Trump’s desire for US energy dominance could mean higher prices at home.

By Naureen S Malik and Ruth Liao

Can the Trump administration’s twin policy priorities of US “energy dominance” and affordability really coexist? We may be about to find out.

Unleashing oil and gas production has been a key theme for President Donald Trump. Output of both are at all-time highs and are forecast to grow again next year.

Trump was quick to remove a Biden-era freeze on new export licenses for liquefied natural gas. Shipments of the fuel have risen to a record this year. With the Golden Pass terminal on the Gulf Coast expected to come online in 2026, the world will see even more US LNG.

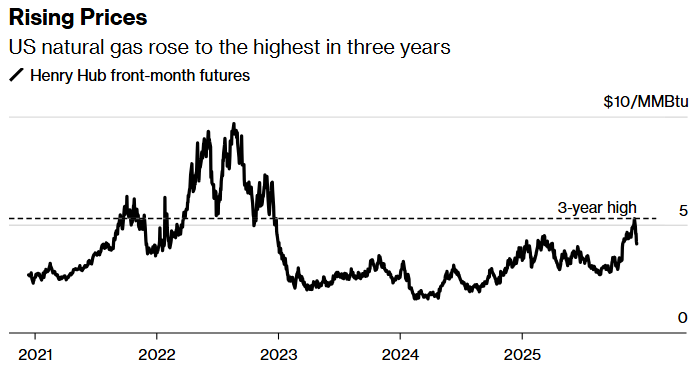

When it comes to energy prices, however, the picture is more mixed. To be sure, the cost of gasoline has dropped sharply in recent weeks thanks to cheaper crude oil. But rising electricity prices are now an election issue and the cost of natural gas hit a three-year high earlier this month.

Source: Bloomberg

That was due in part to forecasts for frigid weather. Gas demand from power generation is also robust due to the AI-led boom in electricity consumption.

But perhaps an even more worrying development for Trump is that LNG exports — the very thing he’s championed — are now beginning to push prices higher. That’s something that some gas consumers have long warned might happen.

“We have been talking about, in apocalyptic terms, for a decade now when the world would start taking away America’s cheap gas,” said Peter Gardett, chief executive officer of Noreva, an energy trading platform specializing in power. “Well, we’re here.”

The Federal Energy Regulatory Commission said in its recent winter report that benchmark US natural gas prices could average $4.39 per million British thermal units, which would be 26% higher than last winter.

Such an outcome would be unwelcome for Trump as he seeks to assure voters that inflation is under control.

It would also be bad news for America’s LNG exporters. They rely on US gas being significantly cheaper than in key consumer markets such as Europe. A convergence of American, European and Asian prices “is going to be a real shock to the system,” Gardett said.

—Naureen Malik and Ruth Liao, Bloomberg News

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS