Oil has rallied from a pandemic low of around $16 to nearly $92 on Friday as the global economy recovers from the pandemic and the Omicron variant of the coronavirus has little impact. However, just when buyers will buck high prices to refill depleted storage is disputed by banks and analysts.

Even top energy watchdog the International Energy Agency (IEA) says the ups and downs of the pandemic are clouding the ability to model a trend.

Global jitters over a possible Russian invasion of Ukraine and a slew of supply shocks have addled the market and keep pushing oil up, exacerbating inflation and threatening the world’s economic recovery. read more

“Tank bottoms are in sight across crude and products worldwide already,” research consultancy Energy Aspects said.

Storage tanks are extremely low and major producers in the OPEC+ alliance are struggling to pump enough to meet pledged production targets, it added.

“There is a growing acceptance that the oil market has few, if any, shock absorbers left.”

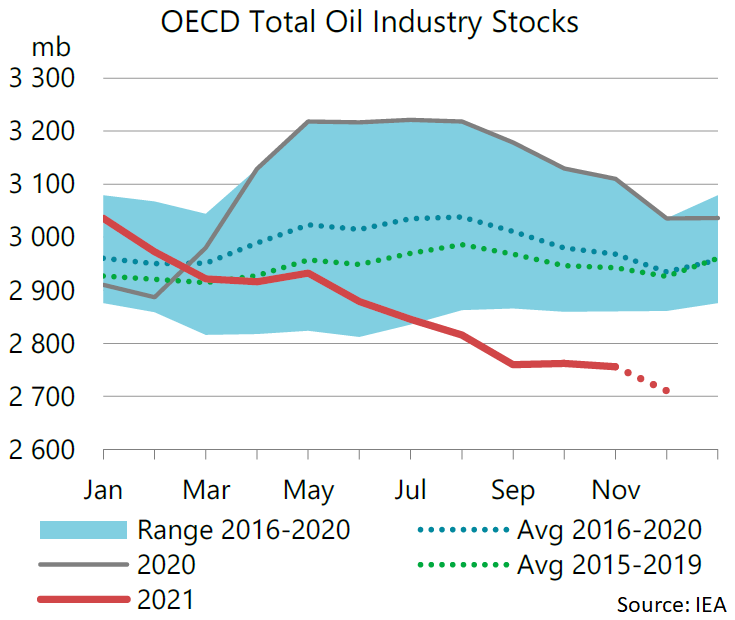

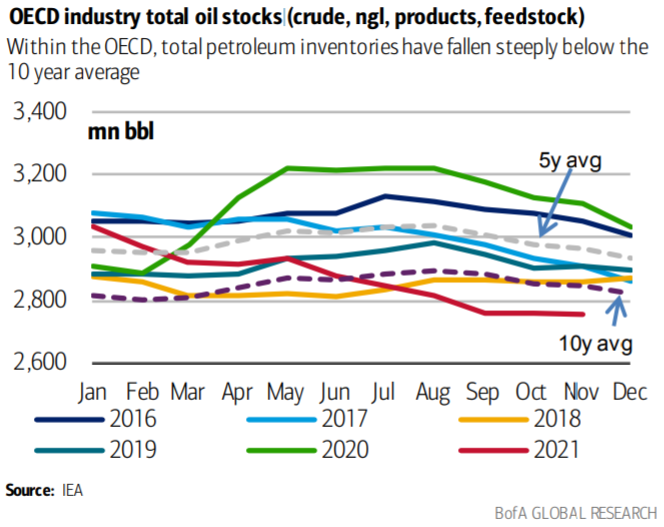

Storage levels in OECD countries plumbed seven-year lows in November and were on track to fall more in December, according to the IEA.

Europe and especially the Asia-Pacific countries, led by Japan and South Korea, were the most depleted of the prosperous bloc of countries.

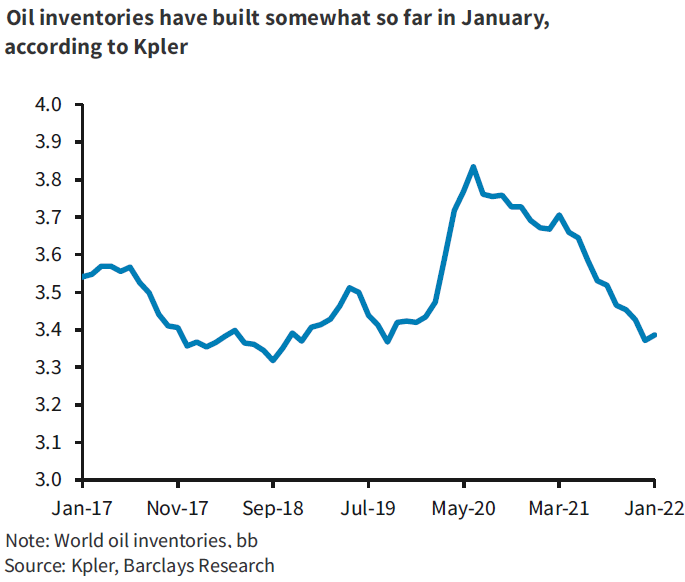

Stocks ballooned during pandemic lockdowns to a record peak in July 2020 of 3.2 billion barrels but have since hit 2.8 billion, the IEA says.

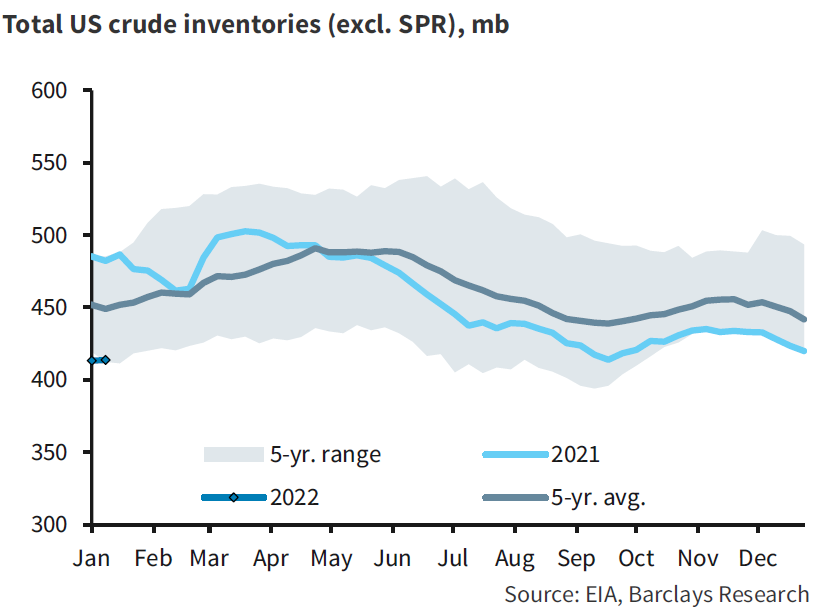

Shoots of recovery could be starting in the United States, where crude stockpiles have built back up in the last two weeks having hit 413.3 million barrels in early January, the lowest since October 2018, according to data from the Energy Information Administration.

U.S. storage could get a boost as already purchased oil gets stored up, according to Robert Yawger, director of Energy Futures at Mizuho Securities USA.

“The refinery utilization rate tends to slide at this time of year … Less crude oil will run through the refinery, and those unused barrels will get stuffed in storage.”

At the same time, global oil storage worldwide is on track to rise slightly in January, tracking firm Kpler found.

Just when the storage slide will reverse consistently divides opinion.

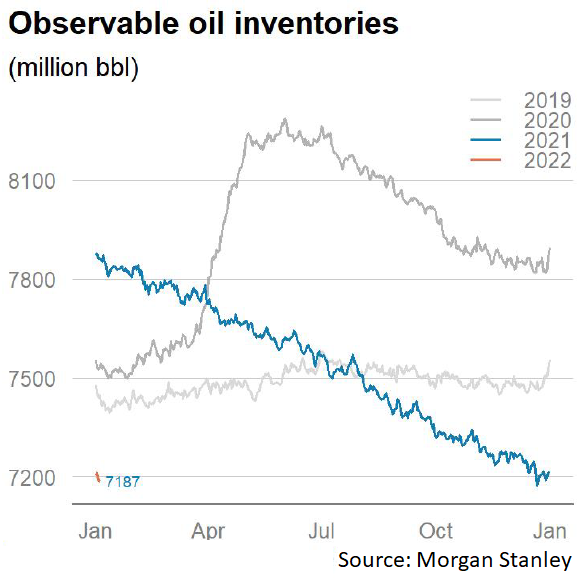

Morgan Stanley predicts inventories will slide yet further in 2022 and Goldman Sachs sees storage in developing countries hitting their lowest since the turn of the century.

Consultancy FGE, however, forecasts stocks starting to build in coming weeks.

Even if storage only pulls up slightly above current multi-year lows, that demand will guarantee a boost to oil prices, Barclays said.

“We do expect a surplus this year … inventories are likely to remain depressed, which should keep prices supported.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein