Enbridge Inc. Chief Executive Officer Greg Ebel said the company’s oil pipeline business has plenty of growth opportunities, with output from both the Permian Basin and Western Canada poised to expand in the years ahead.

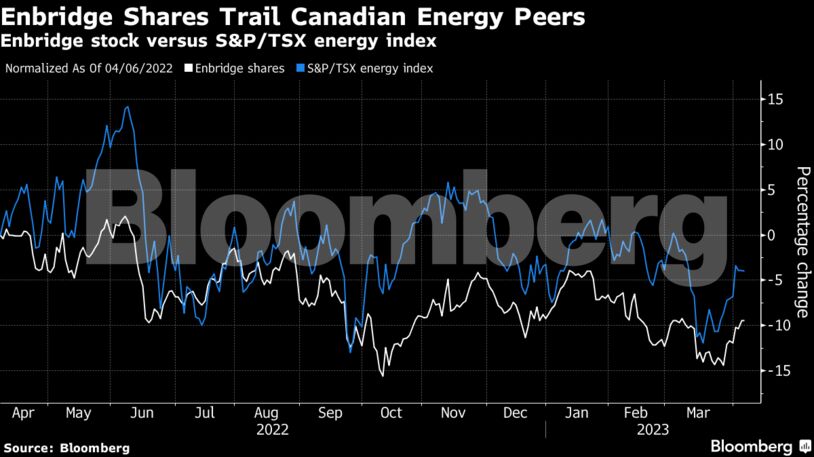

The comments hit back at concerns about weaker growth in Enbridge’s liquids unit — which accounted for almost 60% of its adjusted earnings last year — that have weighed on the company’s shares and reduced analysts’ enthusiasm for the stock. Of the analysts that cover Enbridge, only 48% rate the shares a buy. That’s down from 56% last year and 85% two years ago. Enbridge has slid 9.3% in the past 12 months, trailing the 4% drop for the S&P/TSX energy index but outperforming the 25% decline for rival TC Energy Corp.

The main obstacle for expanding both the liquids and natural gas businesses is the difficulty of obtaining permits for new pipelines, Ebel said.

“It’s hard for me to imagine a brand new greenfield pipe getting done very easily under the current conditions in Canada, and in some respects in the United States,” Ebel said. “Permitting drags out so long, has such uncertain timeframes, that customers generally won’t sign up.”

Share This:

Enbridge CEO Points to Permian to Allay Oil Unit Growth Concerns

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS