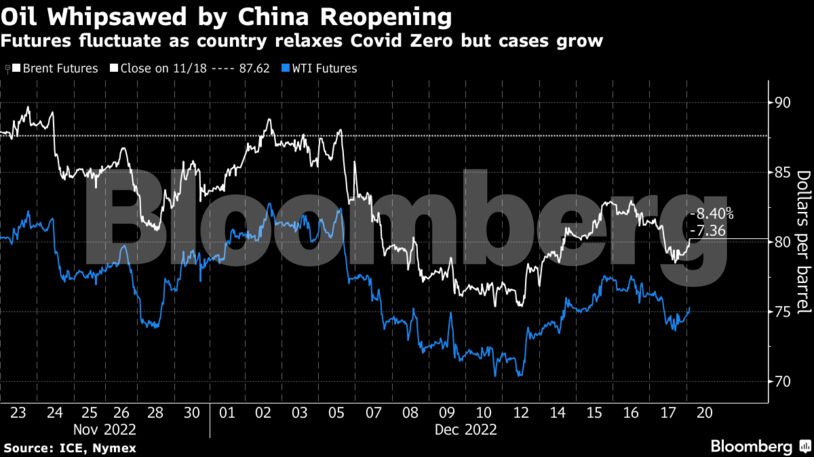

Brent crude fluctuated and traded near $80 a barrel after losing more than 4% in the final two sessions of last week. Trading volumes were below the 30-day average for both the global benchmark and West Texas Intermediate.

Chinese President Xi Jinping said restoring and expanding consumption should “take the precedence” as leaders concluded a meeting to set priorities for 2023. That pledge may help buttress energy demand even as Covid cases surge and the reopening process turns bumpy.

Oil is still headed for a second monthly loss as concerns about recessions in the US and Europe mount, with central banks continuing to tighten policy. In addition, Russian flows have so far proved to be resilient as a price cap imposed by the Group of Seven and European Union hasn’t led to major disruptions. Among major buyers, India said it doesn’t expect problems.

“The prospect of further rate rises will hit economic growth in the New Year and in doing so curb demand for oil,” said Stephen Brennock, an analyst at brokerage PVM. “China’s recovery will not be a swift affair, with the situation likely to get worse before it gets better.”

Prices:

WTI for January delivery added 1.1% to $75.14 a barrel by 9:22 a.m. in London.

The January contract expires Tuesday. More-active February futures rose 1.1% to $75.31.

Brent for February settlement gained 1.1% to $79.92 a barrel.

In the US, authorities are moving to replenish the Strategic Petroleum Reserve, starting with a 3-million barrel, fixed-price purchase, the Department of Energy said on Friday. The announcement caps a year that saw President Joe Biden order an unprecedented release from the SPR to help curb soaring domestic energy costs, which spiked after Russia’s invasion of Ukraine.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS