- Cenovus Energy’s Q4 profit falls due to lower prices, weak refining margins

- Cenovus’ U.S. refining revenues drop amid required turnaround work

- Canadian energy sector faces uncertainty with U.S. tariffs on imports

Feb 20 (Reuters) – Canadian oil and gas producer Cenovus Energy (CVE.TO) anticipates a return this spring to more normal market conditions in the North American refinery sector, the company’s CEO said on Thursday.

On a conference call with analysts, Cenovus Chief Executive Jon McKenzie said the company is already seeing signs of improvement in refined product prices.

In recent months, integrated oil companies like Cenovus as well as giants Exxon (XOM.N) and Chevron (CVX.N), have seen a drop in profitability due to a glut of fuel supply and weak global economic conditions that have reduced demand for refined petroleum products.

“We anticipate returning to more normalized seasonal crack spreads heading into the spring,” McKenzie said. “Our focus in the downstream continues to be improving what is in our control.”

Cenovus posted a fall in fourth-quarter profit on Thursday, even as the company reached a quarterly record for oilsands production, at 628,500 barrels of oil equivalent per day (boepd). The higher production was offset by lower commodity prices and weak refining margins.

Cenovus saw its U.S. refining revenues fall to $6.6 billion in the fourth quarter compared to $7.2 billion in the prior quarter. The company said its refining market capture was negatively impacted by required turnaround work at its Lima, Ohio refinery as well as narrower heavy crude oil differentials.

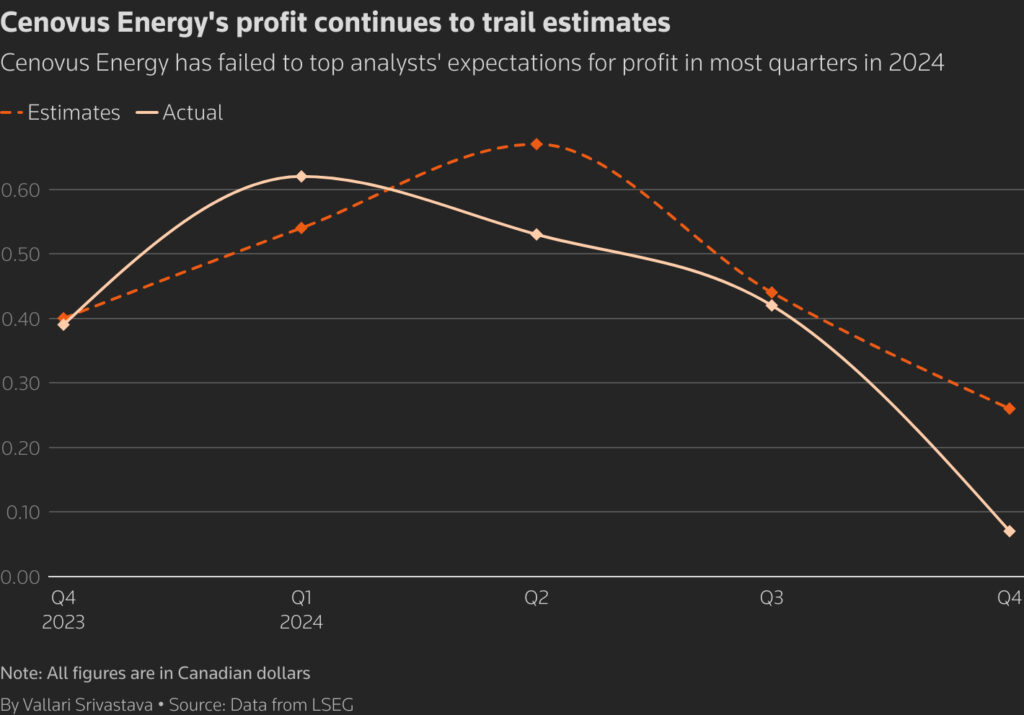

Cenovus’ profit has trailed analysts’ estimates for much of 2024. Investment bank Jefferies said in a note on Thursday that Cenovus’ soft fourth-quarter results were expected, but investors want to see better.

The company’s shares were down 4.5% in midday trading.

A line chart depicting the comparison between Cenovus Energy’s quarterly profit and average analysts’ expectations.

The Canadian energy sector faces an uncertain future as U.S. President Donald Trump imposed 25% tariffs on Canadian imports in early February, but later delayed them by a month.

Canada has been the biggest source of U.S. oil imports for over two decades and supplied more than half of all crude imports into the country in 2023, according to the Energy Information Administration (EIA).

Cenovus had earlier forecast upstream production of between 805,000 and 845,000 boepd for the current year, more than the 797,200 boepd it produced in 2024.

McKenzie said tariffs would not impact the company’s capital spending plans for 2025. But he said it remains unclear what the overall impact to Cenovus could be, as tariffs could lead to a higher discount on the price of Canadian oil as well as higher costs for inputs like natural gas and condensate.

“If we are in a world, unfortunately, in March where tariffs do come, we will watch those price signals and react accordingly,” he said.

The Calgary, Alberta-based company’s net income fell to C$146 million ($102.78 million), or 7 Canadian cents per share, in the three months ended December 31, from C$743 million, or 32 Canadian cents per share, a year earlier.

($1 = 1.4205 Canadian dollars)

Reporting by Amanda Stephenson in Calgary and Vallari Srivastava in Bengaluru; Editing by Devika Syamnath, Andrea Ricci and Diane Craft

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS