Europe’s natural gas balance is “fragile and it remains just one supply disruption away from completely falling apart,” said Shikha Chaturvedi, an analyst at JPMorgan Chase & Co.

Unless processes can be resolved to meet Kremlin demands while also steering clear of European Union sanctions, more countries are at risk of being shut off in coming days or weeks.

Europe relies on Russian gas for one fifth of its electricity generation, and a minor disruption could quickly ripple across the continent. Storage levels are currently at just 32% capacity, compared with the target of at least 80% needed to keep homes heated and factories running through the winter.

The shutoff of Poland and Bulgaria shows the strain. While the volumes are relatively low, the shortfall soaked up supplies from Germany and liquefied natural gas cargoes. That reduces the buffer to cope with further disruption.

President Vladimir Putin has decreed that gas customers in Europe pay in rubles, which the EU says violates sanctions and has called for companies to continue paying in euros — leaving it up to the Kremlin to refuse or accept. While the bloc aims to cut its dependency on Russian gas by two thirds this year, an abrupt halt would come too soon.

The EU has offered vague guidelines in an effort to stand up to Russia over its invasion of Ukraine while maintaining gas flows. On Friday, Russia clarified the rules on how European customers are required to pay, easing the terms slightly but still leaving doubts over the role of the country’s sanctioned central bank in converting euros to rubles.

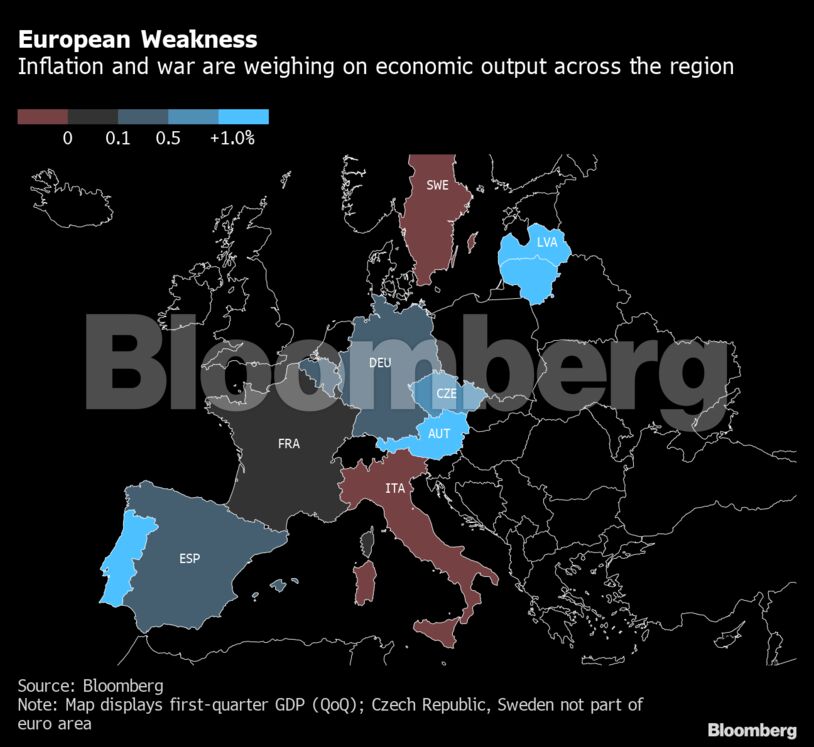

EU energy ministers will gather in Brussels on Monday for an emergency meeting to discuss options to maintain energy supplies and the fallout from the move by state-owned Gazprom PJSC to cut off Poland and Bulgaria. The standoff risks creating divisions between heavy importers such as Germany and those less exposed like France.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS