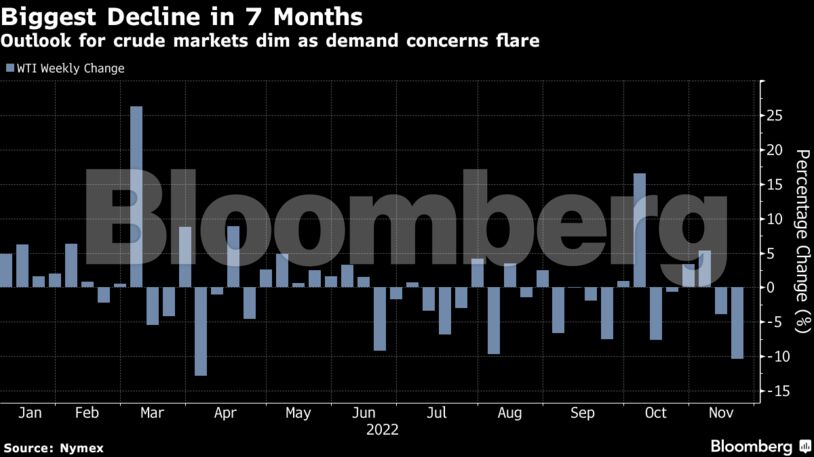

Pullbacks were evident along most of the oil-trading complex. On Friday, the US prompt-spread flipped into contango, a structure that signals oversupply, for the first time since last year. Meanwhile, a deteriorating market for physical barrels has also weighed on prices as demand for winter-delivery cargoes has weakened.

The collapsing gauges of market health sent bulls running for the exits. Hedge funds slashed bullish bets for Brent crude the most in four months. Money managers’ net-long positions on the international benchmark fell around 30,000 contracts, according to data from the U.S. Commodity Futures Trading Commission released Friday

Crude is trading below several key moving averages, sparking so-called technical-based selling. A further collapse in the market’s structure on Friday added to the selling.

Prices:

- WTI for December delivery lost $1.56 to settle at $80.08 a barrel at New York time.

- Brent for January fell $2.16 to settle at $87.62 a barrel.

Coronavirus cases in China have climbed to near their highest level of the pandemic, as authorities signal they’re preparing for even more infections. The increases will likely prove a test for any loosening of the country’s Covid rules.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS