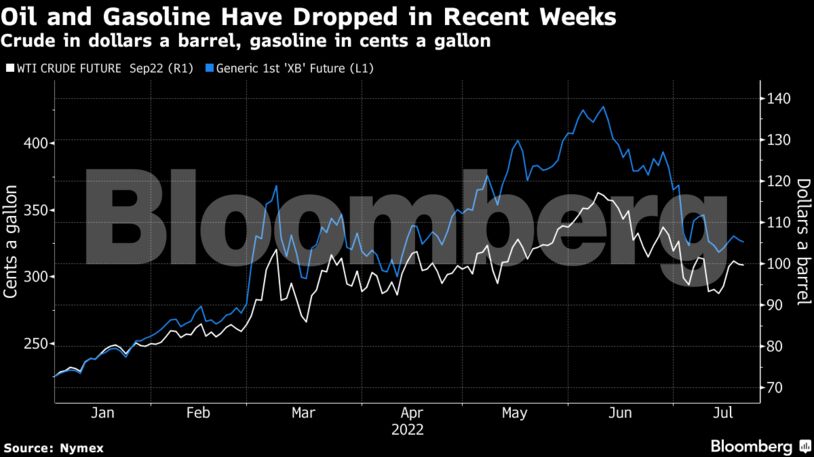

West Texas Intermediate futures fell toward $95 a barrel. The slump came after a US report showed gasoline inventories rose more than expected last week, while stalling demand sent the motor fuel’s premium over crude plummeting.

Further bearish signs emerged from Libya with production rising above 700,000 barrels a day after restrictions on exports were lifted in recent days. Output is expected to return to 1.2 million barrels a day within a week to 10 days. The premium of the nearest crude futures contract over the next month eased, indicating cooling concerns about market scarcity.

After rallying for most of the first half of the year following Russia’s invasion of Ukraine, oil prices have been dragged lower in recent weeks by fears of recession, central bank tightening, and a broad move by investors away from commodities. Prices have swung sharply at times this week as volatility reigns over the market.

“Crude oil price action remains choppy, with trading volumes particularly thin as is typically the case through the summer,” Citigroup Inc. analysts including Francesco Martoccia wrote in an emailed report. “Mobility data around the globe as well as high-frequency implied demand from the US and elsewhere still depict a deteriorating picture.”

The softness in gasoline in particular can be seen in prices. The fuel’s premium over US crude was more than $60 a barrel at one point in June, and is now less than half that. At the same time, retail fuel prices in the US have fallen for 37 consecutive days.

| Prices: |

|---|

|

Traders also tracked events in Europe as Russia’s biggest gas pipeline to the continent restarted after a 10-day maintenance period. While there had been concern that a failure to restore the flows would roil energy prices, pipeline operator Nord Stream AG said Moscow had started sending gas through, bringing some relief to markets.

In Asia, China’s persistence with its strategy of trying to eradicate Covid-19 has acted as a drag on energy usage and slowed regional growth. The Asian Development Bank cut its forecast for gross domestic product growth in developing Asia as Beijing’s approach to the virus creates ripple effects.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS