West Texas Intermediate rose as much as 0.8%, after earlier losing 1.1%. Crude inventories jumped by 14.9 million barrels last week, the American Petroleum Institute reported, according to people familiar with the data. If confirmed by government figures later Wednesday, it would be the largest increase since February 2021.

On the demand side, there’s a more bullish picture for China’s oil use. Trading giant Unipec bought US Mars crude for March-April arrival on Wednesday, while another Chinese firm also purchased American barrels. Earlier this week, the government issued a bumper batch of import quotas, spurring hopes of improved crude consumption.

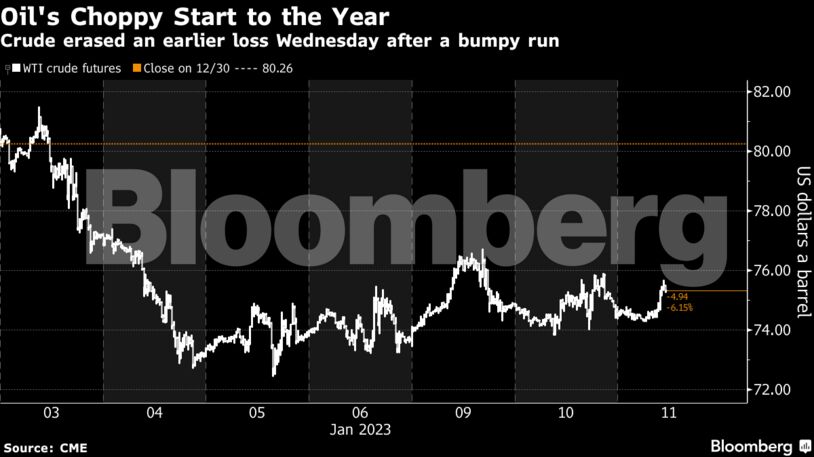

Oil has had a rocky start to 2023, slumping almost 10% in the first two sessions of the year on global recession concerns, before subsequently trending higher. Investors are keenly watching for clues on the outlook for US monetary policy, with JPMorgan Chase & Co.’s Chief Executive Officer Jamie Dimon saying rates may have to move higher than 5%.

“The impact of the bearish API will likely be transient,” said Vandana Hari, founder of Vanda Insights. The market will eventually shift its focus back to the economic outlook and moves by the Federal Reserve, she added.

Prices:

- WTI for February rose 0.3% to $75.31 a barrel at 9:59 a.m. London time.

- Brent for March settlement advanced 0.4% to $80.43 a barrel.

Near-term time spreads are holding in a bearish contango structure, signaling ample supply. Global benchmark Brent’s prompt spread — the gap between the nearest two contracts — was 15 cents a barrel in contango.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS