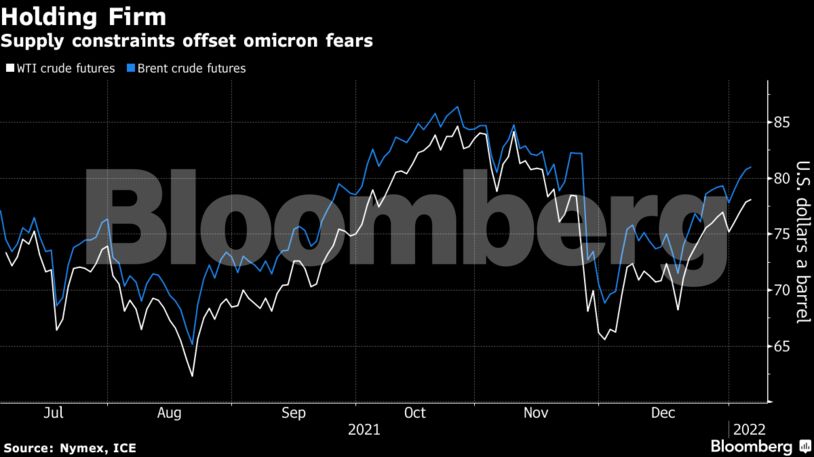

Futures held near $78 a barrel in New York after recouping earlier losses. A deep-freeze in Canada and Northern U.S. is disrupting oil flows, causing a surge in prices just as American stockpiles decline. Furthermore, a growing premium for prompt barrels suggests that supply troubles across the OPEC+ coalition — which was able to provide only part of last month’s planned production increase — are delaying the onset of oversupply.

Concerns over the group’s capacity were stoked on Thursday as protests in Kazakhstan posed the biggest challenge to the central Asian country’s leadership in decades, prompting Russia and its allies to say they would send troops. Production in OPEC member Libya is down around 40% amid militia unrest, while Russia failed to boost output last month.

Still, prices face headwinds as China locks down some cities to try and stem the spread of the worst Covid-19 outbreak since the initial flareup in Wuhan. Meanwhile, Federal Reserve officials said a strengthening economy and higher inflation could lead to earlier and faster interest-rate increases than previously expected, according to minutes published Wednesday.

“Oil is probably drawing support from supply issues, as the freeze in North America impacts production and concerns emerge over a potential disruption in Kazakhstan,” said Giovanni Staunovo, an analyst at UBS AG in Zurich.

Oil ended 2021 on a strong footing as the rollout of vaccines helped economies to reopen, boosting energy demand and allowing OPEC+ to maintain its gradual monthly output increases. Some members of the group have struggled to meet their targets, however, curbing the overall expected return of supply.

| Prices |

|---|

|

“Investors are shunning risk assets including oil on potential aggressive Fed rate hikes on top of growing demand worries surrounding China,” said Will Sungchil Yun, senior commodities analyst at VI Investment Corp. in Seoul. “Prices are likely to be under pressure for the short term.”

At the conclusion of the December meeting, the FOMC announced it would wind down the Fed’s bond-buying program at a faster pace than first outlined at the previous meeting in early November, citing rising risks from inflation. The new schedule puts the central bank on track to conclude purchases in March.

IHS Markit further lowered its projection for China’s total oil demand in the first quarter of 2022 by 420,000 barrels a day due to restrictions on mobility. Similarly, Energy Aspects Ltd. cut its first-quarter forecast by 110,000 barrels a day, while warning there is additional downside risk of between 100,000 and 300,000 barrels-a-day if more outbreaks emerge.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire