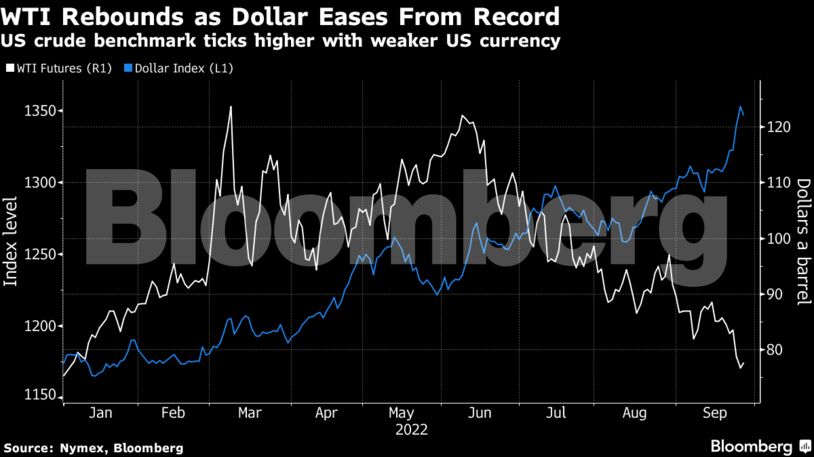

The US oil benchmark remains on track for its first quarterly loss in more than two years on concern that energy consumption will fall, with Russia’s war in Ukraine dragging on. Some analysts have said the slump may spur the Organization of Petroleum Exporting Countries and allies to consider paring supply, while Goldman Sachs Group Inc. slashed its oil forecasts as markets price in a major hit to global growth.

“A strong USD and falling demand expectations will remain powerful headwinds to prices into year-end,” Goldman analysts including Damien Courvalin wrote in a report. “Yet, the structurally bullish set-up — due to the lack of investment, low spare capacity and inventories — has only grown stronger, inevitably requiring much higher prices.”

| Prices: |

|---|

|

Top traders have also indicated wariness about the recent price pullback. Trafigura Group’s chief economist said commodity markets are potentially moving from cycles to a world of price spikes instead amid sustained underinvestment and a lack of spare capacity.

Threats to demand remain as monetary policy is set to tighten further. A parade of Federal Reserve policy makers signaled on Monday that further rate increases are in store, with the need to tame inflation coming at the cost of a slowdown. Among them, Fed Bank of Cleveland President Loretta Mester said that officials will need to keep restrictive policy in place for longer.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS