May 3 – Access to transmission data is becoming crucial for wind and solar developers as they confront the challenges of rising grid connection costs and growing approval queues.

U.S. connection costs are rising as more new projects require grid expansions and this will continue in the coming years as developers take advantage of tax credits in the Biden administration’s 2022 Inflation Reduction Act, Joachim Seel, program leader for grid connection costs at the Lawrence Berkeley National laboratory (Berkeley Lab), said.

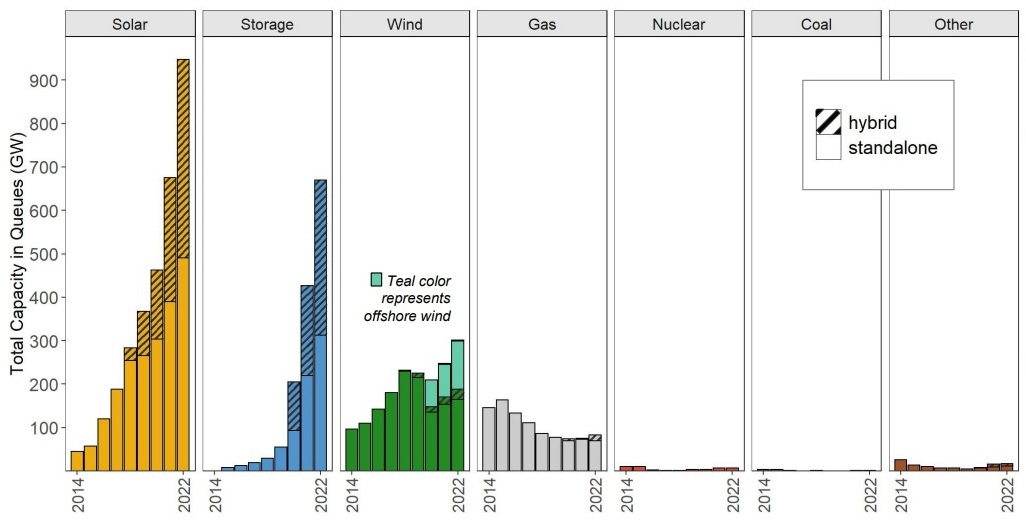

At the same time, connection queues are growing and delaying or derailing projects as grid operators struggle to process a growing volume of applications. The number of requests hiked by 40% in 2022 to over 700 GW as demand for solar and storage projects soared, Berkeley Lab said in a new report.

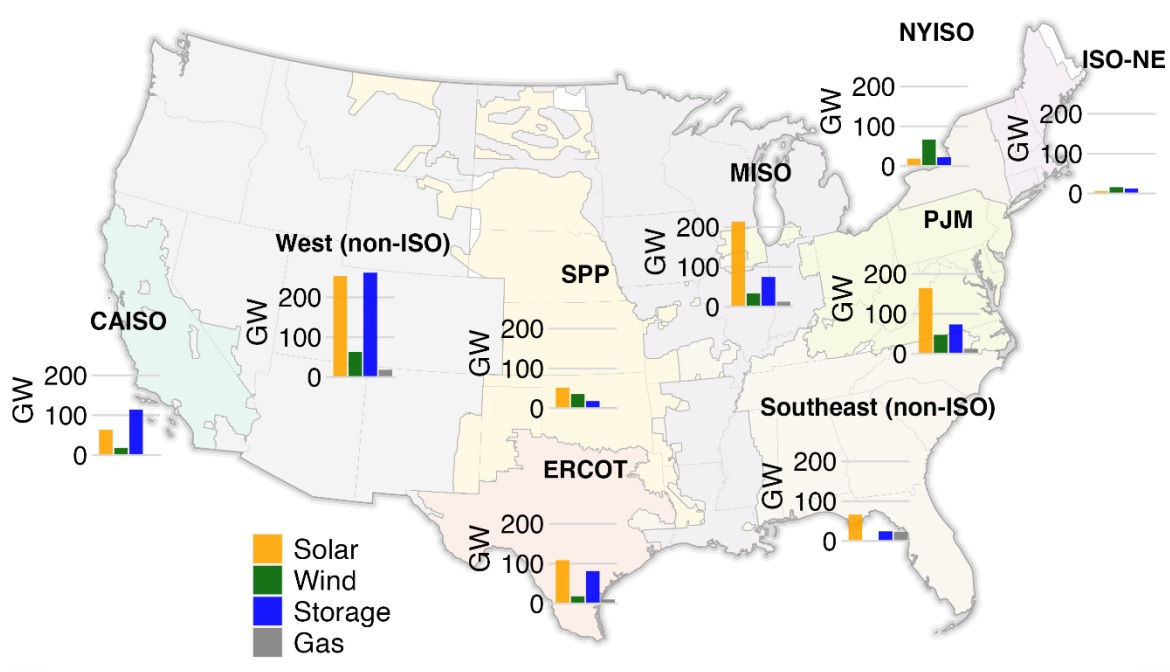

Grid connection costs and project withdrawals are highest in congested grids such as the expansive PJM network, where costs for active projects in the queue have grown eightfold since 2019, Berkeley Lab said in a separate study published in January. PJM paused new reviews until 2026 to tackle its huge backlog and many developers have pivoted to other markets.

CHART: Power capacity in U.S. grid connection queues

Advertisement · Scroll to continue

Developers need data on available grid capacity, queue times and grid upgrade costs to greenlight projects and apply for connection but access to data is limited and slow.

To ease the burden, Southwest Power Pool (SPP) is leading efforts to reduce approval times by assessing projects in groups, and this could soon be rolled out by other network operators under new rules proposed by the Federal Energy Regulatory Commission (FERC).

AI and other technology advancements could dramatically reduce processing times in the coming years, but regulatory hurdles remain, industry sources said.

Bulk studies

The FERC could help increase data transparency in new rules that would require operators to assess projects in clusters and process them on a first-ready, first-served basis. FERC issued a Notice of Proposed Rulemaking in June 2022 and following a consultation is expected to issue final rules in a few months.

The Southwest Power Pool (SPP) network has shown that this approach provides developers with preliminary data and in-depth analysis faster than on a case-by-case basis and some costs can be shared between projects. PJM plans to roll out a similar process next year.

SPP typically conducts studies for groups of 30 to 50 projects, sometimes as many as 200, as this approach is “much more efficient,” said SPP’s vice president of engineering David Kelley.

SPP provides preliminary cost data within 60 days of a request and a final in-depth cost analysis within around a year, Kelley said. The whole study process takes between 12 and 18 months, compared with over three years in most other regions.

MAP: Capacity in U.S. grid connection queues at end of 2022

FERC is also considering imposing a two-tier process where developers would file tentative applications to gain preliminary estimates before filing a formal grid connection request. More preliminary data will dissuade developers from filing exploratory connection requests that are later withdrawn and can delay other more developed projects.

SPP has further aided developers by providing online access to snapshots of transmission capacity and queue data. Likewise, the MISO grid in Central U.S. provides an online heat map which currently shows more transition capacity headroom in Arkansas, Louisiana, and Mississippi than in other states. FERC is considering recommending all grid operators create similar tools.

Harnessing the huge renewable energy resources in the Central U.S. will be key to meeting President Biden’s decarbonisation goals. The Department of Energy (DOE) recently identified a need for widespread grid expansions by 2030 in the Great Plains, Midwest, and Texas and said greater interregional transmission capacity would help reduce costs in neighbouring regions.

Technology leap

Developers in the SPP are set to see even faster approvals after the network operator teamed up with Amazon Web Services to use advanced automation in data submission and validation. In a second phase, the system will incorporate planning models to conduct transmission studies and a third iteration will help engineers decide if additional transmission infrastructure is needed.

The first two phases are likely to be implemented by year end, followed by the third phase in 2024, Kelley said.

“We have high hopes for this system,” Kelley said. “Today our study process takes 12 to 18 months and we’re hoping to bring that down to the six-month or less range.”

MISO is also using automation for some connection studies while PJM and California’s CAISO have indicated they will implement various advanced data solutions going forward.

A key hurdle to widespread number crunching will be getting quality data from the 3,000 investor- and public-owned electric utilities in the U.S. to data scientists and analysts. Utilities are often reluctant to share data due to security and competition issues. Tesla and Google have filed statements of interest urging FERC to increase access to grid connection data, alongside other recommendations.

“The problem is that you have to get all of them to agree to release data but there are so many regulated electric utilities and is not like you can just wave a magic wand and have access to this data across the country,” Jon Gordon, policy director at the Advanced Energy United trade association, said.

In a bid to improve transparency, the Department of Energy last year launched the Interconnection Innovation e-Xchange (i2X) program, which seeks to increase collaboration between different stakeholders such as utilities, grid operators, and state and local governments.

The use of AI remains in the “trial and error” phase, but it will be crucial if the industry is to move towards real-time data that offers the greatest accuracy and efficiency, a director at a large renewable energy developer said.

“There are a lot of details and intricacies but if we don’t automate it and standardize it, we will never be able to train enough engineers to do this kind of stuff,” the director said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran