(Bloomberg)

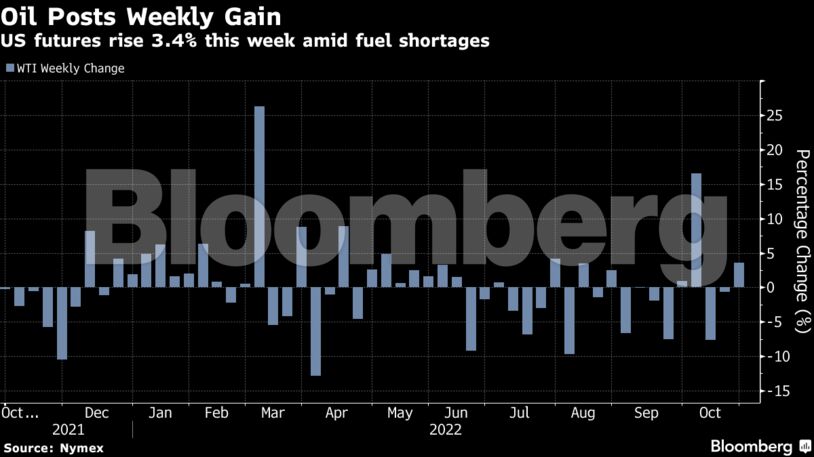

Oil’s rallied as US fuel stockpiles dropped and exports rose to a record, signaling robust demand despite recent bearish economic trends.

West Texas Intermediate futures settled near $88 a barrel after posting a 3.4% weekly gain. The US exported a record amount of fuel last week while East Coast diesel inventories dropped to precariously low levels, according to government data. Tight fuel inventories heading into winter bolstered crude markets even as Wall Street digested uneven corporate earnings.

“Crude prices posted a weekly gain as diesel supplies approach dangerously low levels and on hopes China’s economy could rebound before the end of the year,” said Ed Moya, senior market analyst at Oanda Corp,

Oil is on course to end the month higher, following a four-month decline. A decision by the Organization of Petroleum Exporting Countries and its allies to cut production in November and looming European Union sanctions on Russia have tightened the supply outlook. In addition, refiners in top importer China have snapped up millions of barrels as they plan to ramp up fuel exports.

Prices:

- WTI for December delivery fell $1.18 to settle at $87.90 in New York.

- Brent for December settlement lost $1.18 to settle at $95.77

Widely-watched time spreads continue to hold in backwardation, a bullish pattern signaling tightness. Brent’s prompt spread — the difference between the two nearest contracts — was $2 a barrel, up from $1.27 a month ago.

Meanwhile, Exxon Mobil Corp. and Chevron Corp. amassed more than $30 billion in combined net income as politicians blast Big Oil for raking in massive profits at a time when consumers are struggling with soaring inflation and energy shortages worldwide.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS