The solar surge is a testament to the mounting appeal of sun-based electricity to power daytime operations of companies. Texas is expected to see unprecedented electricity demand growth during the next two years to satisfy the needs of enterprises flocking to the state—including crypto miners. Much of that demand will be met with new generation from renewable energy sources, even if not everything planned gets built.

The state’s grid operator, Electric Reliability Council of Texas, expects crypto mining alone to account for several gigawatts of new demand in that period. Peak power demand next year will be 7.7% above 2021 levels, Ercot data show.

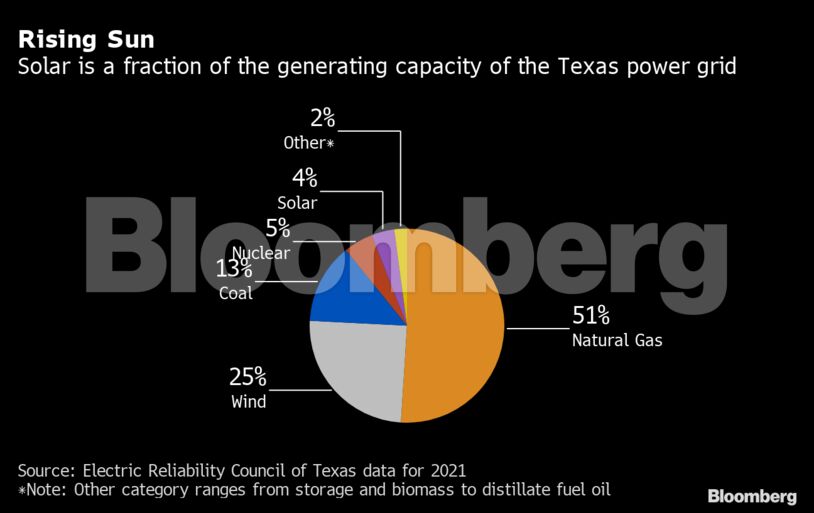

Some oil and natural gas operators in Texas already rely on solar power, and the sun’s energy may prove useful for the flurry of big companies including Tesla Inc., Oracle Corp., and Charles Schwab Corp. that have relocated headquarters to the state in the past two years. Still, much of Texas today relies on power produced from natural gas and wind, followed by coal and nuclear. Solar accounted for 3.8% of the generating capacity of the state’s power grid in December.

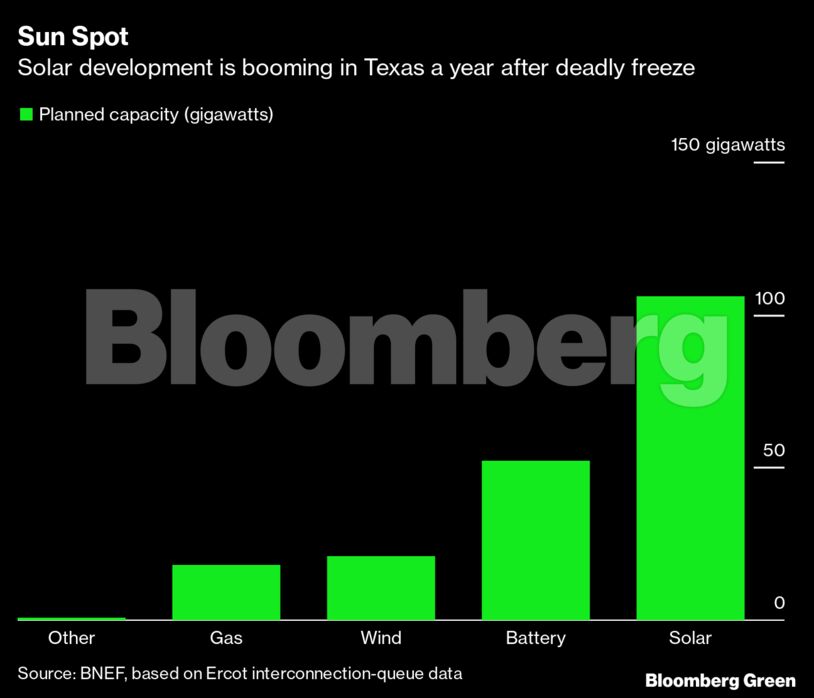

For solar developers, the motivation is clear: Texas is a market that boasts the fastest growth in power demand in the U.S., has cheap land and abundant sunshine. There are 106 gigawatts of solar developments lined up with Ercot, according to BloombergNEF, Bloomberg’s energy data and analysis unit. A gigawatt is enough to power about 200,000 Texas homes.

“No one is sitting around saying ‘Are new solar additions going to slow down or collapse,’” said Tara Narayanan, a solar analyst at BNEF. “The only question seems to be ‘How high is this going to go?’”

Solar developers and their investors are betting on Texas a year after the failure of the state’s grid during a deadly winter storm prompted a backlash against clean power. Widespread blackouts stoked speculation among some conservatives and fossil-fuel proponents that frozen wind turbines were to blame, even though failing gas plants were the bigger culprit. Still, Republican lawmakers in the state considered slapping fees on new clean-power projects, a threat that made investors skittish.

So far, there haven’t been any new fees or laws that could deter renewable-energy projects in Texas. Deals are still happening in the state, and several developments are in the pipeline that pair solar with battery storage. Texas, the biggest U.S. wind state, also has low barriers for entry—including light regulation—and offers owners of generators the prospect of high summertime power-price spikes.

Last year’s deep freeze ended up being a “hiccup” for the market, according to Caton Fenz, chief executive officer at ConnectGen LLC, a Houston-based clean-power developer that has about one gigawatt of renewables developments in the state. Texas saw a brief drop in projects—“then it shot back up,” he said in an interview.

The state makes it easy to find spots for projects since there’s an abundance of low-cost land and the sun’s intensity is strong, said Meranda Cohn, spokeswoman for Vistra Corp., the largest Texas electricity producer. Developers are also experiencing long delays for connecting to grids in other regions, she said.

“Texas has become a haven for developers because of these qualities,” Cohn said.

Ercot’s solar capacity will jump to more than 20 gigawatts by summer 2023, about seven times more than early last year, the grid operator’s Interim CEO Brad Jones noted during a December town hall meeting north of Dallas.

“We want generation coming to our state,” Jones said at the gathering. “We are really the only grid in the nation that is growing.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS