Shell Plc, TotalEnergies SE and Equinor ASA are among the companies that have evaluated the suitability of European utilities for takeovers, according to people familiar with the matter. Potential targets include some of the region’s largest wind and solar producers such as Iberdrola SA, Orsted A/S, and SSE Renewables Ltd.

Internal deliberations like these have happened before without resulting in any deals, largely because the potential targets have been so expensive. But the surge in oil majors profits in the last six months could mean a major takeover is now within reach, the people said, asking not to be named because the information is private.

“These companies have plenty of cash now and much stronger balance sheets,” said Christyan Malek, Global Head of Energy Strategy at JP Morgan. “There is a build versus buy discussion happening within the core of Big Oil and their renewables businesses right now.”

In the words of BP Chief Executive Officer Bernard Looney, the oil and gas industry has become a “cash machine.” Even after a drop of more than 10% this month due to recession fears, Brent crude is still trading near $100 a barrel and refining profits are sky high.

That means the cash will continue to roll in. Analysts expect Shell to post even higher second-quarter profits than the record $9.13 billion it earned in the first three months of the year. TotalEnergies and BP are also expected to benefit from high refining margins as well as oil and gas prices.

Historically, cash flow on this scale would have been the trigger for Big Oil to pour money into large fossil fuel projects. But Europe’s majors have committed to pivoting away from their core business into renewables and low-carbon fuels.

So far, the industry has taken an incremental approach, expanding its clean energy portfolios project by project. Shell plans to build Europe’s largest green hydrogen plant, BP is investing in a large renewables hub in Australia, and TotalEnergies recently joined an Indian conglomerate that will invest as much as $50 billion over the next 10 years in wind, solar and hydrogen.

That was all these companies could afford when they first made their net-zero pledges during the depths of the Covid-19 energy price slump. BP and Shell had just made deep cuts to their dividends. TotalEnergies was in a stronger financial position, but CEO Patrick Pouyanne effectively ruled out any big clean-energy deals because the companies were “extremely expensive.”

That’s still the view of some people in the industry.

“I do not see a super-major and super-utility or super-renewable combination” said Banco Santander SA analyst Jason Kenney. To generate real value companies would be better off developing their own large-scale renewables projects “and building out a portfolio organically.”

Reversal of Fortune

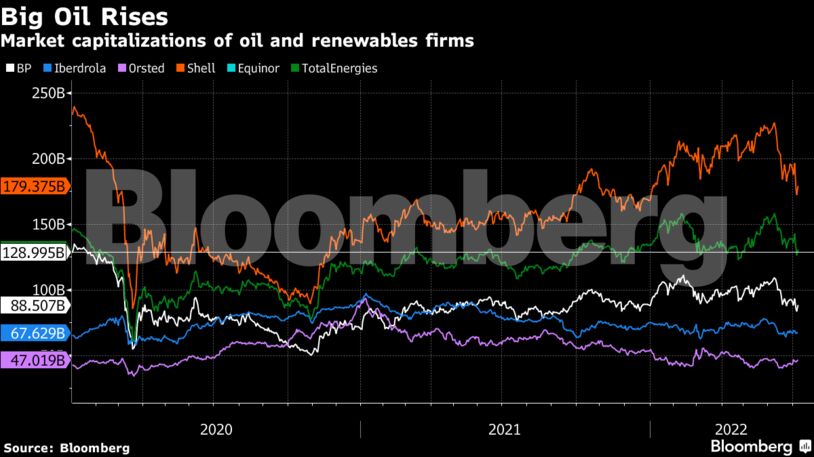

At the height of the coronavirus pandemic, the market capitalization of Iberdrola, a Spanish utility with a heavy focus on renewable energy, overtook BP and TotalEnergies. This year, the petroleum giants are back on top after Russia’s invasion of Ukraine drove a stunning rally in oil and gas prices. Meanwhile, actions by central banks to counter that inflationary surge are making life harder for renewables developers.

“Better balance sheets — coupled with a tougher rates environment — provide an attractive backdrop for the international oil companies to further consolidate in this space and help address the issue of scale,” Citigroup Inc. analysts including Alastair Syme wrote in a note.

Shell has looked at Iberdrola and Orsted as possible targets, according to people with knowledge of the matter. Shell and Equinor have both considered the potential of buying SSE Plc’s renewables unit, the people said. Last year, TotalEnergies explored a takeover of EDP-Energias de Portugal SA, but ultimately abandoned the idea, according to people with knowledge of the matter.

Shell wasn’t immediately able to comment on the matter. TotalEnergies didn’t reply to an email seeking comment. Equinor declined to comment.

These internal discussions have been entirely preliminary and so far there’s no sign that any of the potential buyers are ready to pounce, one person said. Investment banks continue to pitch several other transformative acquisition opportunities to the oil majors, which would accelerate their push into renewables, the people said.

The takeover of a major clean energy producer by a big oil company wouldn’t necessarily mean the world hits it emissions targets any quicker, but could help the buyer leapfrog its peers in the race to adapt to a low-carbon future.

“It makes sense for them to buy assets rather than build them,”said JPMorgan’s Malek. “It’s simpler to buy, expedite your gigawatt targets, thereby allowing you to decarbonize.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS