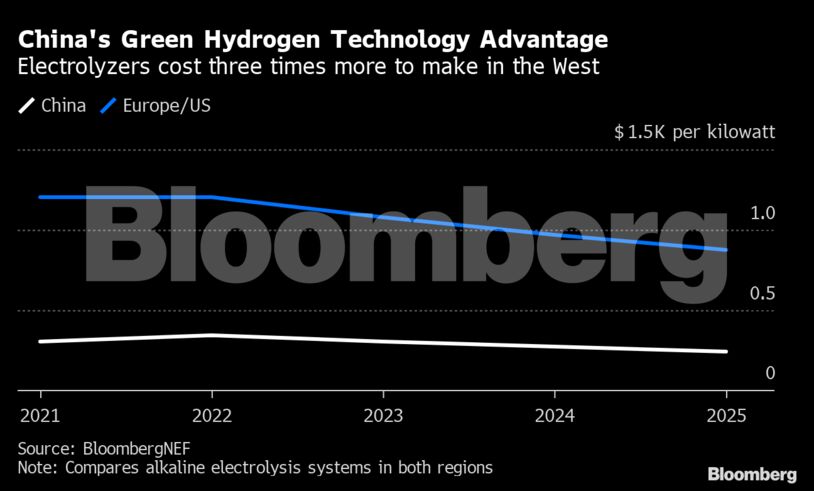

Orders for the systems are soaring as more industries seek to decarbonize, which should help manufacturers build up economies of scale and reduce costs by 30% by 2025, BNEF analysts including Xiaoting Wang said in the report.

Chinese factories enjoy cheaper labor and a more developed supply chain for the components and raw materials, according to BNEF. China also had a relatively larger electrolyzer manufacturing industry before the green hydrogen boom, because of industrial demand in sectors like polysilicon manufacturing, it said.

Even given added costs for transportation and installation, Chinese systems can be delivered to international markets at a significant discount to Western manufacturers. BNEF expects China’s share of European and US sales to be less than 30% through 2025, but says there’s a chance to increase it beyond then.

Any move to erect trade barriers would likely be met by Chinese firms expanding manufacturing into Southeast Asia, following the blueprint of the solar industry, BNEF said.

“Chinese manufacturers have started their march into international markets,” it said in the report. “Electrolysis products made in China are likely to become popular worldwide during 2025-30.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire