Germany will nationalize Uniper SE in a historic move to rescue the country’s largest gas importer and avert a collapse of the energy sector in Europe’s biggest economy.

Chancellor Olaf Scholz’s administration will control about 99% of the Dusseldorf-based utility after injecting 8 billion euros ($8 billion) into the company and buying the majority stake held by Finnish utility Fortum Oyj. The final package will likely run into the tens of billions of euros, including credit lines to keep the company operating with energy markets still in turmoil.

Germany is paying the price for building up a reliance on Russia, which supplied more than half of the country’s gas before President Vladimir Putin ordered the invasion of Ukraine. Scholz is now overseeing a rapid overhaul, but the implications will last for years.

Uniper shares tumbled as much as 39%, with its market value falling to about 1 billion euros. Freed from its risk related to the German utility, Fortum shares surged as much as 20%, its biggest ever jump.

Nationalizing Uniper is Germany’s biggest step to date to protect the country from blackouts and rationing this winter and beyond, and more will likely follow. The government is also in advanced talks to take control of VNG AG and Securing Energy for Europe GmbH, the former German unit of Russia’s Gazprom PJSC.

| Deal Details |

|---|

|

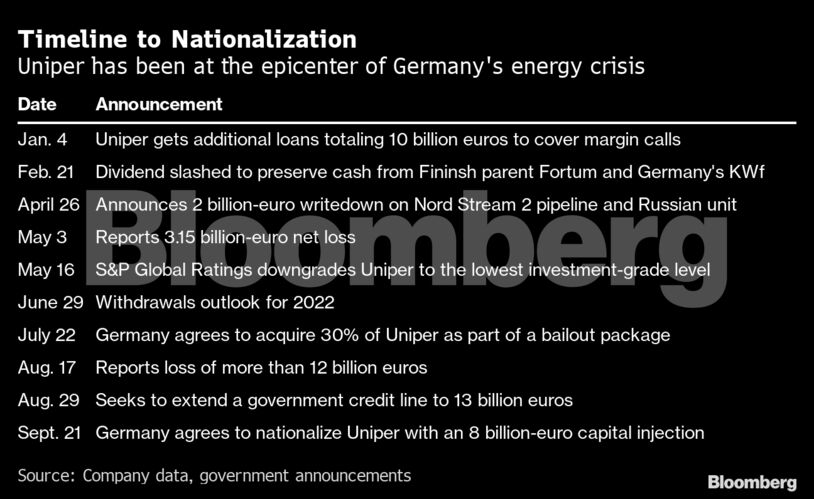

Uniper is at the epicenter of Germany’s energy crisis. Its massive gas contracts with Russia exposed the company to the Kremlin’s moves to slash supplies in retaliation for sanctions. The utility has accumulated 8.5 billion euros in gas-related losses after prices for alternative sources soared.

“Today’s agreement provides clarity on the ownership structure, allows us to continue our business and to fulfill our role as a system-critical energy supplier,” Uniper Chief Executive Officer Klaus-Dieter Maubach said on Wednesday. “This secures the energy supply for companies, municipal utilities, and consumers.”

The company’s problems are tied to its creation in 2016. With Germany setting the wheels in motion to gradually shift to wind and solar energy, the need for hulking power plants that burn coal and gas was declining. To focus on operating renewable capacity, EON SE pooled these assets into Uniper and spun it off.

Despite Uniper’s issues, Germany can’t allow it to collapse for fear of setting off a chain reaction that could leave factories halted and households without heat. Those concerns are motivating discussions to nationalize VNG and Gazprom’s former unit. The government also seized control over the local unit of Russian oil major Rosneft PJSC to secure a key refinery that supplies Berlin with fuel.

The risk of energy shortages has rippled across Europe. Public spending to contain the crisis has swollen to half a trillion euros across the European Union, the UK and Norway, according to think tank Bruegel.

Germany’s exposure to Uniper includes an existing 13 billion-euro credit line from KfW. The state-owned lender will continue to provide financing until the deal is completed. The total rescue package will cost the government around 30 billion euros, according to reports in German media.

Uniper’s losses from finding alternative suppliers to Russia will likely surpass 18 billion euros this year, according to Bloomberg Intelligence. The company already reported a loss of more than 12 billion euros for the first half, ranking among the biggest in German corporate history.

Talks to rescue Uniper were complicated by the involvement of the Finnish government, which has come under pressure over its handling of the rescue from opposition parties. Prime Minister Sanna Marin’s administration said it was satisfied with the deal.

For Scholz’s ruling coalition, the tensions are likely just starting. The effort to shore up the energy sector is being overseen by Habeck, a member of the Green party, and the process of putting billions of euros of taxpayer money at risk could put him at odds with Finance Minister Christian Lindner, a fiscal hawk who heads the business-friendly Free Democrats.

The Uniper rescue also raises questions about the implementation of the government’s planned gas levy. The temporary measure, which is supposed to take effect from Oct. 1, is designed to allow suppliers to share the burden of high prices with consumers but has prompted a public backlash.

Around a dozen companies have applied for compensation totaling about 34 billion euros, according to Trading Hub Europe, which is overseeing the levy, with Uniper guzzling most of the aid.

Habeck has said he plans to revise the controversial levy to shut out company’s that aren’t affected by surging prices. On Wednesday, he said the plan is being revised, but said questions whether the measure can benefit a state-owned company is being “intensively discussed.”

If the levy fails, financing energy bailouts and aid to householdes and businesses could put Lindner’s plans to restore constitutional debt limits at risk. Lindner said Germany can press ahead with the measure without a further review, in an apparent contradiction to Habeck’s comments.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein