By Liam Denning

Projects worth nearly $42 billion have been delayed, shrunk or canceled since Trump’s inauguration.

The capriciousness of US energy policy under President Donald Trump increasingly looks like a feature rather than a bug.

A nearly built offshore wind project is suddenly blocked on spurious grounds. A giant transmission project ready to be built loses an agreed federal loan guarantee. Executive orders redefine the very notion of ‘energy’ to exclude certain sources. The objective seems to be not merely to rip up clean technology by the roots but also to salt the soil. The damage is real, even if the objective is ultimately futile.

The energy transition is on the defensive across the US, and that includes its sinews: The domestic green supply chain encouraged by the subsidies in former President Joe Biden’s Inflation Reduction Act. These had prompted a wave of announced investments in factories worth hundreds of billions of dollars, aimed at reshoring production of things like solar modules, electric vehicles and, especially, batteries (see this feature from the summer of 2024).

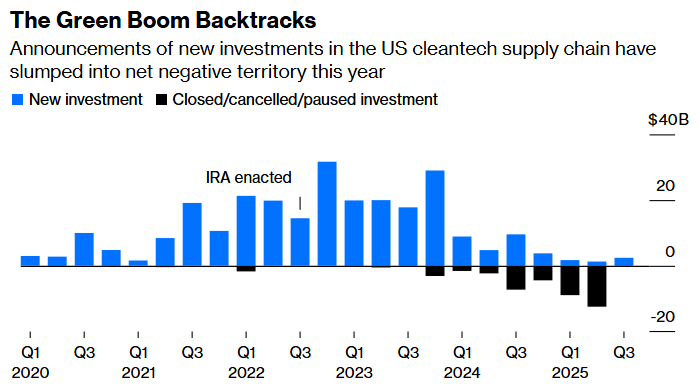

The Big Green Machine project, led by Professor Jay Turner at Wellesley College, tracks the progress of more than 600 North American cleantech supply chain projects representing a nominal investment of almost $300 billion, the vast majority of which were announced during Biden’s term in office. From Trump’s inauguration through mid-August, Turner’s team count 70 projects worth about $32 billion that have progressed — but another 39, worth almost $42 billion, that have been delayed, shrunk or canceled. This represents an abrupt shift in the direction of travel, with the roll-back of IRA manufacturing subsidies under Trump being the obvious culprit. While the surge of announcements immediately after passage of the IRA was bound to level off, this year’s collapse is striking.

Source: Jay Turner and the Big Green Machine project, Wellesley College

Note: Data as of August 22, 2025.

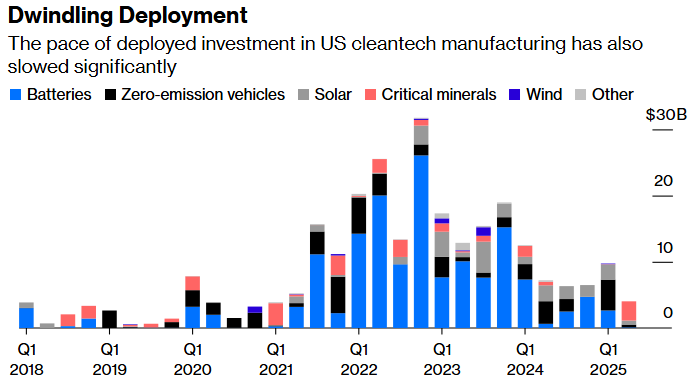

Besides the production subsidy cuts, curtailing the IRA’s consumer subsidies also has an impact on manufacturing, since developers need to believe there will be a market for their products. Rhodium Group, together with the Massachusetts Institute of Technology, tracks deployment of dollars in cleantech manufacturing, two-thirds of which related to batteries over the past three years. The imminent loss of consumer EV incentives puts such investment at risk, potentially teeing up a huge surplus of capacity relative to now-subdued EV demand projections, according to this Rhodium analysis. Similar risks weigh on projects targeting solar modules, wind turbine equipment and, of course, EVs themselves.

Source: Rhodium Group, MIT

Incentivizing this domestic supply chain was, apart from anything else, designed to create a set of facts on the ground, reshaping key markets such as autos and providing insurance against a Republican backlash. The latter has proven less effective than many, including myself, anticipated given the GOP’s willingness to gut subsidies supporting jobs for their constituents. Trump’s willingness to pull the plug on green infrastructure either already almost built or ready to begin construction compounds the damage. By tearing at the sanctity of permits and contracts, he raises the cost of capital for US cleantech projects in general. The same could be said for the recent raid on a Hyundai Motor Co.-LG battery plant in Georgia by immigration officials.

For all that, it would be premature to declare Trump’s crusade victorious. The Big Green Machine’s net cancellations figure of $10 billion still leaves more than $200 billion of announced cleantech manufacturing projects that are either operating, under construction or in the pipeline. Projects can flip from being in progress to getting cancelled on a dime, of course, but there clearly has not been a wholesale retreat.

For example, while Trump’s assault provides the perfect opportunity for Ford Motor Co. to ditch its loss-making EV efforts, in August it reaffirmed them as a “Model T” moment for the company. Ford has scaled back its targets and delayed some electric models. But, like its peers, it knows that having a competitive EV portfolio is becoming table stakes for global auto brands, regardless of who sits in the White House. Meanwhile, Rivian Automotive Inc. broke ground this week on a new EV plant in Georgia, with Republican Governor Brian Kemp in attendance.

The same goes for renewable energy, where the benefits of speed-to-market, falling costs and diversification away from imported fuels make it attractive, regardless of net-zero considerations. Renewables still dominate the pipeline of new generating capacity in the US. Investment in wind, solar and battery projects — as opposed to the supply chain — actually increased slightly in the first half of the year, to almost $41 billion, according to Rhodium and MIT data. It is said that it doesn’t matter if you believe in climate change, what matters is if your insurance provider believes in it. Similarly, it doesn’t matter if you believe renewable energy to be unreliable and expensive, what matters is if datacenter developers and utilities believe that. Judging from ongoing development, they don’t.

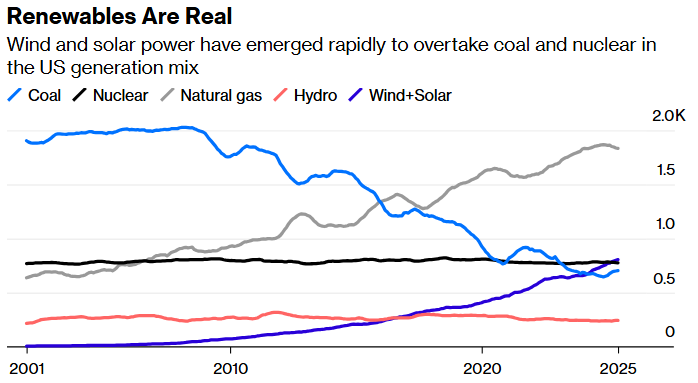

Trump’s contest with green energy has a Canute-like quality.1 The US is important but accounts for only 16% of global energy transition investment, according to Bloomberg NEF. The notion that it will somehow wall itself off from cleantech’s march around the world is nonsense. So, too, is the idea that the US can lead in artificial intelligence powered solely with coal (too expensive), natural gas (too backlogged) and nuclear power (too slow). Trump’s exclusion of wind and solar from the very definition of ‘energy’ in his directives has an ominous feel. But there is also something pathetic about pretending that two energy sources which, together, have gone from virtually zero to overtaking coal and nuclear power in the space of 25 years, essentially don’t exist.

Source: Energy Information Administration

Note: Data are 12-month trailing totals in terawatt-hours.

Blocking existing investments in grid infrastructure and deterring money from renewables will serve to increase electricity bills, which are rising faster than inflation already. Deterring investment in the green supply chain, which also undermines research and development, is corrosive to US competitiveness as a whole, and detrimental to energy security objectives. None of this will kill off cleantech altogether. Even futile policies can do real harm, though.

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS