By Stephanie Kelly and Shadia Nasralla

- Last year’s edition saw peak oil demand in 2025

- Renewables to overtake coal share in energy mix by 2040

- Natural gas demand set to grow almost 20% by 2040

LONDON, Sept 25 (Reuters) – BP (BP.L) said on Thursday it expects global oil demand to grow until 2030, five years later than its forecast a year ago, pointing to slowed efforts to increase energy efficiency and reduce global carbon emissions.

The oil major’s latest Energy Outlook, an annual study of energy trends through 2050, models two scenarios.

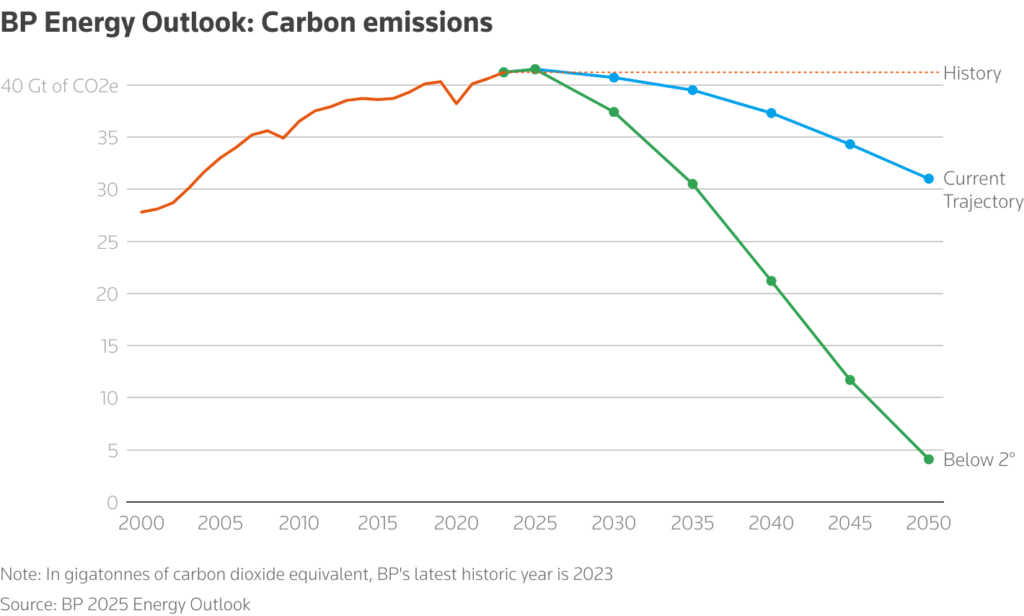

The “Current Trajectory” scenario is based on existing policies and pledges. Its “Below 2-Degrees” scenario, a reference to the aim of limiting global warming to less than 2 degrees Celsius in line with Paris Agreement goals, envisions about a 90% drop in carbon emissions by 2050 from 2023 levels.

Emissions are largely the result of burning oil, natural gas and coal.

The following are highlights from the report:

OIL DEMAND, OIL PRODUCTION

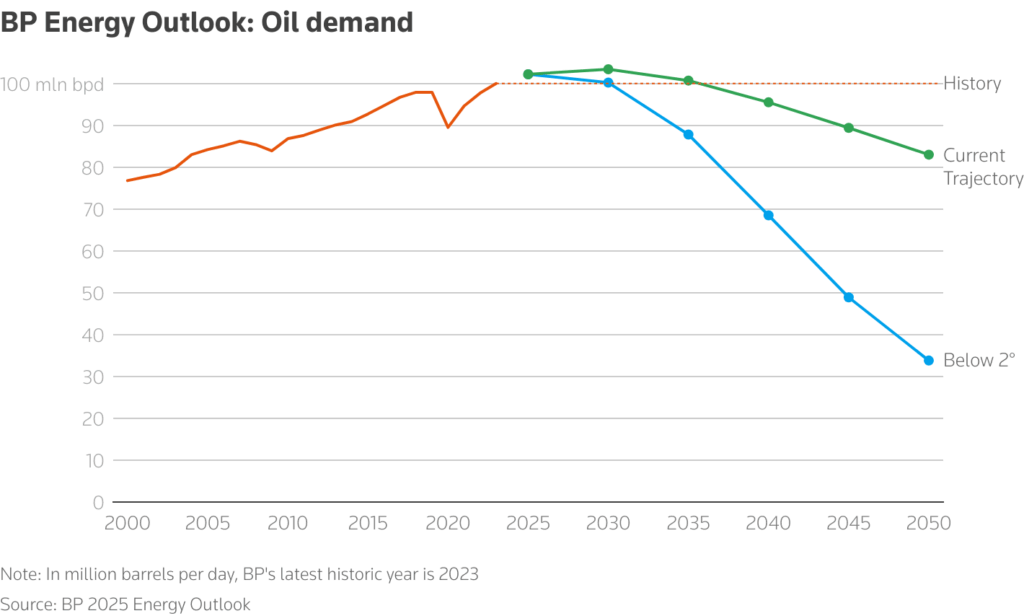

Global oil demand is expected to hit 103.4 million barrels per day (bpd) by 2030 in BP’s Current Trajectory, before falling to 83 million bpd by 2050.

BP’s report last year had forecast demand peaking by 2025 at around 102 million bpd, but slowing efficiency gains have changed the picture.

If weak energy efficiency gains persist, oil demand increases to about 106 million bpd by 2035.

In its Below 2-Degrees scenario, oil demand peaks this year at 102.2 million bpd before falling to 33.8 million bpd by 2050.

In the Current Trajectory, U.S. onshore production is broadly flat at around 15 million bpd over the first half of the outlook. Brazil and Guyana see the largest increases, reaching about 5 million bpd and 2 million bpd respectively by 2035.

A chart shows BP Energy Outlook’s forecast for oil demand

CARBON EMISSIONS

In the Current Trajectory, CO2 equivalent emissions stay broadly flat to 2030, then fall by about 25% by 2050 from 2023 levels.

In the Below 2-Degrees scenario, emissions drop 90%, driven by faster decarbonisation in emerging economies.

A chart shows BP Energy Outlook’s forecast for carbon emissions

NATURAL GAS AND LNG DEMAND

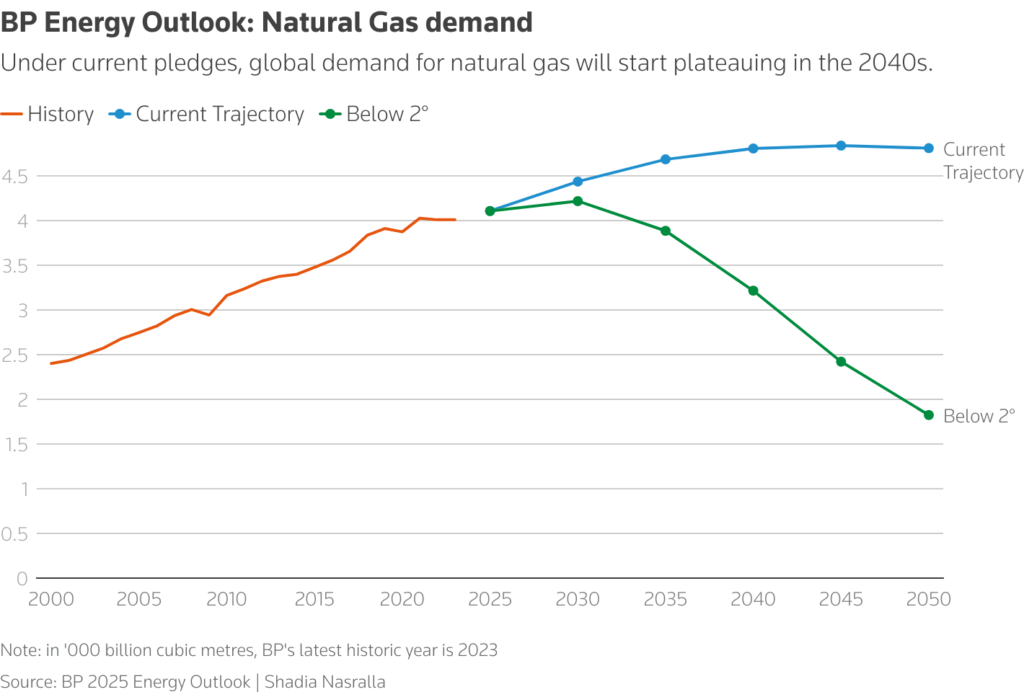

In the Current Trajectory, natural gas demand grows to around 4,800 billion cubic metres (bcm) by 2040, up by around 17% from current levels, boosted by China, India and other Asian and Middle Eastern countries, then plateaus at that level.

Under current pledges, global demand for natural gas will start plateauing in the 2040s.

The European Union’s imports of Russian pipeline gas fall by around 50% to 15 billion cubic metres (bcm) and stay at that level for decades to come.

Exports of liquefied natural gas, which BP uses as a gauge for demand for the fuel, increase to around 900 bcm by 2035 in the Current Trajectory, with more than 50% of those supplies coming from the U.S. and the Middle East.

BP rival Shell (SHEL.L) has pegged LNG demand by 2040 at between 630 million and 718 million metric tons a year, or around 860 to 980 bcm.

ELECTRICITY, AI AND RENEWABLES

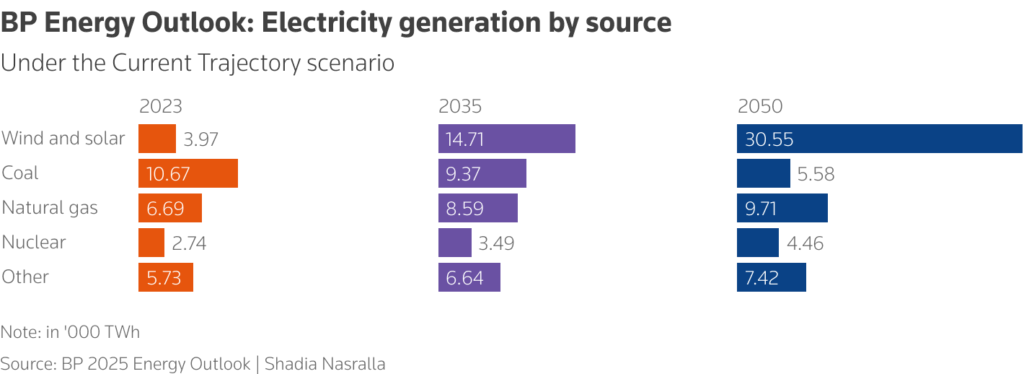

Global electricity demand in the Current Trajectory scenario rises to over 40,000 terrawatt hours over the coming decade, up around 40% from 2023 levels, boosted by China and India.

Under the Current Trajectory scenario

By 2050 it roughly doubles, driven mainly by huge leaps in the electrification of transport. Over half of power generation will come from wind and solar by then.

Renewables are set to overtake coal’s share in the energy mix in 2040, oil around 2045 and gas by 2050.

Reporting by Stephanie Kelly and Shadia Nasralla in London; Editing by Jason Neely and Joe Bavier

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS