Aug 24, 2022

(Bloomberg)

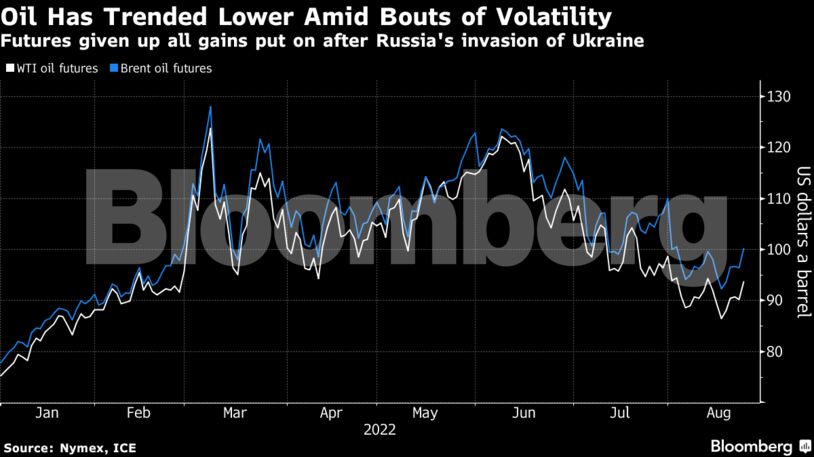

Oil rallied for a second day as an industry report signaled another drawdown in US crude inventories, adding to a tightening supply outlook after Saudi Arabia flagged possible cuts to production.

Brent futures rose 1.4% to trade above $101 a barrel in London. The American Petroleum Institute reported crude stockpiles dropped by 5.63 million barrels last week, according to people familiar. That followed news that exports from Kazakhstan may be disrupted for months.

The market’s rally has spurred a more positive technical picture in the oil market, with Brent trading above its 200-day moving average. Timespreads that gauge market strength also jumped in recent days.

Oil has rebounded since Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said the futures market is increasingly disconnected from fundamentals, and the OPEC+ alliance may be forced to cut output.

“Overall the comments from the Saudi minister sent the ball rolling, and the API data gave it an extra spin,” said Ole Hansen, head of commodities strategy at Saxo Bank.

The potential revival of a nuclear deal with Iran, which could lead to a surge in exports from the OPEC producer, has weighed on the market recently. A senior House Republican demanded that the US Congress be given a chance to review any agreement as Tehran and Western powers inch toward an accord.

| Prices: |

|---|

|

There also has been a fresh push in US-led efforts to cap the price of Russian oil. India said it will seek a broader consensus before supporting any such plan, with US officials expected to advocate for it in the country this week.

The Energy Information Administration will release official figures on US demand and stockpiles later Wednesday. The API also reported that fuel inventories and supplies at the key storage hub at Cushing, Oklahoma, rose.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS