Only the fast and the competitive will prosper in changing times.

WUDONG, a liquefied natural gas (LNG) tanker, fills up at an LNG Canada facility, in an aerial view, in Kitimat, B.C., on Thursday, November 13, 2025. THE CANADIAN PRESS/Ethan Cairns

By Resource Works

More News and Views From Resource Works Here

Now that two major LNG proposals in B.C. have the full backing of the federal government, the final hurdle to final investment decisions is an economic one.

Can the owners of LNG Canada and Ksi Lisims LNG lock up enough bankable long-term contracts to justify billions in capital spending at a time when a wave of new LNG supplies threaten to create a global glut?

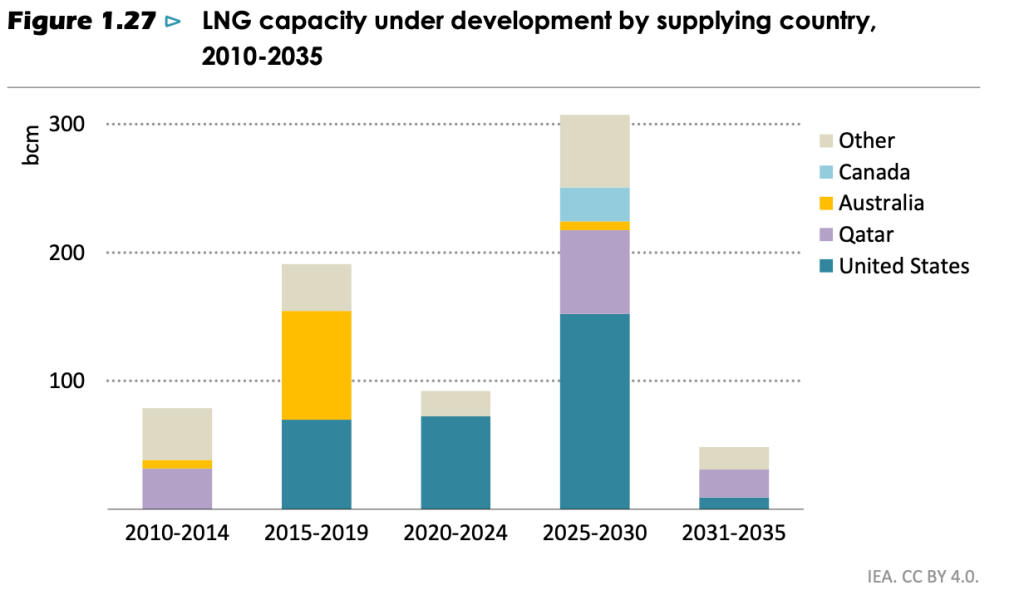

Several new global energy forecasts warn that, while the demand for natural gas and LNG is strong and now expected to continue growing into the 2040s, a wave of new LNG supply coming online, mostly from the U.S., could create a glut and drive LNG prices down.

That could pose challenges for new entrants and higher cost producers, and lends urgency to getting projects sanctioned in time to meet demand windows.

Both the Ksi Lisims LNG and a phase 2 expansion of LNG Canada have all the required environmental certificates in hand, and the full backing of the federal and provincial governments and key First Nations like the Haisla and Nisga’a.

One of them – Ksi Lisims – still needs to build a pipeline, while LNG Canada already has a pipeline: Coastal GasLink.

Both LNG Canada phase 2 and Ksi Lisims LNG have been listed on the federal government’s Major Projects list.

Also on that list is the North Coast Transmission Line — a key component of B.C.’s LNG and climate strategies, since it is needed to electrify new LNG projects.

All that is needed now are capital investment commitments of $40 billion or more.

The capital cost of the Ksi Lisims LNG project and associated Prince Rupert Gas Transmission line has been ballparked at $22 billion, but the Major Projects Office says Ksi Lisims would attract “nearly $30 billion in investment,” while LNG Canada Phase 2 would represent $33 billion.”

Given that LNG Canada Phase 1 plant in Kitimat was estimated to cost around $18 billion, the Major Projects Office is clearly including other associated investments in its figures, such as the North Coast Transmission Line, estimated at $6 billion.

Timing of the projects is critical, if they are to get into production before a potential global LNG surplus challenges their economic viability.

Outlooks project LNG overhang, lower prices

The 2025 outlooks from International Energy Agency (IEA), Oxford Institute of Energy Studies and BP all point to large amounts of new LNG supplies coming onto the world market, mostly from the U.S., which could depress prices and pose a challenge to the economics of the next wave of LNG projects.

While the just-released IEA 2025 World Energy Outlook is more bullish on oil and gas demand than it was just one year ago, and considerably more so than 2021, when it said no new major oil and gas investments would be needed, it warns of a potential looming glut of LNG coming onto global markets.

“Natural gas demand has been revised up in this year’s WEO, but questions still linger about where all the new LNG will go,” the IEA states in an outlook summary.

The IEA’s forecasts should, perhaps, be taken with a grain of salt. In recent years, it has over-estimated the momentum of the energy transition and under-estimated the stickiness of fossil fuels.

Javier Blas, energy and commodities writer for Bloomberg, recently noted this, in response to the IEA’s latest outlook.

“Just two years ago, the International Energy Agency unequivocally said that fossil-fuel demand would peak before the end of this decade,” he writes.

“But it was premature, in part because it didn’t anticipate an obvious flaw: governments backpedaling on their clean-energy commitments.

“The flip-flopping has damaged the agency’s reputation, perhaps irreparably.”

Earlier this year, Daniel Yergin, vice chairman of S&P Global, co-authored a report for Foreign Affairs that also questioned the IEA’s over-estimation of the energy transition’s impacts on demand for oil and gas.

Yergin and his co-authors point out that energy demand in all its forms continues to grow, including for fossil fuels.

“As energy use grows, ‘carbonization’ will precede ‘decarbonization,’” they write. “Natural gas is a readily available option, and it’s a better alternative to coal…

“Although global oil demand seems slated to plateau in the early 2030s, natural gas consumption is expected to continue to increase well into the 2040s.”

The IEA’s forecasts vary depending on the scenarios used, such as net-zero targets being met by 2050.

It is worth noting that China and India – key markets for Canadian LNG – have net zero targets that are 10 and 20 years further out than the rest of the world: 2060 and 2070 respectively.

Asia remains the key growth market for LNG

And natural gas could play an important role in meeting them through coal-to-gas fuel switching for power generation – something that could be accelerated through lower LNG prices.

In its 2025 outlook, Shell – the major partner in LNG Canada – forecasts a 60% increase in demand for LNG out to 2040.

“More investment is needed to ensure supply can keep up with demand,” the company states.

But that investment is already being made in the U.S. and Qatar, which are expected to account for 50% and 20% of new LNG supplies respectively, with Canada and “others” making up the rest, according to the IEA.

A recent report on natural gas by the Oxford Institute for Energy Studies (OIES) estimates global LNG prices could fall from a long-term average of US$8 per MMBtu to US$6 as a result of all the new LNG coming onto world markets.

That could challenge the economics for new entrants and higher cost producers.

The upside of lower LNG prices is the potential demand response – one with positive implications for decarbonization.

The OIES notes that lower LNG prices could accelerate a switch from coal to natural gas power in Asia, which would create new longer-term demand for LNG.

If LNG prices were to fall to US$6 per MMBTU, “gas could become seriously competitive with coal,” the OIES notes.

The longer term demand for and price of natural gas and LNG will be affected by the pace of competing low-carbon energy sources (renewables, nuclear power, etc.), carbon pricing and climate action policies.

“However, lower coal plant capacity, higher electricity demand, and the forecast lower gas prices of $6 per MMBTU will contribute to sustaining gas demand in the power generation sector in the coming years, even alongside the rapid growth of renewables,” OIES notes.

But if new LNG projects are to avoid entering markets when LNG prices are falling, they will need to make final investment decisions soon.

“We’ve already seen the recent buildout of U.S. and Canadian LNG export capacity put pressure on global LNG prices, which have been trading around $11/MMBtu this winter – roughly 16% lower year on year,” says Ross Wyeno, LNG short-term analysis lead for S&P Global. “We expect that the (current) slate of sanctioned projects will continue to put downward pressure on LNG prices through the end of the decade, which will make it increasingly difficult for any pre-FID project – including those in Canada – to make FID if they have not done so already.”

Fortunately, B.C. has two big competitive advantages, when it comes to competing in the LNG space. It has a super-abundance of liquids-rich natural gas in the Montney formation, and is a low-cost producer. It also has proximity to the one region where the demand for LNG is still expected to grow: Asia.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS