Washington’s $80 billion investment in nuclear reactors won’t yield carbon-free power anytime soon.

By Will Wade

The control room at the Three Mile Island nuclear power plant in Middletown, Pennsylvania. Photographer: Michelle Gustafson/Bloomberg

After a generation of stagnation, interest in US nuclear energy is sky high, thanks to artificial intelligence’s voracious energy needs. Nuclear companies are stock market darlings, and the Trump administration recently unveiled an $80 billion-plus commitment to help fund new reactors.

There’s just one problem: Hardly anything will be ready to to plug in for a decade.

In theory, $80 billion can buy enough reactors to power all of Virginia’s Data Center Alley. In reality, traditional reactors take 10 years or more to build, while a highly anticipated wave of small, modular reactors has yet to produce commercial power. That means the only plants that will go into service anytime soon are a handful of shuttered facilities that can be restarted.

“There’s a lot going on, and nothing is going on,” said BloombergNEF’s head nuclear analyst Chris Gadomski.

That dissonance underscores how radically, and rapidly, the US energy system has transformed in recent years. Not long ago, utilities were shutting down costly nuclear plants and replacing them with cheaper natural gas-fired and renewable plants. The AI boom has since supercharged electricity consumption, straining power supplies and driving up prices. But while nuclear is suddenly in demand again, logistics and technology constraints threaten to thwart development even with President Donald Trump’s moves to streamline permitting and commit billions of dollars in funding.

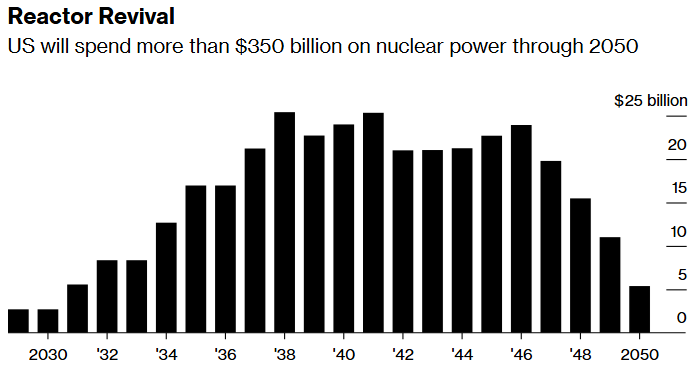

Source: Bloomberg Intelligence

It’s possible the nuclear industry can meet Trump’s goal of starting construction on 10 big nuclear reactors by 2030. But there won’t be a lot of wiggle room, said Wyatt Hartley, head of North American asset management for Brookfield Asset Management Ltd. The company is emerging as a key player in the industry, in part because it’s the majority owner of Westinghouse Electric Co., which is expected to be a key beneficiary of the $80 billion reactor deal announced last month.

“Nothing in nuclear happens overnight,” said Jeffrey Merrifield, a former commissioner with the Nuclear Regulatory Commission.

Besides permitting, developers must line up buyers for the power and hire thousands of skilled workers. And some of the most critical components of a plant, such as reactor vessels and steam generators, can take as long as four years to manufacture and deliver.

Hartley expects some of those orders to be placed “in the very near term” but, realistically, it will take 10 years to get just two plants up and running.

Until then, some reactor developers are relying on natural gas. Fermi Inc., an energy real estate investment trust co-founded by former Energy Secretary Rick Perry that is developing a massive data center in Texas, placed orders for reactor components last month, but doesn’t expect them to go into service until the early 2030s. Start-ups Blue Energy Global Inc. and First American Nuclear Co. also expect their reactors to be completed next decade. All three companies are installing gas systems to supply data center customers as soon as possible.

And there’s another wrinkle that could slow deployment of big reactors: The Trump administration hasn’t yet laid out how the $80 billion will be allocated. It’s also not clear who would be responsible for covering the costs for a project that goes significantly over budget. Cost overruns resulted in the 2017 abandonment of the two-reactor VC Summer project in South Carolina.

“What matters at the end of the day is who takes on the cost overrun risk,” said Jigar Shah, who headed the US Energy Department’s loan programs office under President Joe Biden.

Hyped Up

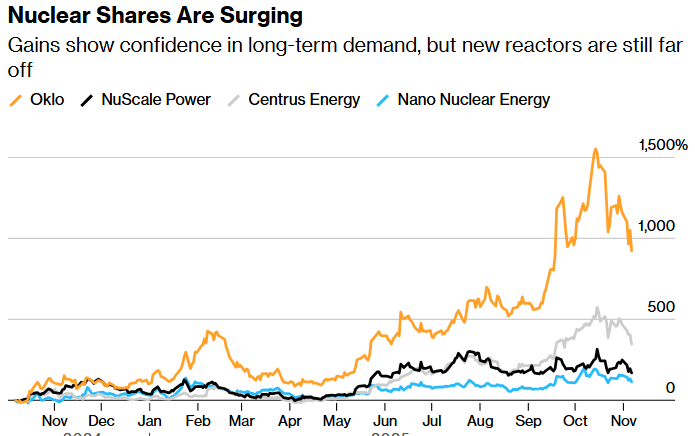

The buzz around nuclear is so cacophonous that simply announcing plans to develop reactors is enough to drive up company valuations. Fermi, which has yet to build any electricity generation and only listed on the New York Stock Exchange in September, is now valued at about $13 billion, more than Campbell’s Co. or Moderna Inc. Meanwhile, firms developing small, modular reactors have seen share prices skyrocketing in the past year.

Source: Bloomberg

Data is normalized with percentage appreciation as of October 7, 2024.

Despite the hype around small reactors, which are designed to be produced in factories and assembled on site, actual progress is painstakingly slow. Shah and others think small reactors could come online sooner than big ones because they’re potentially cheaper and faster to produce, but only three companies have started construction: Oklo Inc., TerraPower LLC and Kairos Power LLC. None of them have regulatory approval to build a commercial system, nor have they proven they can produce power at a commercial scale.

Kairos may be the closest to delivering on its plans for commercial plant. It’s building a demonstration reactor to validate the technology but won’t generate electricity, and has permission to build a slightly larger version that will produce 50 megawatts. Once the company gets all regulatory approvals, it has a deal to sell that energy to the Tennessee Valley Authority for Google data centers, potentially as soon as 2030.

BloombergNEF’s Gadomski remains skeptical of the modular projects: “They’re just pushing bulldozers around.”

‘A Lot of Talk’

That means the fastest-moving part of the industry is restart projects.

More than a dozen reactors were shut down from 2012 to 2022, mostly for economic reasons, and three of them are now being revived. Holtec International expects the Palisades plant in Michigan to resume service early next year, and Constellation Energy Corp. is on track to switch on a reactor in 2027 at Three Mile Island, in Pennsylvania. NextEra Energy Inc. announced last month that it would bring the Duane Arnold plant in Iowa back online by 2029. Brookfield, meanwhile, is in talks to take over the abandoned VC Summer project, which could go into service in the early 2030s, Hartley said, though the deal is not yet finalized.

But the list of potential restart candidates is very short, and the three planned revivals would produce just 2.2 gigawatts of electricity at most, a fraction of the power Trump wants to generate from reactors.

“It’s a lot of talk,” said Scott Levine, an analyst with Bloomberg Intelligence. “Will we see anything soon? No.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Booming LNG Exports May Get Dragged into US Cost-of-Living Debate