“Powell reminded Wall Street that restrictive policy is required but we are not there yet, so recession fears and a deteriorating crude demand outlook is not warranted yet,” said Ed Moya, senior market analyst at Oanda.

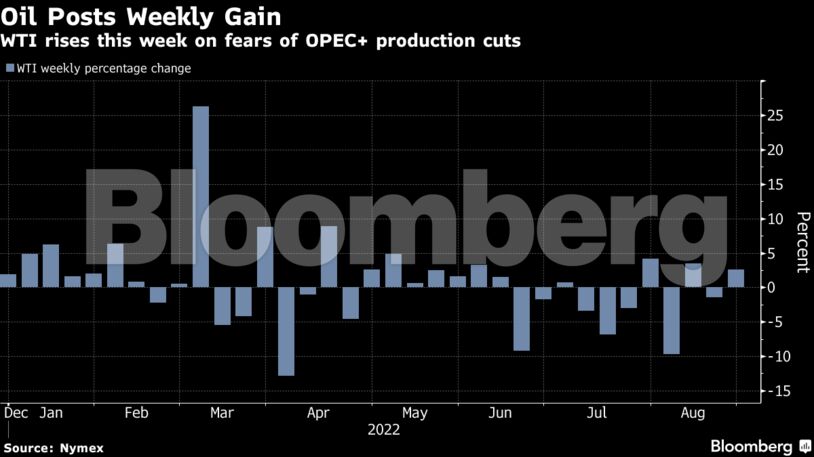

Oil has lost almost a quarter of its value since June on escalating concerns over a global economic slowdown, but seems to have found a floor around $90 a barrel this month. The prospect of a revived nuclear deal with Iran, which could lead to a surge in crude exports, has added to bearish sentiment recently.

With inflation still rampant, Fed officials revived concerns Friday that they would take continue to move aggressively to slow the economy.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time,” Powell said in remarks prepared for a policy forum in Jackson Hole, Wyoming. “The historical record cautions strongly against prematurely loosening policy.”

| Prices: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS