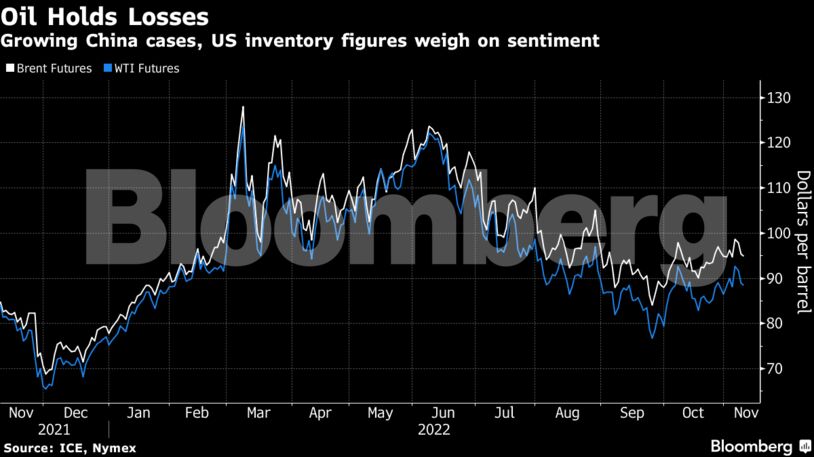

In the US, the industry-funded American Petroleum Institute reported oil inventories increased by 5.61 million barrels last week, according to people familiar with the figures, which also showed higher gasoline stockpiles. Official data from the Energy Information Administration follow later Wednesday.

Crude rebounded of late, with Brent crude futures rallying toward $100 this week, after the Organization of Petroleum Exporting Countries and its allies agreed to cut supplies. The International Energy Agency said on Thursday that the group may need to rethink its plans as they are damaging emerging economies. The world’s main physical oil benchmark, Dated Brent, rallied back above $100 this week.

“For now the market worries about fresh lockdowns hurting sentiment and demand, and together with the API storage report it has triggered some light selling,” said Ole Hansen, head of commodities strategy at Saxo Bank. “Especially after the failed attempt to break higher through recent highs earlier in the week.”

Prices:

- WTI for December delivery fell 0.7% to $88.33 a barrel at 10:20 a.m. in London.

- Brent for January settlement dipped 0.5% to $94.87 a barrel.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS