(Bloomberg)

In the hydrocarbon-rich fields of Texas, natural gas was always treated like the dregs that crews had to deal with as they pulled oil out of the ground. The two often emerge from wellheads together, and so for decades drillers would simply burn off the gas or sell it at cost. Oil, and all the riches that came with it, was always the big prize.

Now, in a sign of just how much Russia’s invasion of Ukraine has thrown global energy markets into disarray, it’s natural gas, not oil, that’s becoming more coveted in US shale fields. With Europe desperately seeking alternatives to Russian gas that powered furnaces and electricity grids, prices are skyrocketing and US drillers are scrambling to extract, liquefy and ship more of it overseas.

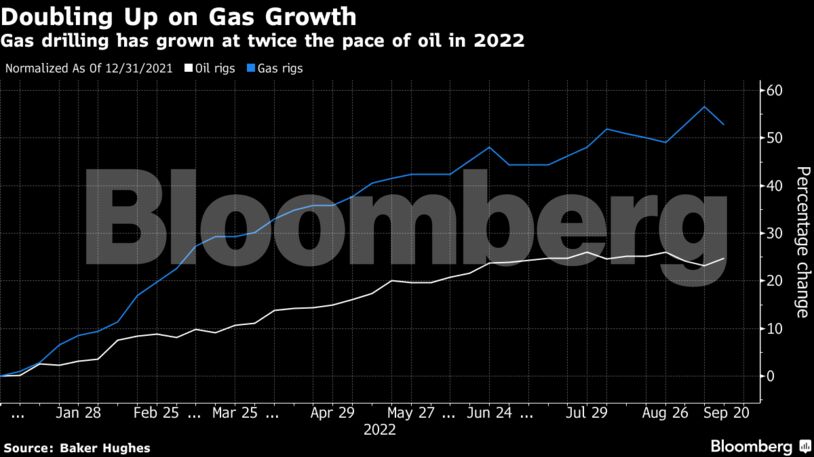

Meanwhile, US oil drilling has only risen 25% this year, according to Baker Hughes Co., a reflection of the much weaker performance of the underlying commodity relative to gas. Benchmark US crude prices have advanced less than 3% since the end of 2021.

“The commodities folks have somewhat ignored the big growth that we’ve seen in the gas-rig count versus last year,” Leo Mariani, an Austin-based analyst at MKM Holdings LLC, said in a phone interview. “It seems like oil’s gotten hit hard over concerns over the economy recently and gas has quietly just done really well on a relative basis this year.”

Oil has for decades been a far more profitable target for drillers relative to gas. But that axiom has been turned on its head as the advent of the US gas-export sector enabled American companies to capitalize on overseas price spikes heretofore beyond their reach.

The math is compelling. The forward prices on which explorers base drilling decisions have advanced much more dramatically for gas than oil this year. Gas to be delivered two years from now has climbed 50% from the end of last year, compared with a 5.8% rise for US crude over the same timespan.

Some of the biggest US shale specialists are shifting more of their production mix to gas at the expense of crude. Callon Petroleum Co., Continental Resources Inc. and Pioneer Natural Resources Co. are among drillers that have switched more than 10% of their overall output to gas from oil, according to data compiled by Bloomberg.

There are a number of factors at play, including a crackdown on so-called flaring in remote regions as well as the natural process whereby aging wells pump out a greater concentration of gas versus crude as time goes by. The capture of formerly flared gas has been largely driven by the environmental, social and governance movement.

“Investors are more supportive of the gas narrative, both from an ESG standpoint and an investment standpoint,” said Ben Dell, co-founder and managing partner at Kimmeridge Energy Management. “As a result, becoming incrementally gassy hasn’t been punished.”

Energy stocks have increased more than 25% this year, compared with a 23% loss for the broader S&P 500 Index. And yet, analysts such as Vince Piazza at Bloomberg Intelligence still see muted enthusiasm for gas among equity investors.

“It’s underrepresented in a lot of portfolios,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS