The country’s output and exports have been closely scrutinized by traders and European policymakers as gas prices in the region climbed to unprecedented levels in the winter, contributing to inflation and a cost-of-living crisis. Gazprom PJSC’s capped deliveries have partly been blamed, including by the IEA, for the crisis.

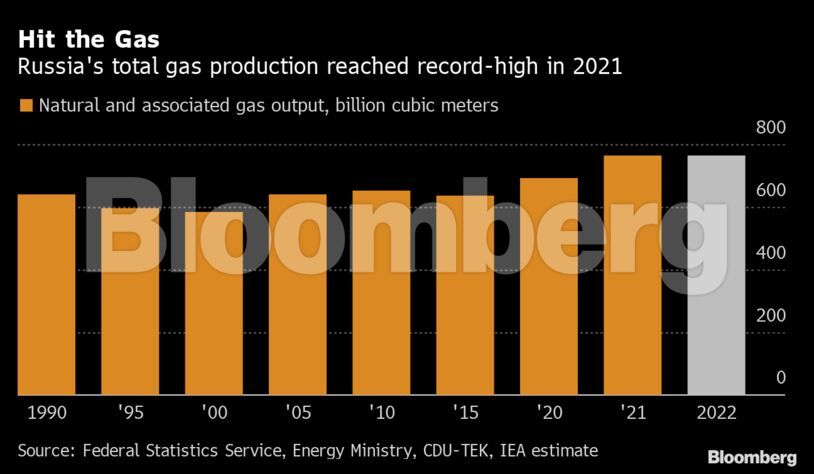

Russia is set to pump 763 billion cubic meters of gas this year, the IEA said in its quarterly report on Monday. That would be the highest annual output in over 30 years, based on governmental statistics.

But higher production doesn’t always mean more exports. Russian gas output last year reached an annual record of 762.8 billion cubic meters, but Gazprom, the nation’s pipeline-gas export monopoly, sold just over 185 billion cubic meters to its key overseas markets. That’s only the fourth-highest yearly exports for the company.

Gazprom has often said its shipments to Europe are fully in line with contract obligation and requests from clients. But flows were markedly below the seasonal levels in the last quarter of 2021.

With Russia sticking to its strategy of capped deliveries to the continent in the first weeks of this year, market watchers are divided over whether flows will continue to stay low through the remainder of the heating season. Analysts at Citigroup see exports flat in the first quarter, but Sinara Financial Corp. forecasts a rebound from February or March.

Russia’s standoff with Western countries over Ukraine could make Europe’s crunch worse this year, especially if the Kremlin attacks its neighboring nation. The European Union and the U.K. are considering sanctioning new Russian gas projects in case of a military attack, and Gazprom’s Nord Stream 2 pipeline may also be a target. Russia has repeatedly said it has no plans to invade Ukraine.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire