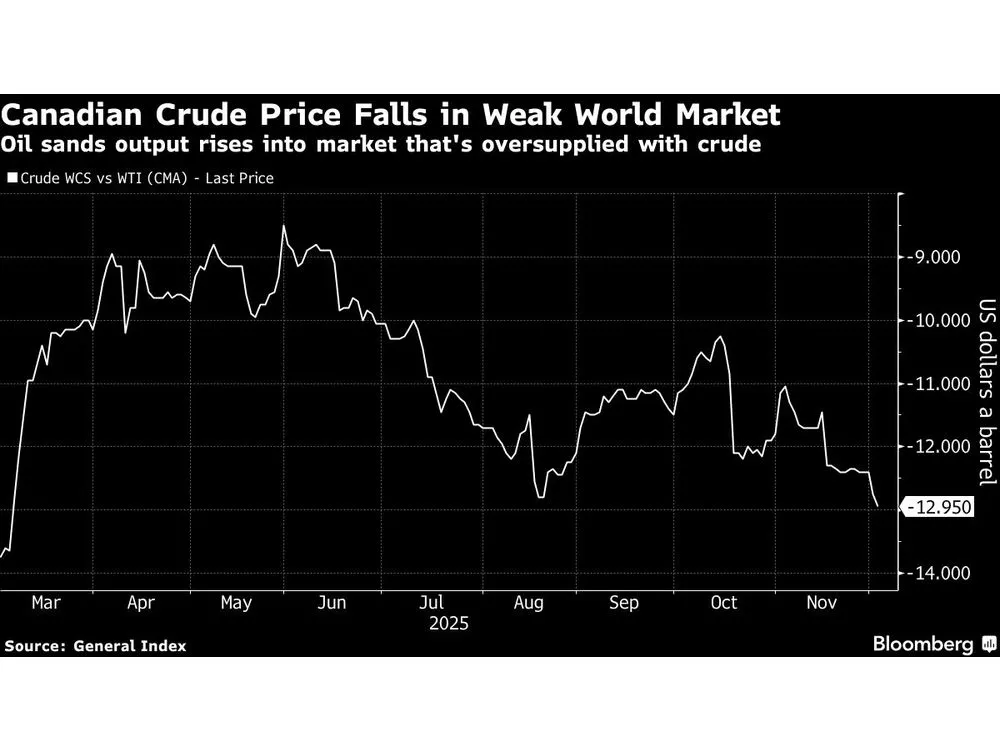

Heavy Western Canadian Select fell to US$13 below West Texas Intermediate on Tuesday

By Robert Tuttle

Canadian crude prices have fallen to their weakest relative to the U.S. benchmark since March as surging production from Alberta meets an already well-supplied world market.

Heavy Western Canadian Select, traded in Alberta for January, fell to US$13 below West Texas Intermediate on Tuesday, according to data from brokerage Modern Commodities. That’s the biggest discount since March, when the Trump administration briefly imposed 10 per cent tariffs on Canadian oil.

On the U.S. Gulf Coast, Canadian heavy crude for January is trading US$4.55 shy of WTI, the widest discount since January, according to Link Data Services.

The slide in Canadian prices comes as the return of rationing on the country’s biggest crude export pipeline system signals output is soaring after seasonal oil-sands mine maintenance in October. Canada’s production is adding further bearish pressure to the global market as the first major glut since 2020 emerges, with U.S. futures now trading below US$60 a barrel. Demand growth is faltering as U.S. President Donald Trump’s tariffs weigh on economies around the world, while China struggles with a property-market downturn and lackluster consumer spending.

Volumes on the expanded Trans Mountain Pipeline, Western Canadian producers’ sole conduit for shipping crude to Asia and the US West Coast, are poised to dip in December due to the buildup of stored volumes of oil on tankers around the world, Trans Mountain Corp. chief executive Mark Maki said on Friday.

Bloomberg.com

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS