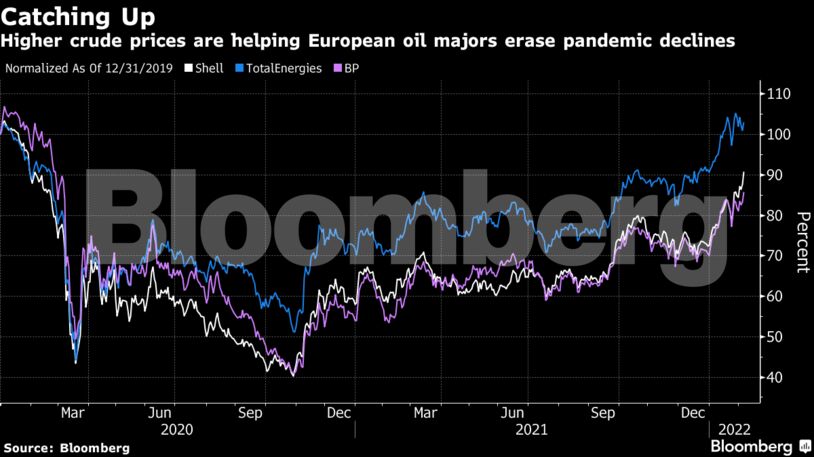

Energy stocks have had the best returns in Europe so far in 2022 and strategists are bullish on a sector that underperformed in the past three years. A tight market and tensions around Ukraine have sent crude prices soaring. Now, investors are looking to earnings and guidance from the biggest companies to see where the stocks go from here.

“Energy stocks are an attractive diversifier as the sector remains absolute and relative cheap with ongoing earnings upgrades,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “On top, the sector could also benefit from geopolitical tensions, strong nominal GDP growth in 2022, rising bond yields and heightened inflation risks.”

Shell led gains on Friday, rising for a second day after expanding its share buybacks as the company reported profit that blew past analyst estimates.

While Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital, is bullish on energy for the first quarter, he expects gains to be capped around March due to concern about a slowdown in China as well as the seasonal decline in demand.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet