It’s a similar picture in the shape of the futures curve. The nearest Brent futures are more than $4 higher than the second month — a bullish structure that indicates scarce supply. The spreads typically trade at a premium or discount of just a few cents.

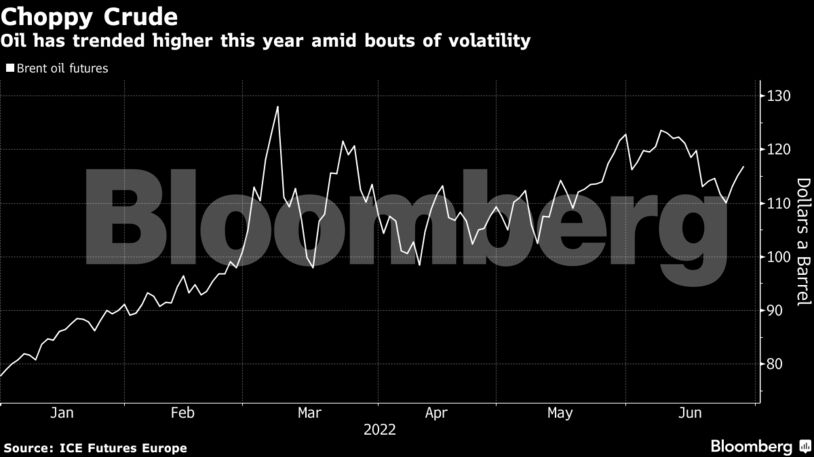

Oil is up about 50% this year, but the strength in physical markets has run contrary to a sharp slide in headline prices in recent weeks. While fears of a global economic slowdown have weighed on futures, demand remains robust for now. Support for crude and refined products is also coming from the risk of Russian supply disruptions amid the war in Ukraine.

“While the tight supply of oil products was still the focus a few days ago, attention is now shifting increasingly to the tightness of crude oil again,” said Carsten Fritsch an analyst at Commerzbank AG.

Oil prices also rose Tuesday as broader sentiment was boosted by China’s move to cut in half the time new arrivals must spend in isolation, the biggest shift yet in its pandemic policy. Meanwhile, the G-7 tasked ministers to urgently discuss an oil price cap on Russia.

| Prices |

|---|

|

Travelers to China must spend spend seven days in centralized quarantine, then monitor their health for another three days at home, according to a government protocol. That’s down from 14 days hotel quarantine in many parts of China currently, and as many as 21 days of isolation in the past.

The prospect of additional supply from two of OPEC’s key producers also looks limited. French President Emmanuel Macron told his US counterpart Joe Biden that the United Arab Emirates and Saudi Arabia are already pumping almost as much as they can. Macron was relaying a conversation he had with UAE ruler Sheikh Mohammed bin Zayed. OPEC+ ministers gather on Thursday.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS