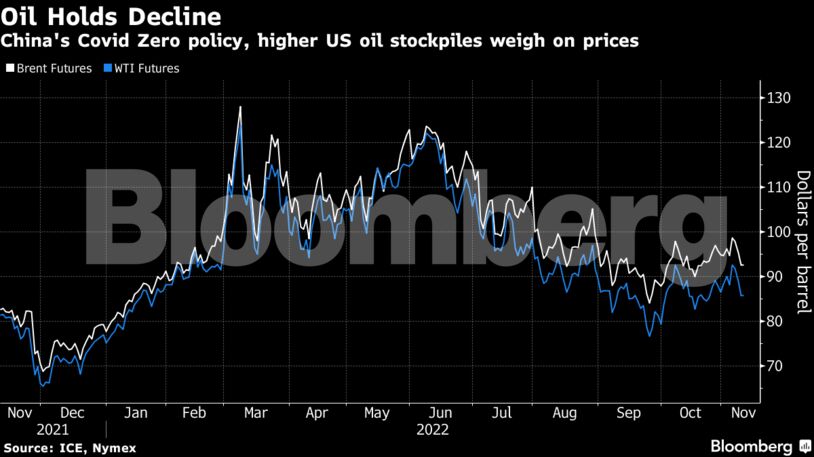

After Brent crude rallied toward $100 earlier this week, prices have pulled back on concerns about the demand outlook. Still, futures have regained some ground this quarter after the Organization of Petroleum Exporting Countries and its allies agreed to reduce supply, and traders are now looking ahead to US inflation data due later.

US CPI data should provide some guidance as to how successful the Fed’s efforts in tackling inflation are, said Tamas Varga, an analyst at PVM Oil Associates. “Chinese Covid-related demand woes, the reinvigorated dollar and a loose 4Q oil balance could push prices further south, but it is worth remembering that the EU oil boycott and the G7 price cap are less than a month away.”

The disruption to Russian oil flows is creating turmoil in the oil tanker market. Benchmark supertanker earnings neared $80,000 a day on Wednesday, the highest level since May 2020. Tanker owners have said in earnings calls that they expect cargo distances to increase in the coming months due to sanctions on Russian exports.

Prices:

- WTI for December delivery dipped 0.6% to $85.34 a barrel at 11:54 a.m. in London.

- Brent for January settlement was 0.4% lower at $92.26.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS