By Emily Forgash and Mark Chediak

US President Donald Trump hates wind power. His administration has made a concerted effort to thwart the industry. Trump issued a directive within hours of his return to the White House in January that froze new permitting for wind energy and ordered officials to consider terminating existing leases.

But his campaign — which cast a pall over the wind industry, triggering project delays and some cancellations — has run into legal problems. A federal judge ruled on Dec. 8 that Trump’s decree was illegal. Earlier, in September, a different federal judge suspended an order the administration had issued to stop work on Revolution Wind — a large, nearly completed wind farm off the coast of Rhode Island.

Still, the US wind industry’s troubles are far from over.

What does Trump have against wind energy?

Trump has been a vehement critic of wind turbines for years, falsely claiming they cause cancer and deriding them as bird-killing eyesores. Before his first presidential term, Trump sued Scottish authorities to prevent an offshore wind project from being built within sight of a golf course he owns in Aberdeen, but he lost in court. “Windmills are a disgrace,” he said in July after a visit to the course. “They hurt everything they touch. They’re ugly.”

On that and other occasions, Trump has said that wind turbines are inefficient. He’s claimed, incorrectly, that they are “the most expensive form of energy there is.”

How do the costs of wind energy compare with alternatives in the US?

Based on the long-term price a power plant needs to charge to break even, an offshore wind farm is much more expensive than a new gas-fired facility in the US. It’s cheaper than nuclear with or without subsidies, according to a BloombergNEF assessment published in February. Meanwhile, like solar, onshore wind with tax breaks is cheaper than a new-build gas plant. Without the tax breaks, some wind and solar projects would still be price competitive. Whether subsidized or not, onshore wind is cheaper than coal, and unsubsidized offshore wind is cost-competitive with it, according to BNEF.

What was Trump’s directive targeting wind projects?

Trump’s directive, issued in the form of a memorandum to high-level administration officials, effectively froze offshore wind development. It stipulated that no new wind projects would be authorized in ocean areas controlled by federal rather than state authorities, which is where most major offshore wind farms are located. In addition, the edict suspended the issuance of new or renewed federal authorizations for all wind farms. Projects on federal lands or waters require such approvals, as do other projects whose transmission lines cross a federal waterway or public land.

The freeze on federal approvals was meant to last while the administration reviewed permitting practices during the presidency of Trump’s predecessor, Joe Biden, who championed wind energy. Trump administration officials have argued that under Biden, offshore wind projects were given preferential treatment, to the detriment of other energy sources. Trump has called for more power to be generated from natural gas, coal and nuclear energy.

His decree also directed the Interior Department to review the “necessity of terminating or amending any existing wind energy leases” and to identify “any legal bases for such removal.” Accordingly, the administration in August ordered work halted on the Revolution Wind project when it was 80% completed.

Wind companies and local government officials have warned that the administration’s actions against the industry put jobs and billions of dollars in investments at risk.

What have the courts said?

Ruling on a legal challenge to Trump’s directive brought by more than a dozen US states and a clean energy group, US District Judge Patti Saris threw out the order entirely. She said the edict was “arbitrary and capricious” in violation of the Administrative Procedure Act, which governs how federal agencies develop and issue regulations.

In a separate lawsuit, the developers of the Revolution Wind project, Orsted A/S and Global Infrastructure Partners, made the same argument in challenging the administration’s stop-work order. After concluding that they were likely to win the case, US District Judge Royce Lamberth issued a preliminary injunction, enabling work on the project to continue pending the final outcome of the suit. Orsted Chief Executive Officer Rasmus Errboe has said the company expects to complete Revolution Wind by the second half of 2026.

What effect will the ruling on Trump’s directive have?

Wind industry advocates have hailed Saris’ December decision as a victory. Marguerite Wells, executive director of Alliance for Clean Energy New York, said it will allow projects to be judged on their merits.

However, analysts with ClearView Energy Partners, an energy policy research firm, argue that the win could prove to be merely symbolic. The administration is expected to appeal the ruling, which could extend the legal uncertainty for at least another year. In addition, Trump’s opposition to offshore wind farms especially has already dampened the interest of project investors and developers, and the cloud could last beyond Trump’s presidency, according to ClearView.

There’s nothing in the judge’s ruling compelling the administration to issue new leases or approvals for wind projects. Agencies can still reject permit applications or slow-walk reviews, ClearView said. There’s a precedent for this from the Biden presidency. A federal court suspended a policy of the Biden administration to stop issuing companies licenses to export natural gas to countries without free-trade agreements with the US. Even so, the moratorium continued informally.

As part of Trump’s “drill, baby, drill” agenda, his administration is making it easier to explore for oil and gas on millions of acres of federal land and waters while imposing standards that essentially prevent new installations for producing renewable energy, including wind farms.

What’s the outlook for the US wind industry?

The industry’s woes pre-date Trump’s second term. It struggled during Biden’s presidency even as he provided tax credits and financial support for renewable energy. Inflation was a particular challenge. The cost of wind farm components, including the raw materials that go into the towering structures, increased during the Biden years. Rising interest rates also drove up developers’ financing costs. As a result, the cost to produce wind power rose. Just a few years ago, companies were making plans — and signing massive power contracts — based on projections that they could produce electricity at a cost of $77 per megawatt hour, according to BNEF. But by late 2023 that figure had jumped 48% to $114.

Source: BloombergNEF

In late 2022 — two years before Trump won a return to the White House — developers began to announce that their projects had become unprofitable. A number of them were either delayed or canceled. In late 2023, for example, Orsted dropped two offshore wind projects and took a $4 billion writedown.

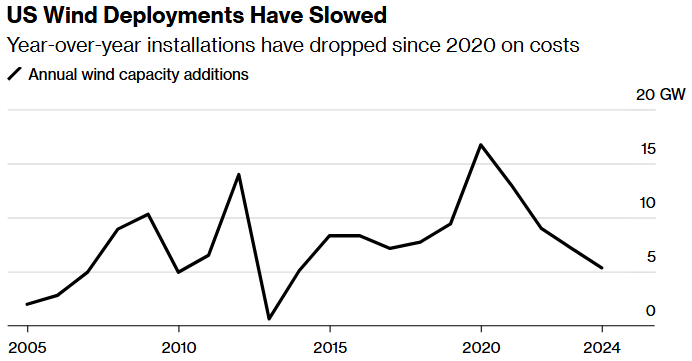

In 2024, wind turbine installations in the US shrank for a fourth year in a row, to the lowest level in a decade, according to BNEF. The US also fell out of the top three turbine makers for the first time that year. By contrast, globally, installations, driven by rapid growth in mainland China, hit a record for the second year in a row in 2024. Mainland China accounted for six of the top 10 turbine makers worldwide.

The US industry is set to bounce back over the next few years, according to a report published Dec. 18 by the research and consultancy company Wood Mackenzie and the American Clean Power Association. They project that the US will add more than 7 gigawatts of new wind installations in 2025, a 36% jump over the previous year, and that in the subsequent two years it will add 10.7 gigawatts and 12.7 gigawatts.

As of 2028, however, new installations are projected to start falling again because of project cancellations and permitting and other challenges.

— With assistance from Jennifer A Dlouhy

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS