Geoffrey Cann

For the first time in your life, the relationships you have with your energy suppliers are contestable. But why are fossil fuel companies not in the contest?

For the first time in your life, the relationships you have with your energy suppliers are contestable. But why are fossil fuel companies not in the contest?

Contestability Defined

While in junior high school many years ago, I played basketball, and I was pretty good at it. I was competitive in the city league (which isn’t saying much, to be fair). That all changed once I got to high school and had to compete against kids a foot taller than me. My skills plateaued, I gave up basketball, and I went into drama and politics (two things that go together, it turns out).

Alongside basketball, I also played baseball and volleyball, but basketball was the only sport where the ball was the subject of a continuous contest for possession. Control of the basketball can change at any time while the game is being played. The ball is contestable. An opposition player can slap the ball away, grab it from your hands, block your shot, or any number of other similar moves. Football (or what North Americans call soccer), gridiron (or what North Americans call football), water polo, Aussie rules, rugby, and many other sports are similar.

Similarly, businesses are in continuous contests for the consumer wallet. I’m presently scheming on a house renovation program and I’ve invited four renovation contractors to the contest. My relationship with a renovation contractor is contestable at the moment but once I select someone to work with, the contest is over.

How does contestability work in the context of the energy industry?

Our Relationship with Energy

As consumers, we’re conditioned to have an ambivalent unemotional relationship with our energy. It’s just there, lurking behind the light switch, or sloshing around in the gas tank, or springing into hot action when the house temperature falls too low in winter. Many people have no idea who even supplies their energy or how it gets to their homes.

As a result, our relationship as energy consumers with energy suppliers is not particularly contestable. Once you sign up with a local gas or power supplier, you don’t easily or often change. It’s fire and forget. Even payments are automatic.

In many settings, regulators see to it that you have only one energy supply option (admittedly a highly regulated one). In turn suppliers are motivated to introduce some friction into the process of switching (a need to see your credit history, for example, or a requirement to agree to a lengthy legal contract), to make it a little difficult for the consumer to craft a contest.

Due to the historic approach to energy value chains, consumers typically have more than one energy supplier relationship—in my case, a gas utility for heat and hot water, an electric utility for household mains, and one or multiple candidate fuel suppliers for my vehicle.

In truth, to most power and gas utilities, there are truly no customers at all, but billing addresses.

The most contestable of these energy relationship isn’t even a relationship at all, but a transaction—when you fill up your fuel tank. Given the ubiquity of fuel pumps at c-stores, grocery chains, and big box retailers, we get to make a choice of energy supplier at the margin every time we fill up. This choice might only be on the basis of the posted price of gasoline, but at least it’s a choice.

These fuel suppliers are in a daily contest for the energy dollar in your wallet.

It’s been this way for my entire life, 60+ years.

And it’s all about to change.

The Energy Consumer Relationship Is Now Contestable

Several factors are coming together that put all of these energy customer relationships into play at the same time, creating a war of all against all for the customer energy relationship of the future.

The biggest force is of course energy transition. Carbon is being priced out of the market, often times through taxation. But carbon-based fuels are also curiously losing ground in head-to-head competition against renewables. In Texas, home of the most dynamic oil and gas industry on the planet, renewables are frequently coming out the winner in the contest to be supplier.

To meet their obligations under the Paris Climate agreement, governments are creating cash programs to improve energy efficiency, insulate leaky buildings, create new energy sources, and swap out carbon for non-carbon energy in buildings and transportation.

The most mature alternate source of energy is solar power. Household solar changes the relationship the homeowner has with their electric and heat utility supplier quite dramatically. The formerly one-way arrangement (power utility sells, customer consumes) changes as the consumer can wheel their unused solar energy to the grid for a toll, or sell it to a neighbouring home. The consumer is suddenly a micro producer as well as a consumer. Contestants for this new relationship include solar panel makers, power suppliers, local distribution utilities, grid operators, software companies, financiers, and various third parties.

Next are batteries. No one household battery will transform a power market, but if you aggregate enough batteries together, you can create a virtual on demand stand-by power plant. That’s the idea behind Tesla’s power wall after it has scaled up to grid level. Instead of a stand-by gas turbine, utilities deploy massive banks of batteries that can instantly wheel power to the grid. Once enough households have their own batteries, through software they can be configured as a virtual power plant, able to store selected energy supplies, dispatch energy on instruction at market peak, as well as supply energy for the household.

Contestants for the relationship with the battery owner include battery suppliers, grid operators, power utilities, and energy traders.

Coming on strong are battery electric vehicles. All those batteries in the aggregate also form another virtual power plant that’s inconveniently on wheels. These batteries are big enough to displace household mains for a time, but it will take considerable software smarts to figure out the optimal way and timing to replenish those batteries when they’re on the move, and when to discharge them to the grid. Intimate knowledge of day-ahead markets, carbon pricing, power availability, planned outages, and a host of other factors create the landscape of an epic contest. Contestants for the relationship with the battery include power suppliers, power utilities, grid operators, charge point owners, smart chargers, charge point operators, vehicle owners, and vehicle makers.

The possibility of a winner-take-all scenario isn’t beyond reason—it has happened in other sectors, such as technology where Apple has created a powerful hardware-software-services stack that accounts for most of the profits in the phone industry. Tesla has cobbled together batteries, solar panels, vehicles, charge points, satellite networks, software and insurance products in a similar stack. It’s completely conceivable that in the future us consumers will have a single energy supplier that brings together our heat supply, power supply and transportation fuel in a single relationship, stitched together with software.

The vehicle companies (Ford, GM, Toyota and their brethren) have a lot to lose as electric vehicles have far fewer moving parts and lower ongoing maintenance. Revenue streams are at risk, and they’re not that good at software. The market is pricing their shares well below the market leader (Tesla). They’re trying out new ideas, such as BMW’s odd move to turn its heated car seats into a subscription service.

In my view, the battery, which is the most valuable part of the battery electric vehicle, will draw the bulk of the customer’s attention as they consider where and when to charge, how frequently, with what provider, on what terms, with what incentives. Will we continue to have a transaction-based relationship with energy, or will we have an energy supplier relationship that features a number of transactions?

Whither Fossil Fuels?

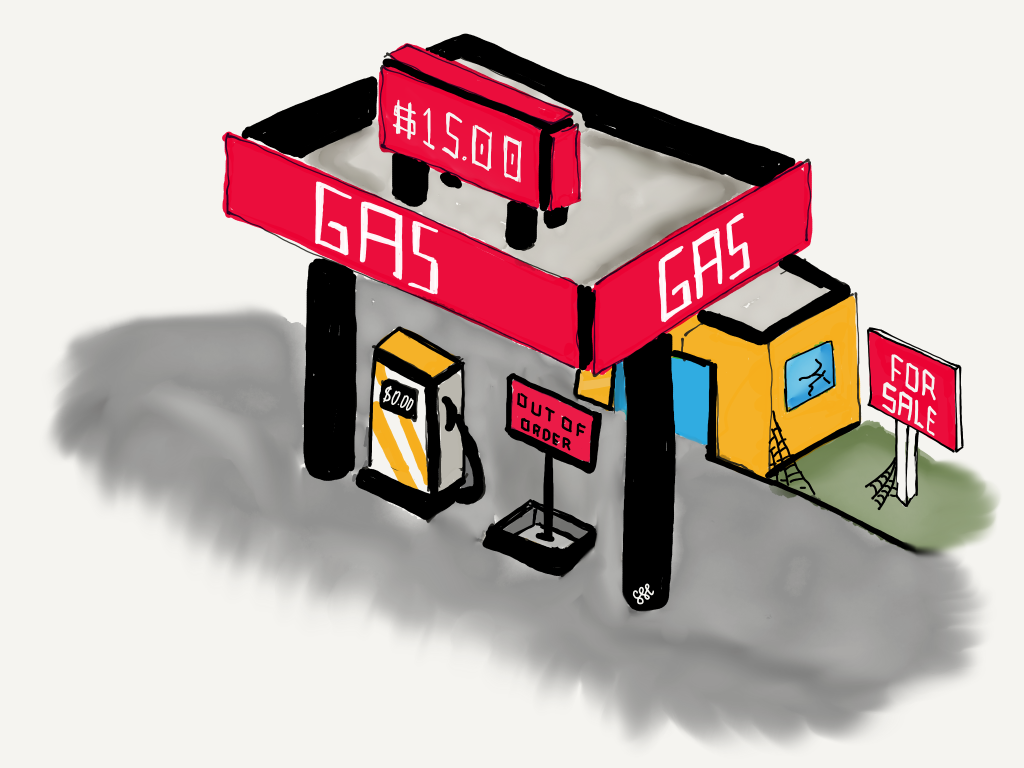

Note who is not in the contest here—fossil fuel energy companies. And this is puzzling to me. You would think that the incumbent energy companies would be all over this once-in-three generations opportunity:

Fossil fuels used in transportation account from between 25% to 50% of the value of a barrel of crude oil. Up to 50% of the demand for crude oil is in play, leading to potential stranded resources in the ground, along with stranded infrastructure used in the industry (refineries, tankers, tank farms, pipelines, delivery trucks, retail stations). Company boards must be asking what’s going to replace that.

Petroleum companies have the financial resources to invest to figure out the new customer relationship. Margins in oil and gas are more volatile, but when they’re good, they’re exceptional. When was the last time you heard a politician discuss windfall taxes on a solar farm?

Oil and gas companies have the engineering talent base to devote to this challenge, and that engineering talent base will be increasingly looking for other things to do as the battery vehicle market eats the petroleum industry.

The oil and gas industry has been setting and following standards for the use of its products since the inception of the modern industry over 150 years ago. The industry is very good at managing the regulatory process to achieve safe, reliable outcomes for society, its workers and its business partners. The energy world of the future will be highly fragmented and costly without some standard ways of working.

Oil and gas companies have powerful market relationships in place as sponsors of kids sports, major events, social institutions, and the arts. Their brands are in the main positive.

Fuel brands are among the very few that are truly global, as oil and gas is consumed in very corner of the planet. The biggest retail chains on the planet sell gasoline, not burgers. That asset is exceptionally powerful if it can be mobilized.

Conclusions

As part of my house renovation, I’ll be adding in a charge point or two, and sometime in the not too distant future, I’ll be buying a battery electric car. At that point, the transactional relationship I have with fossil fuel suppliers will cease entirely, unless they replace it with something. So far, they don’t appear to be in the contest. And that’s a shame.

Check out my latest book, ‘Carbon, Capital, and the Cloud: A Playbook for Digital Oil and Gas’, available on Amazon and other on-line bookshops.

You might also like my first book, Bits, Bytes, and Barrels: The Digital Transformation of Oil and Gas’, also available on Amazon.

Take Digital Oil and Gas, the one-day on-line digital oil and gas awareness course on Udemy.

Take the one-hour Digital for the Front Line Worker in Oil and Gas, on Udemy.

Biz card: Geoffrey Cann on OVOU

Mobile: +1(587)830-6900

email: [email protected]

website: geoffreycann.com

LinkedIn: www.linkedin.com/in/training-digital-oil-gas

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein