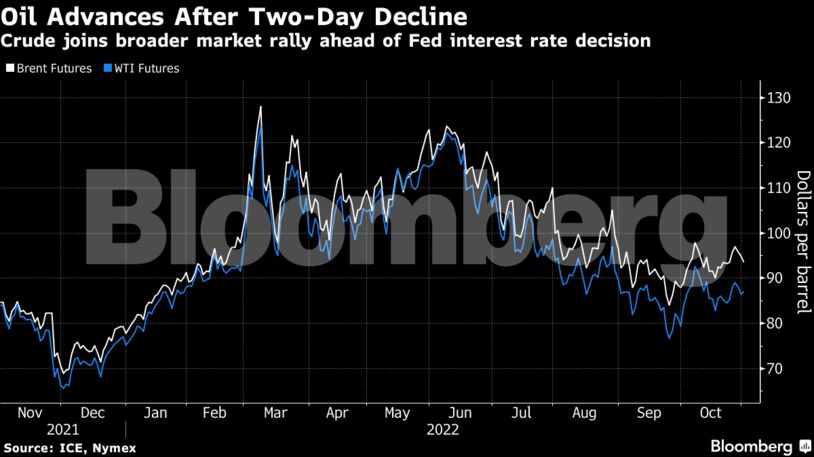

West Texas Intermediate futures climbed to trade above $87 a barrel after losing around 3% over the previous two sessions. The Federal Reserve is scheduled to make a decision on rates Wednesday, as central banks continue to tighten monetary policy to tame inflation. Chinese stocks surged on speculation that policymakers are making preparations to exit Covid restrictions.

While oil is down by almost a third since early June, futures capped the first monthly gain since May last month after the OPEC+ alliance agreed to sizable production cuts. Excess supply was the main reason to curb output from November, the group’s Secretary-General Haitham al Ghais said on Monday.

“We’re in a tale of two markets,” Joe McMonigle, the International Energy Forum’s secretary-general, told Bloomberg TV at the Adipec conference in Abu Dhabi. “The physical markets are very tight. The paper markets are pricing in bad economic news and a bad recession.”

Prices:

WTI for December delivery rose 1.7% to $87.99 a barrel on the New York Mercantile Exchange at 10:17 a.m. in London.

Brent for January settlement gained 1.8% to $94.49 a barrel on the ICE Futures Europe exchange.

A US-led plan to cap the price of Russian oil sales, part of the broader international response to the invasion of Ukraine, will temporarily exempt shipments loaded before Dec. 5, according to the US Department of the Treasury. Exempted cargoes must also be unloaded by Jan. 19.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS