By Geoffrey Cann

A banking collapse was not likely on the long list of worries that plague the digital entrepreneur. What are the kinds of risks that digital startups face in oil and gas?

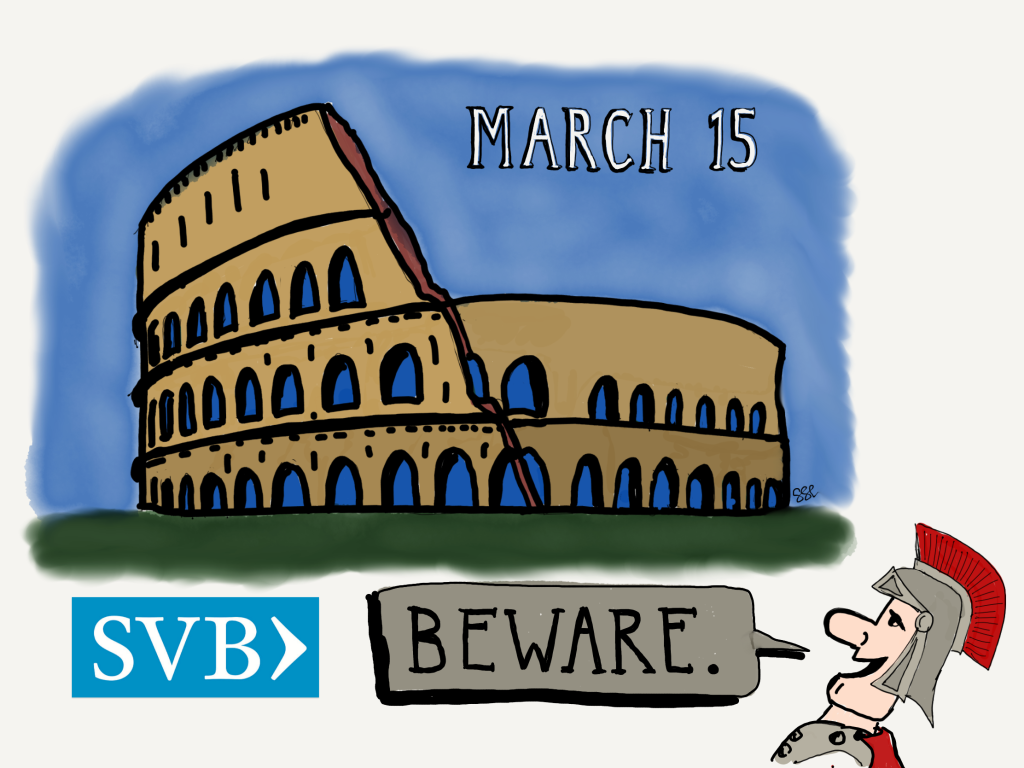

Beware The Ides of March

March 15 stands in infamy as the day that Julius Caesar was stabbed to death at a meeting of the Roman Senate. The conspirators, led by Brutus and Cassius, were ratted out by a seer, who ominously warned Caesar that harm would come to him that day, advice that Caesar pointedly ignored because:

- he was arrogant, popular and successful—precisely why the Senators chose to off him, and

- the seer was not unhelpful in clarifying exactly when the harm would come, where in Rome, and what form the harm might take.

With hindsight, ‘Beware the Ides’ was sound advice from the seer, who apparently derived his insights by consulting the entrails of recently deceased animals.

I too have ‘gut instincts’, but generally I’m more data driven and not in the business of conducting colonoscopies of goats and sheep for clues about the future.

The Ides did not disappoint this year, as it turns out. The big event of the week was the failure of the Silicon Valley Bank, who stands accused of ignoring an iron-clad law of financing—they were inadequately hedged against rising interest rates, and lost a bundle when forced to sell a bond investment at a huge loss.

Time will tell when the investigators get through with the carcass if a seer had warned the bank that harm would come to it, but chances are good that warning bells were sounded internally as rates started rising.

Depositors decided to exploit the spread between the interest on their deposits and interest available, by withdrawing their money and investing it elsewhere, and SVB had no where near enough coverage for the risk.

The fall out has been quite swift. My inbox has been blowing up with missives from across the technology world as tech companies reach out to assure me that they had no exposure to SVB.

There will be plenty of ink spilled over the fortunes of the unfortunates lost in the collapse. A bit like the Bernie Madoff situation, but without the puns. But digital entrepreneurs face many other perils, and oil and gas poses its own unique set.

What Harm Can Come To Us

I’m pretty sure that the risk matrix for digital entrepreneurs does not have an entry for ‘our bank might collapse’. And if it did, it would likely have been flagged as exceptionally low probability. After all, the banking industry has been through the wringer after the Great Financial Crisis of 2008-09.

Here are the risks imposed by the oil and gas industry on the digital sector.

NO PATHWAY TO SCALING UP.

In my view, the single greatest challenge facing technology companies when dealing with oil and gas is the lack of a clear pathway from the outset of the relationship to scaling up or gaining an enterprise commitment to adoption. The initial oil and gas buyer of a technology innovation inevitably has a narrow scope of control, and views success as the go live in their unit. There are few if any enterprise level structures (organizational teams, funding mechanisms, executive leadership) in oil and gas that are dedicated to the challenge of achieving enterprise level change.

The technology company, however, only succeeds if the technology exits the first go live and commences the next on a pathway to the enterprise play.

It’s very hard to bank a series of individual pilots that don’t add up to much. Investors who are financing the technology company need to see solid growth in recurring revenue, or they sell out. Employees in tech companies need to see appreciation in their stock options—again tied to long term cash flows—or they move on.

If you can’t predict when you’ll get the enterprise license, or even how, then the seer is projecting harm in the form of exhaustion.

LONG DECISION CYCLES.

The level of fragmentation of decision making inside oil and gas means that a lot of managers get to weigh in on technology that might impact their unit. That makes sense to me—no one wants a technology decision imposed on you, only to discover that the solution can’t quite accommodate the completely reasonable but utterly unique way of working that one of your team members insists is mission critical.

But for the technology company, that fragmentation also translates into heroically long decision cycles, long waits between meetings, and time spent helping decision makers get to a conclusion when other pressing matters go unaddressed.

If you’re on meeting number five, and you can’t see a decision point clearly in sight, the seer is whispering in your ear that you’re running out cash.

GENERAL INDECISIVENESS.

Long and slow decision cycles are not the same as general indecisiveness. It is structurally advantageous in oil and gas to be indecisive. There’s frequently no compelling or immediate reason to change anything, and the right answer can simply be to wait a bit for conditions to improve. The commodity markets can move without warning, both up and down, making prior decisions look pretty foolish if their execution is longer than the commodity cycle.

Oil and gas is one of the few self destructing business models, in that the longer an oil and gas business runs, the less it is worth. Barrels of oil do not simply regenerate—once they’re produced, that’s it. Put another way, the cure for low prices is low prices as low prices discourage investment, which sets the stage for future shortages and price increases.

If you have run a reasonable sales effort to convince a customer to try you out, and they can’t seem to make a decision, the seer is warning you to move on lest you get trapped onto a perpetual treadmill of inaction.

SLOW CASH PAYMENT.

There is a structural disconnect in energy between the flow of energy products in one direction (to the customer) and the flow of cash to the energy producer in the other direction. That structural disconnect is measured in days, and it is the standard in oil and gas that the days between invoicing and payment is 60.

This 60 day delay is then imposed on all participants in the supply chain even though they may be tangential to the true energy-for-cash transaction. In the case of digital entrepreneurs, this cash cycle is a killer. Banks generally lend where they have some assets that they can eventually seize, but the assets of a digital start up are usually limited to some crummy laptops. A thoughtful oil and gas company that is serious about supporting digital change will reflect on this financing problem and accelerate payment.

If you’re having no luck in your negotiations to move to 30 day terms or faster, in light of your cash needs, the seer is pointing to the sharpened blade in the hands of the Senator from Procurement.

INADEQUATE CHANGE MANAGEMENT.

One of my many projects in oil and gas brought me face to face with our legendary change challenges. We had loaded a brand new laptop with specialised software and dispatched it to a field office in Alberta, only to have it returned to us with what were clearly tire tracks across the shattered case. So many digital companies have contacted me seeking help in fixing the change management problems they encounter in oil and gas that I actually prepared a service offer.

Change management is not the forte of oil and gas. In fact, it’s quite the opposite. Oil and gas has generally three measures of performance—safety, cost, and reliability—and none have to do with innovation. Success is running the business to its engineered design parameters, and going beyond design limits is often viewed as risky and not necessarily a good thing.

If your oil and gas client is telling you that change management is your task, the seer is foretelling the 23 knife wounds you’re going to experience trying to get your product adopted.

NO PUBLICITY.

It’s surprising to me that oil and gas companies refuse to reveal which digital companies they are working with. It’s actually written deeply into the contracts that the relationship is confidential and will remain so for life, if not beyond. I get the historic logic—oil and gas does not want to be seen to be endorsing technologies or solutions in case things don’t work out. And if a technology you own is found to be vulnerable in some way (legacy SCADA systems have tons of vulnerabilities), you’ll be targeted.

But from the vantage point of a digital company trying to get to scale, in need of additional clients, and an industry in need of new solutions, publicity is precisely what is needed. As one executive in oil and gas reminded me, if your innovation is in use somewhere in oil and gas, that means it is at least a little derisked. That is value.

If you can’t get the customer to reveal the relationship, agree to appear on stage together, or collaborate on a white paper, the seer is predicting you will suffer from stunted growth.

Et Tu, Brute?

Digital entrepreneurs do not need to sacrifice a goat to figure out what the risks are to their business. They need only look at the features of oil and gas, and the future becomes crystal clear.

Check out my latest book, ‘Carbon, Capital, and the Cloud: A Playbook for Digital Oil and Gas’, available on Amazon and other on-line bookshops.

You might also like my first book, Bits, Bytes, and Barrels: The Digital Transformation of Oil and Gas’, also available on Amazon.

Take Digital Oil and Gas, the one-day on-line digital oil and gas awareness course on Udemy.

Take the one-hour Digital for the Front Line Worker in Oil and Gas, on Udemy.

Biz card: Geoffrey Cann on OVOU

Mobile: +1(587)830-6900

email: [email protected]

website: geoffreycann.com

LinkedIn: www.linkedin.com/in/training-digital-oil-gas

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS