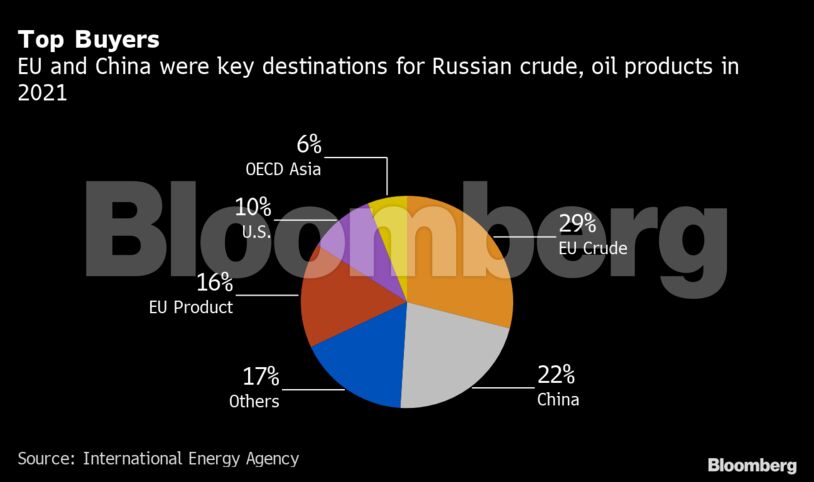

“The implications of a potential loss of Russian oil exports to global markets cannot be understated,” the Paris-based agency said in its monthly report on Wednesday. “While it is still too early to know how events will unfold, the crisis may result in lasting changes to energy markets.”

Sanctions on trade with Moscow and widespread condemnation of its aggression have rendered Russian oil almost untouchable to traders, with companies from TotalEnergies SE to Shell Plc pledging to curtail purchases. International crude prices rocketed to a 13-year high near $140 a barrel last week, though have since pulled back sharply.

Russian oil production could plunge by 3 million barrels a day to 8.6 million a day from next month, further squeezing a world market already strained by the post-pandemic rebound in demand, said the agency, which advises most major economies.

World markets now face a shortfall in the next two quarters instead of previously anticipated surpluses, the IEA said. That will force developed nations to further deplete oil inventories that are already at their lowest since 2014.

With Russia’s fellow exporters in the OPEC+ coalition so far refusing to fill the gap, the IEA repeated that its members — which include the U.S. and Japan — are willing to release more from emergency oil stockpiles. Nations announced the deployment of 60 million barrels at the start of the month.

OPEC+ leader Saudi Arabia has rebuffed pressure from Washington to open the taps faster, partly to preserve its political ties to Moscow and partly from a belief that markets remain adequately supplied for the time being. U.K. Prime Minister Boris Johnson is visiting Riyadh and Abu Dhabi in a bid to change their mind.

The crisis is also inflicting a hit on global economic activity, and with it, oil consumption.

The agency slashed forecasts for demand growth in 2022 by a third as the inflationary pressure from elevated commodity prices depresses growth. Oil use will increase by 2.1 million barrels day this year.

Normally such a steep revision to the demand forecast would dominate the report, but the changes to the supply outlook are even bigger. Projections for non-OPEC production, which includes Russia, were cut by 2.1 million barrels a day for the year, double the reduction to the demand-growth estimate.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire