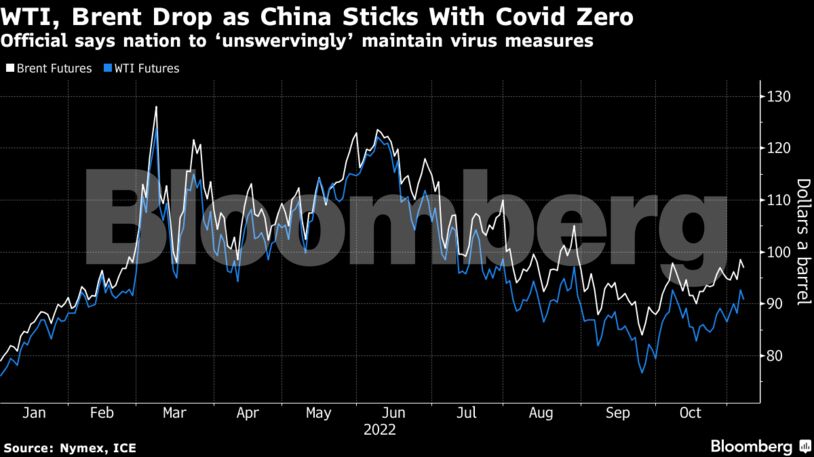

Oil has been buffeted in recent weeks as investors sought to gauge the outlook for demand in China, the impact of looming sanctions on Russian flows amid the war in Ukraine, and a decision by the Organization of Petroleum Exporting Countries and its allies to rein in production from this month. Gathering concerns about a global slowdown and tighter monetary policy have also swung prices. Nevertheless, a recent rally has once again brought the global Brent benchmark back toward $100 a barrel.

“Optimism that China will abandon its zero-Covid policy is evaporating,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates. “Nevertheless, the oil market is still likely to see upward price pressure heading into the year-end period as Russian supplies take a dive.”

Money managers have been betting on higher prices in the coming months. Net-bullish bets in the global Brent benchmark climbed to the highest level since June last week, while options markets have seen a flurry of bullish positions taken of late.

Prices:

- WTI for December delivery lost 0.5% to $92.19 a barrel at 9:51 a.m. in London.

- Brent for January settlement fell 0.3% to $98.23 a barrel.

China’s Covid Zero strategy relies on a combination of lockdowns and mass testing to stamp out infections, and its implementation has weighed on the nation’s economy and been a sustained headwind for the global crude market. Countrywide, more than 5,400 new cases were reported for Sunday, up 27% from a day earlier and the most since May 2.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS