By Geoffrey Cann

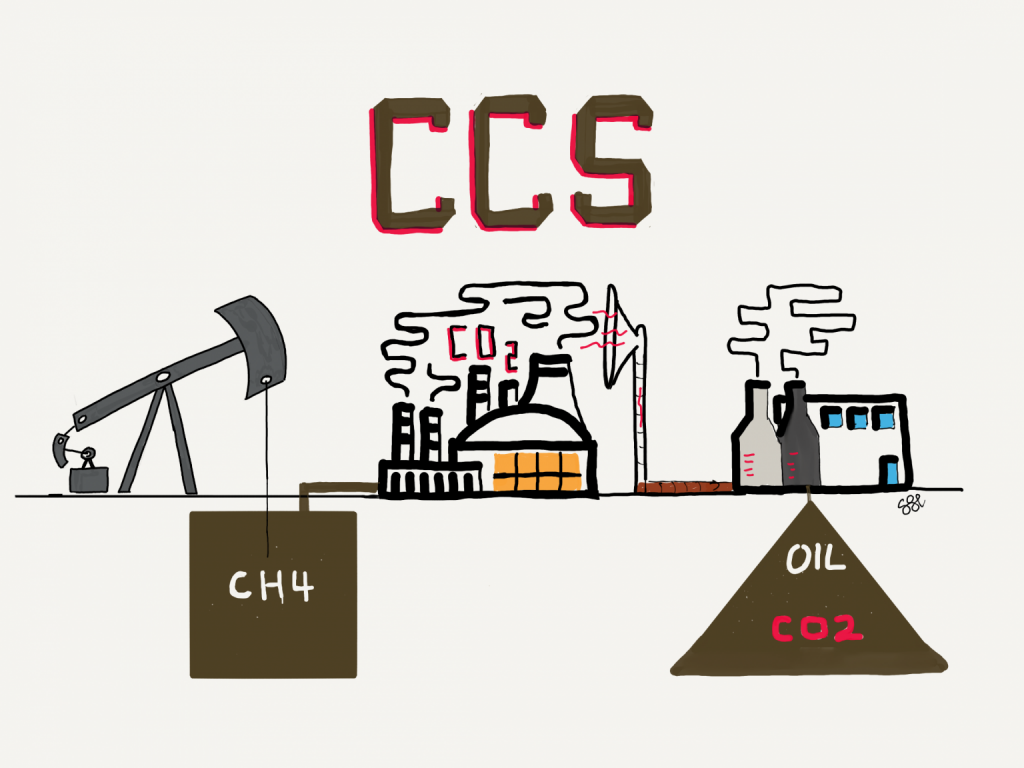

Carbon capture and storage (CCS) is the reverse of an integrated liquified natural gas export project. Here’s how digital makes CCS projects more valuable.

CCS Is The Mirror Image of LNG

In the drive to decarbonize their economies, few nations have the capital and borrowing capacity to completely replace their existing energy supply chains. Indeed, to keep energy supply secure during diversification or transition to renewables, national economies will continue to rely on their existing hydrocarbon fuels and their energy delivery systems, despite the fact that those fuels are adding to the carbon problem.

That’s why carbon capture and storage continues to get a hearing among energy analysts and governments. It’s a thing because there are numerous large scale sources of carbon dioxide wherever there is a large industrial heat source based on combusting a hydrocarbon fuel (ie, a gas or coal power plant that generates electricity, or a cement plant, or district heating), and there are plausible places to store CO2 back underground. CO2 is also handy as a mechanism to improve oil reservoir recoveries (CO2 doesn’t mix with the oil and can push the oil into place for recovery).

In a perfect world, we could sort out how to extract carbon dioxide straight from the air, at scale, like a forest, but we don’t know how to do that yet. Capturing CO2 from car tail pipes is impractical given the 1.2 billion cars out there and the need to retrofit them all for what would individually be too little gas to make a difference. Same for adding CO2 recovery to all those little burner tips in the typical household, such as the hot water heater or the cook top.

Carbon capture and storage is actually misnamed. It should actually be carbon dioxide capture, liquefaction, and storage, because that’s what these projects entail:

- Commercially secure a reliable scale source of unwanted gaseous carbon dioxide that would otherwise be vented to the atmosphere.

- Capture the gas and transport it via pipeline to a treatment and liquefaction facility.

- Treat the gas, removing impurities, and condense the gas into a liquid.

- Inject the liquid into an underground reservoir where it can be stored forever.

This is the reverse of a traditional methane LNG project:

- Commercially secure a reliable source of gas (methane from an underground reservoir), and, ideally, lock in a market that will purchase and consume the gas.

- Extract the gas from the underground reservoir.

- Transport the gas via pipeline to a liquefaction facility, usually on a coastline.

- Treat the gas to remove any impurities and liquefy the gas.

- Ship the liquid by vessel to market.

Regardless of whether methane is being extracted, or CO2 is being injected, financing these large scale industrial projects depends on long off-take contracts that provide the guaranteed cash flow to the debt markets, proving the ability to service the debt. In the case of LNG, it’s the contracts with the gas utility that buys the methane for 20 years. In the case of CO2, it’s the carbon tax avoidance that allows an existing scale emitter to avoid replacing their entire energy supply.

The key operating difference looks like getting the geology right. Liquid CO2 can’t be transported long distance by pipeline (as it warms up it will want to become a gas), so the liquefaction facility needs to be very close to the reservoir. A gigantic, and nearly depleted oil field, would work nicely.

Lessons from Down Under

I moved to Australia in 2012 to work on the east coast LNG projects because I was certain Canada would sanction more than one of its proposed 21 projects, and I’d get to work on one. Got that wrong. Meanwhile, I had a front row seat to the reality of building these large scale projects, seeing what works and what doesn’t.

The Australian government, through its R&D arm called CSIRO, commissioned a study looking back at its LNG projects to ask what would need to be done differently to reduce their expansion costs. I had the great fortune to work on this assessment. We concluded that if a standard LNG project (in-country gas wells, gas compression assets, transmission pipeline, and LNG manufacturing trains) were delivered 12 months faster, the project would reduce its 20 year break even cost by $1/gigajoule produced. A nine million ton per year plant produces 455.97 million gigajoules annually. Over 20 years, that’s a $9b saving.

While Australia struggled to build its projects on time and on budget, Exxon built a new facility in Papua New Guinea (a developing country, unlike Australia, which is fully developed) ahead of schedule and under budget. The facility produced several months of LNG cargos before the debt repayment kicked in, giving the project huge cash flow benefits (in the billions).

Australia learned a lot of lessons from its experience in building three large LNG projects cheek-by-jowl in Queensland, including:

- Have projects collaborate on common use infrastructure, such as transmission pipelines, so as to avoid overbuilding capacity.

- Set aside energy corridors through which network infrastructure can be built so as to minimise ground disturbance.

- Avoid too many simultaneous large scale projects that can overwhelm local construction capacity, and trigger cost escalation.

- Plan for expansion which improves project economics, provided that the original project included underutilized assets, like tankage, pipelines, and power generation.

- Figure out how to monetize the waste energy involved. Chilling gas to a liquid releases a lot of heat that could be recycled, such as into agricultural green houses or food processing.

- Build the physical plant as a series of modules and transport to site, rather than pursuing a stick-build approach.

- Carefully manage the engineering and construction contracts and information assets so that the resulting business had the data it needed to operate the plant.

- Challenge the tendency among engineering suppliers to simply copy the plans from the last project, which fails to take into account improved tools and techniques.

Digital and Gas Manufacturing

Australia’s gas developments predated the digital era. The projects were designed as if the internet did not exist, cloud computing was mythical, mobile computing was not a thing, and big data was beyond reach. Imagine designing a project, let alone a business, today with those assumptions.

Here are some of the digital design parameters that I would be building into any CCS project that might be coming forward:

- Get the geology right. Build very serious models about where the CO2 is going to be sourced and stored so that the siting of the liquefaction plant is optimized. Australia’s east coast plants didn’t quite get the geology right, and spent the first several years building wells that were heroically over engineered for the conditions.

- Build a digital twin of the entire business, not just the liquefaction facility, and run the twin thoroughly under as many operating conditions possible. Run the twin not just as an integrated gas manufacturing facility, but also the construction of the facility. For example, Australia’s LNG projects were predicated on an oil price that didn’t go below US$50, and that there was ample construction capacity available for three separate simultaneous $10b projects.

- Link the full construction chain, end to end, from steel foundry to fab shop, into a single as-built database. Include the module yards and their subcontractors. One of Australia’s LNG projects commissioned 4 separate engineering contracts to build the main components, resulting in 4 separate and incompatible operating datasets about the business.

- Build the operating infrastructure (SCADA systems, PLCs, controllers) around an evergreen model, the way military kit is built. These plants will last a long time and they can’t simply be frozen forever in their as built state. Imagine buying a fighter jet for the next 30 years, but discovering that it cannot ever be upgraded to deal with the latest inbound missile.

- Design the facilities like an automotive manufacturing facility, with as much robotic execution as possible, and then layer in the human supervisors. Australia pursued the old fashioned model of design for the asset, and then layer in ample human facilitators. Once designed, this cost is very painful to extract.

- Imagine as many of the assets as possible to run lights-out, with no humans on site. See that the control rooms are fully virtualized. Australia’s projects had state of the art control rooms, but they were also located on the most expensive real estate in Queensland’s capital, Brisbane.

- Collapse the three solitudes (operating technology, information technology, and digital technology) under a single line manager. One of Australia’s projects had an operating server failure at one of their field assets, but the logon ids and passwords for recover were not managed anywhere close to the standard expected for commercial systems. 100 wells in a gas field were down for 72 hours while the managers called around to track down the right engineer with the password for the rogue server.

Conclusions

A lot of community money is going to be spent on these CCS projects. Smart operators will insist that these projects be designed with an eye not just to their day one operating requirement, but their operating needs five years from now.

Check out my book, ‘Bits, Bytes, and Barrels: The Digital Transformation of Oil and Gas’, coming soon in Russian, and available on Amazon and other on-line bookshops.

Sign up for my next book, ‘Carbon, Capital, and the Cloud: A Playbook for Digital Oil and Gas’, coming March 15, 2022.

Take Digital Oil and Gas, the one-day on-line digital oil and gas awareness course on Udemy.

Mobile: +1(587)830-6900

email: [email protected]

website: geoffreycann.com

LinkedIn: www.linkedin.com/in/training-digital-oil-gas

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire