The plan emerging from central bank proposals and a gradual unwinding of local restrictions will focus on mobilizing capital at home while catering to jurisdictions it considers friendly.

From Monday, the Moscow exchange will allow trading in debt securities for investors from countries that haven’t joined the sanctions imposed by the US and its allies. The decision ends a hiatus in place since Russia sealed off its markets to restrict the flow of money out of the country when the war began in late February.

But the resumption won’t extend to clients from “unfriendly” countries, who remain subject to capital controls banning foreigners from selling or collecting payments on local securities. The group — which includes nations from European Union members to Canada and Japan — accounted for around 90% of total portfolio investments into Russia as of last year.

“At the start it was a necessary capital control to stabilize the situation,” said Christopher Granville, managing director for global political research at TS Lombard in London. “But now it’s more a matter of principle of not relaxing while there are these unprecedented sanctions from the West in place.”

It’s the latest example of Russia taking an increasingly hard line sorting friend from foe.

This month, President Vladimir Putin banned some foreign banks and energy companies from exiting their businesses in the country. Another decree allowed Russian lenders with frozen foreign exchange to halt operations with corporate clients in those currencies. And Russia’s sovereign wealth fund may now invest in the currencies of nations like China, India and Turkey, after penalties blocked euro and dollar purchases.

Putin Calls Time on Foreign Listings in Fresh Hit to Tycoons

“Given the circumstances, it will be necessary to develop trade and financial relations with those countries that are ready to do this with Russia,” said Oleg Vyugin, a former top Russian central bank and Finance Ministry official.

Finance emerged as a new front against Russia almost immediately after Putin ordered his military into Ukraine on Feb. 24.

To punish the Kremlin, foreign governments slapped sanctions on trade and finance, froze about half the reserves of its central bank and cut many of its banks from the SWIFT global messaging system.

Unable to intervene to defend the ruble with only yuan and gold, the central bank put up capital controls and other emergency measures to calm investors.

New Normal

But Russia is turning the page now that domestic markets appear to have ridden out the storm.

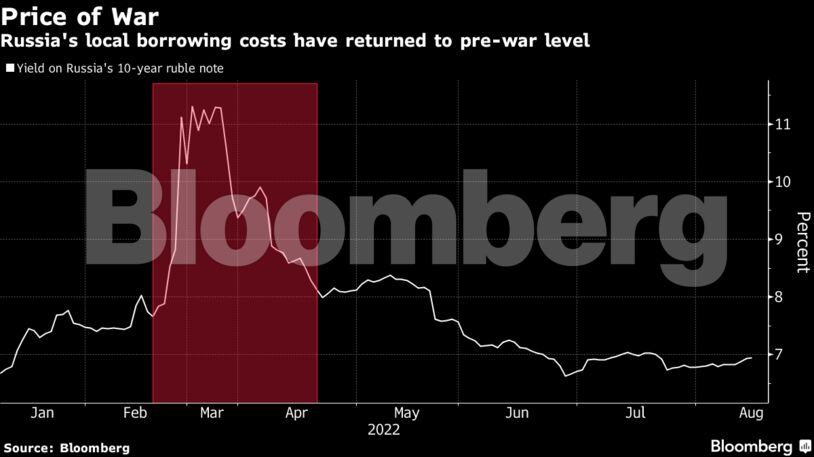

Windfall energy revenue and a collapse in imports helped the ruble bounce back, allowing authorities to roll back restrictions on capital controls. Local bond yields are back to pre-war levels.

It’s unclear how Monday’s partial reopening of the domestic market will impact investors from hostile jurisdictions intending to divest their holdings of local currency debt. Even now, it is possible for investors to sell their holdings, albeit at depressed prices, according to Viktor Szabo, a fund manager at Abrdn in London.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS