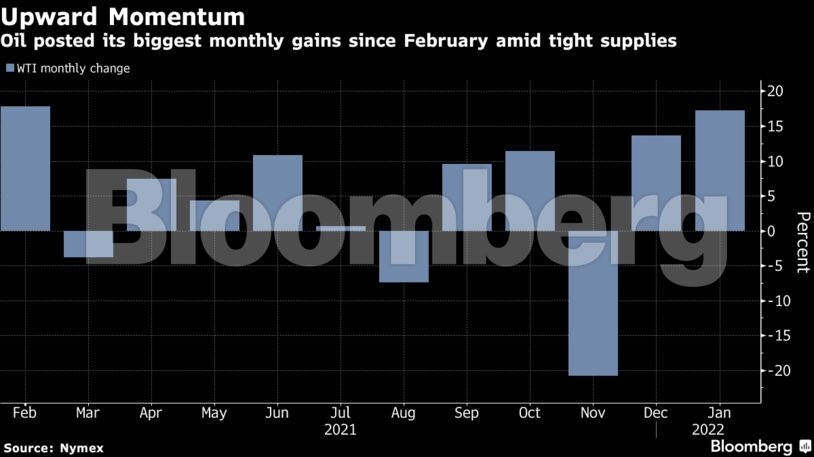

West Texas Intermediate futures fell 0.2%, after the strongest performance in about a year last month. Crude’s recent surge has been supported by a tight global market and geopolitical concerns over Ukraine, even though Russia has denied it plans to attack its neighbor. While most analysts expect OPEC+ to maintain its supply increases, Goldman Sachs Group Inc. warned the recent price surge could mean the group may deliver more than expected.

Demand signals and the risk of an escalating Russia-Ukraine crisis are likely to be discussed by the Organization of Petroleum Exporting Countries and its allies when they convene on Wednesday. The group is expected to ratify another 400,000 barrel-a-day increase for March, although there have been signs in recent months the alliance has not met its production target in full.

“Oil markets are steady with traders cautious ahead of the OPEC+ meeting,” said Daniel Hynes, a senior commodities strategist at Australia & New Zealand Banking Group Ltd., adding that the group is likely to continue with its monthly increase in quotas. “However, the market will be keen to hear whether producers are able to increase output given the struggles they have had.”

A bullish signal is emerging in the U.S. with Texas facing an Arctic blast this week that may freeze oil and natural gas production areas, potentially causing another supply shock. Still, it currently looks less likely to lead to a repeat of last February’s cold snap that triggered catastrophic blackouts and left more than 200 people dead.

| Prices |

|---|

|

Oil has roared higher over the past year as energy consumption continues to bounce back from the hit caused by the pandemic. That’s depleted inventories and underpinned a bullish backwardated pricing structure, with near-term contracts commanding a premium to those further out. Banks including Goldman Sachs have forecast crude will hit $100 a barrel this year.

Despite its warning about an surprise OPEC+ move on production, Goldman Sachs said it remained bullish on oil. Stockpiles are “incredibly tight,” and given the strength of demand there’s a need for sharply higher prices, the bank’s analysts said in a Jan. 31 note.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran