Oil has recovered from a steep drop at the start of the year, largely on hopes that Chinese consumption will pick up following years of lockdowns. Liquidity is also returning to the futures market, with open interest in global benchmark Brent near the highest since last February.

US crude inventories rose for a fifth week to the highest level since June 2021, the Energy Information Administration reported Wednesday. Still, the gain of 533,000 barrels was smaller than some market participants expected.

“Continuing inventory builds are somewhat limiting the upside of oil prices at the moment,” said Giovanni Staunovo, commodity analyst at UBS. “The recent rise in open interest is likely due to commodities lagging Chinese equities in pricing in the optimism over Chinese demand returning.”

Prices:

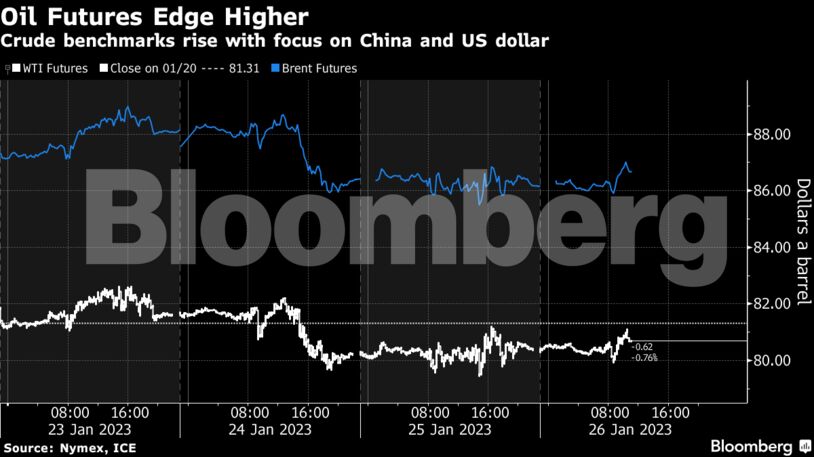

- WTI for March delivery rose by 50 cents to $80.65 a barrel at 11:24 a.m. in London.

- Brent for March settlement increased 0.7% to $86.69 a barrel.

In less than two weeks, a European Union ban on seaborne imports of Russian oil products will start at the same time as a Group of Seven-led price cap on the fuels, with concern it may be more disruptive to markets than recent sanctions on Russian crude. Russian shipments of diesel-type fuel from the Baltic port of Primorsk are on course to slow ahead of the restrictions.

Meanwhile, a 48-hour strike in France in protest against a government plan to overhaul the pension system is hampering deliveries of fuels from two oil refineries operated by TotalEnergies SE for the second time this month.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS