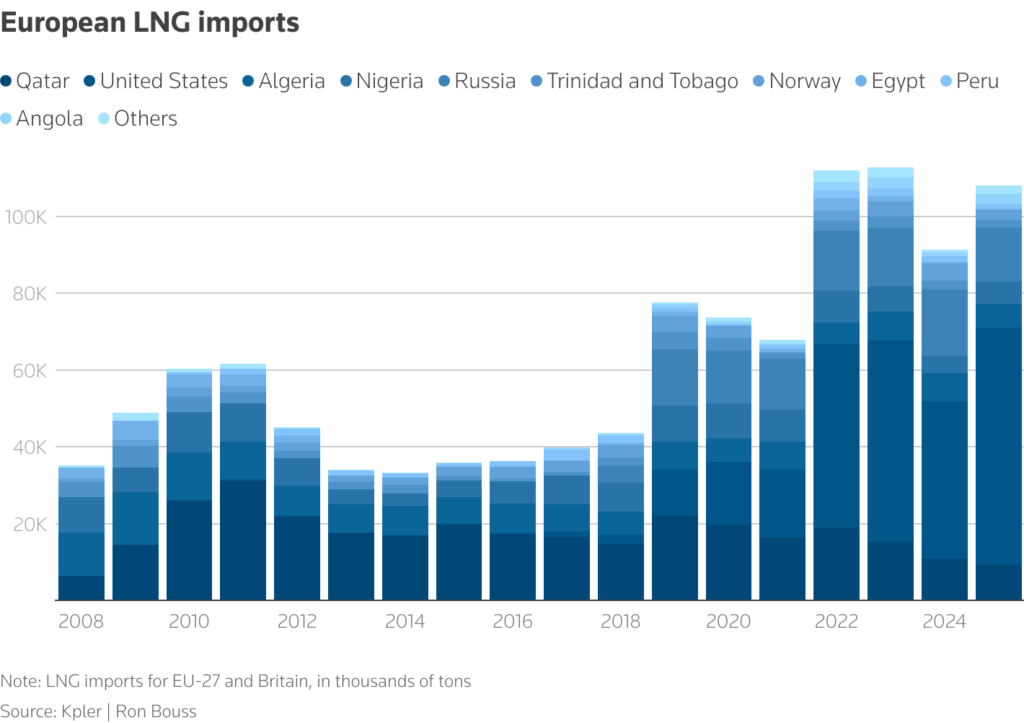

Since Russia’s full-scale invasion of Ukraine in 2022, Europe was forced to replace at a huge cost its reliance on pipeline Russian oil and gas with imports of liquefied natural gas (LNG) and crude, primarily from the U.S., which today accounts for 16.5% of the EU’s total gas consumption.

Developing new domestic production would therefore allow Europe to reduce its reliance on gas imports and potentially benefit from lower energy costs.

Europe’s natural gas production

GREECE SHIFTS GEARS ON GAS

The change is stark in Greece, which in November issued its first offshore oil and gas exploration licence in over four decades to a consortium of Exxon Mobil (XOM.N), Energean (ENOG.L) and Helleniq Energy (HEPr.AT).

The Block 2 licence in the Ionian Sea could hold as much as 200 billion cubic metres of gas, according to some estimates, though the exact scale and cost of developing the resource will only be known after extensive drilling, which is expected to begin in late 2026 or early 2027.

“It’s a big change in policy for Greece that has shifted from ‘we don’t want hydrocarbons, only renewables’, to a new narrative that exploration for gas is key for energy security,” said Mathios Rigas, the CEO of Energean, which will lead the exploration campaign. If commercial, the field will not start production before 2030.

Greece, which itself consumes only around 6 bcm of gas per year, hopes to develop the gas and export it to other European markets.

Greece also awarded Chevron (CVX.N) and Helleniq exploration rights in blocks south of the Peloponnese peninsula.

ITALY, BRITAIN CHANGE TACK

In neighbouring Italy, Giorgia Meloni’s government is also considering reviving offshore oil and gas exploration, which was suspended in 2019. Shell (SHEL.L), the country’s top producer, last week said it was willing to invest more in upstream production.

In Britain, the government last week loosened its strict ban on new exploration activity in the North Sea to allow companies to expand production in existing fields. It is also expected to give the green light to two major new fields in the coming months.

A major oil discovery in Poland earlier this year also sparked renewed interest in the country’s offshore prospects, while in Norway, the region’s largest oil and gas producer, state-backed Equinor plans to drill 250 exploration wells over the next decade to sustain production.

Some countries buck the trend. Denmark in 2020 banned all new exploration, though it does allow some limited activity, and aims to halt its North Sea production by 2050. The Netherlands in 2023 banned new onshore fields, though it allows offshore exploration.

Europe LNG imports

THE U.S. CONUNDRUM

U.S. President Donald Trump’s administration has encouraged Europe to expand its fossil fuel production. Trump has berated Britain for restricting oil and gas activity in the North Sea.

U.S. Energy Secretary Chris Wright, who attended the Block 2 award signing ceremony in Athens along with Interior Secretary Doug Burgum, said the development of the field would help Europe displace Russian energy.

Growing Europe’s domestic production would also reduce its dependence on LNG imports, including from the U.S.

In that context, the energy security drive appears to contradict the EU’s pledge under a trade deal reached in July to more than triple U.S. fuel purchases over the next three years to $750 billion, though the target appears unrealistic.

To be sure, the revival of oil and gas activity in Europe does not radically change the region’s long-term climate aspirations, nor will it dramatically increase its domestic production. The EU and Britain both aim to achieve carbon neutrality by 2050 by expanding renewables and phasing out fossil fuels, which are responsible for three-quarters of carbon emissions.

Ron Bousso Editing by Marguerita Choy

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS