MUMBAI, Feb 4 (Reuters) – Crude oil prices are likely to rise above $100 per barrel due to strong global demand, market strategists said this week, citing a potential war between Russia and Ukraine as one of their top concerns for markets in 2022.

Oil prices would gain if global supplies got disrupted, and as “substitution” demand from sky-rocketing natural gas prices in Europe and Asia picks up, along with re-openings from COVID-19 lockdowns, which will propel demand for aviation and other fuels, three strategists told the Reuters Global Markets Forum (GMF).

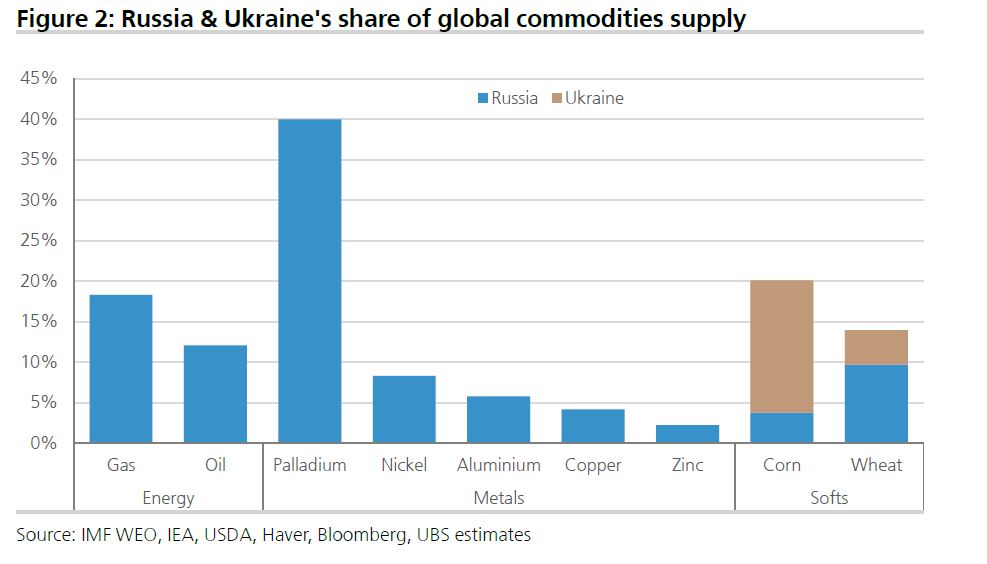

“The top geopolitical risk is Ukraine,” said John Vail, chief global strategist at Nikko Asset Management in Tokyo. “The trend looks good in general for commodities.”

The United States warned on Thursday that Russia has formulated several options as an excuse to invade Ukraine, including the potential use of a propaganda video showing a staged attack. Moscow dismissed the charge and has in the past says it is not planning an invasion.

Bjarne Schieldrop, chief commodities analyst at SEB in Oslo said oil prices in equivalent terms already look “cheap” in comparison to natural gas.

If war breaks out between Russia and Ukraine, natgas prices could rise to “$200 to $250 per barrel of oil equivalent (as) up to 600 terawatt-hour worth of natural gas imports — the spot volume — from Russia to Western Europe would be lost,” Schieldrop said.

Brent crude was 55 cents or 0.6% higher at $91.67 a barrel by 0807 GMT, after rising $1.16 on Thursday.

Invesco’s Hong Kong-based global market strategist David Chao predicted crude prices may rise by 10%-15%.

“This would then place tremendous upwards pressure on inflation in Western countries that would force many major central banks to pre-emptively raise policy rates,” Chao said.

Nikko’s Vail believes central banks will have a hard time taming surging inflation, and expected the U.S. Federal Reserve to hike interest rates seven times this year.

Chao said emerging markets were likely to see some fluctuation heading into the first Fed rate hike, but cyclical divergence and lower operating leverage will keep them supported.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS