(Bloomberg)

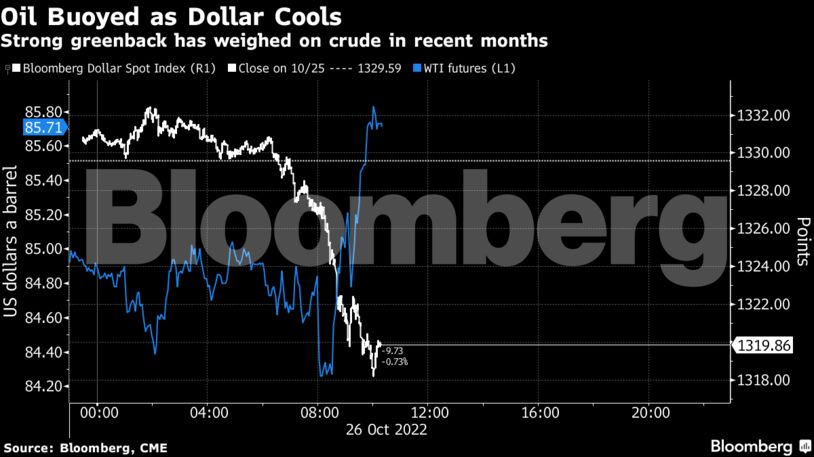

Oil pared an earlier drop as sharp decline in the dollar made commodities priced in the currency more attractive.

West Texas Intermediate traded near $86 after earlier shedding 1.4%. A gauge of the dollar declined for a second day to its lowest level in three weeks. Strength in the greenback has weighed on crude ever since its retreat below $100 a barrel over the summer.

The benchmark has lacked direction lately, torn between the prospects of a slowdown in global growth as central banks hike interest rates to combat inflation and OPEC+ output cuts. Trading volumes have suffered on WTI as a result, coming in at about half of normal levels so far this week.

“Crude oil remains rangebound,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “Short-term direction is being provided by the movements in the dollar and focus on today’s weekly US stock report.”

The American Petroleum Institute reported US inventories expanded by about 4.5 million barrels last week, according to people familiar with the figures. Government data will follow later Wednesday, with the breakdown coming amid heightened concern about product supplies including diesel.

| Prices: |

|---|

|

Click here to read Bloomberg’s daily Europe Energy Crunch blog

Signs of macro-economic weakness continue to emerge, darkening the outlook for energy demand. The economy in China, the top crude importer, slowed in October, according to a Bloomberg index of early indicators, signaling last month’s pickup wasn’t enough to change the country’s grim economic picture.

To help rein in crude and gasoline prices the Biden administration has released millions of barrels of crude from the nation’s strategic reserves. On Tuesday, Saudi Arabia’s energy minister criticized major importers for trying to tame prices by selling down their inventories, while defending OPEC+’s supply cut.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS