Deal values in the global energy sector have fallen about 6% this year

By David Carnevali and Fareed Sahloul

Low energy

On this Tuesday a year ago, as US voters were handing Donald Trump the keys to the White House for a second time, M&A bankers were looking forward to the boom times; few more so than those covering the oil and gas sector, which was supposed to be supercharged by the president’s pro-fossil fuel agenda.

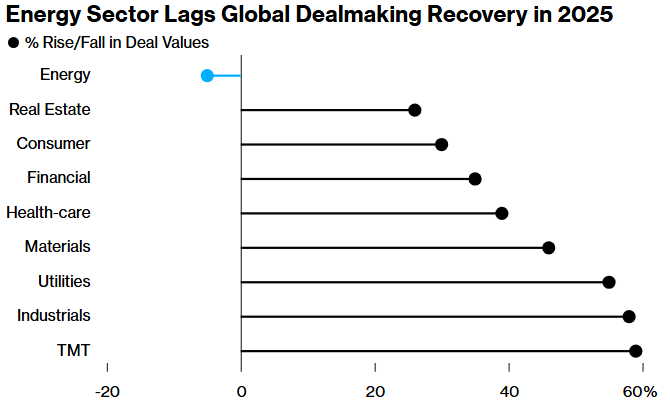

Twelve months on, however, energy companies and their advisers are the only ones missing out on what’s turned into one of the best ever years for the world’s dealmakers. Bloomberg-compiled data show that energy is the single major industry in which transaction values are trailing 2024 levels; it’s down about 6%, while all others are up by between roughly 25% and 60%, the data show.

With the price of oil having fallen sharply this year and still stuck in the low-to-mid $60s a barrel, would-be sellers, including private equity firms with assets in the sector, have been struggling to get the valuations they want. Worryingly for them, the oil market remains oversupplied as we head toward 2026.

So far, OPEC+ hasn’t given any indication it is about to cut production, and Trump is content for prices to drop further to keep Americans happy at the pumps ahead of mid-term elections next November. For the White House, low oil prices offer the bonus of putting extra pressure on Russia, Iran and Venezuela.

Source: Bloomberg

Ben Lett, a Houston-based vice chairman in mergers and acquisitions at Bank of America, acknowledged it had been a difficult year but said lower commodity prices would ultimately create pressure for more M&A, especially at the smaller end of the market.

“This year was an interim period in the consolidation story,” Lett said. “There will be additional consolidation both at the small end of the independents and at the larger end. It just takes time.”

One standout deal this week suggests the stirrings of a recovery.

Publicly traded drillers SM Energy and Civitas Resources on Monday confirmed our reporting with the biggest shale deal of the year: an all stock tie-up valuing the combined entity at $12.8 billion including debt. In a recent report on the state of oil and gas M&A, Enverus Intelligence Research said consolidation among such small and mid-cap players could continue to deliver some wins for the sector, amid the scarcity of high-quality inventory from private sellers.

“Stock-for-stock swaps should be easier to negotiate in a weak crude environment compared to cash deals,” Andrew Dittmar, principal analyst at EIR, said in the report. “However, companies will need to scout for prospects with overlapping in-basin operations.”

This week has also brought news that private equity firm Sixth Street will buy some US shale assets from oil major BP, and KKR-backed producer Crescent Energy will sell its drilling portfolio in the Rocky Mountain region to Aethel Energy.

“You are also seeing the majors come to market with divestiture packages, which has a tendency to lift the number of private opportunities out there,” said Bank of America’s Lett.—David Carnevali and Fareed Sahloul

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Big Oil Won’t Keep Beating the Crude Market