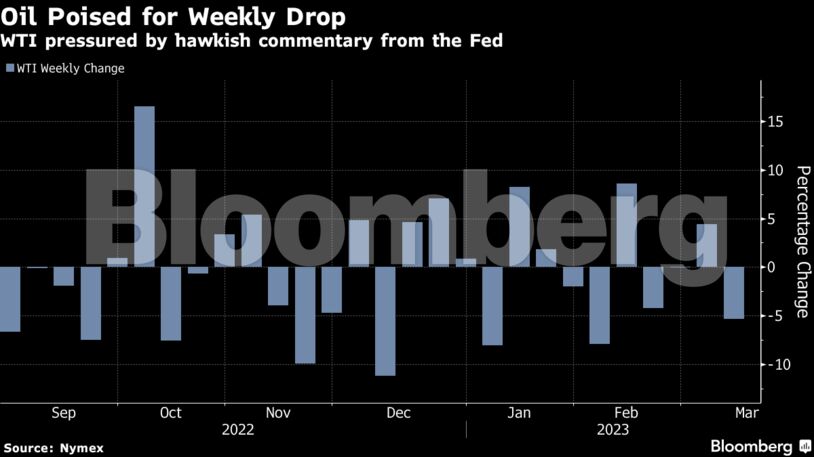

West Texas Intermediate futures traded near $75 a barrel, falling for a fourth session and down almost 6% this week. A hawkish tone from Fed Chair Jerome Powell has rippled across risk assets, with investors keenly anticipating jobs data later for further clues on the path for monetary tightening. Markets were also pressured by worries about the health of the US banking system.

“It is risk off in financial markets to end the week and the oil market isn’t spared,” said Jens Pedersen, a senior analyst at Danske Bank A/S. “Given that global risk sentiment and the dollar are important factors for the oil market currently, the jobs report this afternoon and the US CPI data next week will set the direction for the market.”

Bearish sentiment around more rate hikes has overshadowed optimism over China’s recovery after the end of Covid Zero policies. The country’s revival is already increasing the cost of shipping crude, while Shell Plc sees higher oil prices over the coming months as China underpins record global demand.

Oil has had a bumpy year so far, whipsawed by the opposing drivers of global slowdown concerns and China’s rebound. Traders are also monitoring energy flows from Russia, with indications the nation’s exports are holding up more strongly than initially expected, even in the face of sanctions.

Prices:

- WTI for April delivery declined 0.8% to $75.09 a barrel at 10:04 a.m. in London.

- Brent for May settlement dropped 0.6% to 81.09 a barrel.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS