The country has imposed a series of lockdowns, including in Shanghai to stamp out a fresh Covid-19 wave. The drop in fuel demand is the equivalent to a decline of 1.2 million barrels a day, the people said.

“Shrinking demand is a direct result of the impact of lower economic activity globally,” said Claudio Galimberti, Rystad Energy’s senior vice president of analysis. This year, “oil demand is set to shed 1.4 million barrels per day, dropping below the highs set in 2019.”

The macroeconomic picture is also creating headwinds for crude. Investors are bracing for the U.S. central bank to hike interest rates at a rapid clip, with Chair Jerome Powell signaling two or more half percentage-point increases in comments on Thursday. The pivot has boosted the dollar, making commodities more expensive for holders of other currencies.

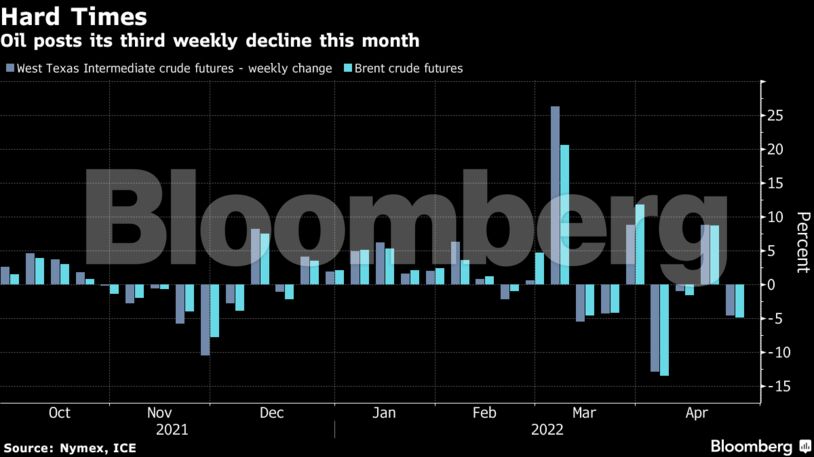

Oil remains about 35% higher this year, despite the recent weakness, as the fallout from Moscow’s invasion of Ukraine continues to rattle markets and roil crude flows. There are calls for the European Union to ban Russian oil, matching steps taken by the U.S. and U.K. Support for prices has also come from interruptions to supplies from Libya amid a wave of protests.

“We’re in this middle ground area where we are waiting to see whether EU will ban Russian oil,” said Fiona Cincotta, senior financial markets analyst at City Index Ltd. That’s the one event that will change the course of oil prices considerably.”

| Prices: |

|---|

|

Shanghai, China’s main commercial hub, vowed to step up the enforcement of lockdown measures, disappointing expectations that its outbreak had peaked. Reflecting the drag caused by the disruption, economists polled by Bloomberg lowered their growth forecasts for the country once again.

Still, Morgan Stanley raised its forecasts for Brent crude by $10 for both the third and fourth quarters. The bank said it sees tighter market balances, with a deficit of about 1 million barrels a day persisting throughout the year, according to an April 21 note.

“Risks to prices are skewed to the upside,” the bank said. “We see a high risk that the EU will enact an import embargo for Russian crude, although it would probably be implemented with a lengthy grace period of four-to-five months.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS