Hans Beyer, SEB’s chief sustainability officer, says most of the roughly 150 pitches that he received last year weren’t backed by any recognized body validating claims to be permanently removing carbon dioxide from the atmosphere. And some were pitched on the basis of doing nothing at all — merely pledges to avoid emitting CO2 in the future.

The buying and selling of credits that purport to offset a company’s pollution has become a cornerstone of the effort to limit global warming, and it’s being bolstered by a deal to create an international market mechanism struck at the COP26 talks in Glasgow last year. But the regulation of projects to cut carbon and win those credits is still its infancy, and amid hopes that the market will balloon to some $180 billion by the end of the decade, opportunism is rife.

“The whole concept of ‘I will not pollute and therefore I should get paid’ solutions are likely the worst,” Beyer said. “This will be a crazy market until it is regulated, completely crazy.”

In an October report, the United Nations warned that without stronger emissions-reduction targets, the world will warm 2.7°C by 2100, with catastrophic consequences. That’s creating a new wave of urgency to announce that businesses will be “net zero” in terms of carbon emissions within the coming decades. Global banks with a combined $130 trillion balance sheet are piling in.

At COP26, global leaders agreed on general principles for projects that generate carbon credits, which include initiatives as diverse as re-forestation, renewable power installation or measures to help household energy efficiency. The guidelines now say that projects which generate credits by claiming to remove carbon emissions must not have been done otherwise; reductions must be long-term and not lead to polluting elsewhere. COP26 also agreed to the creation of a registry, to track credits and the use of proceeds from their issuance.

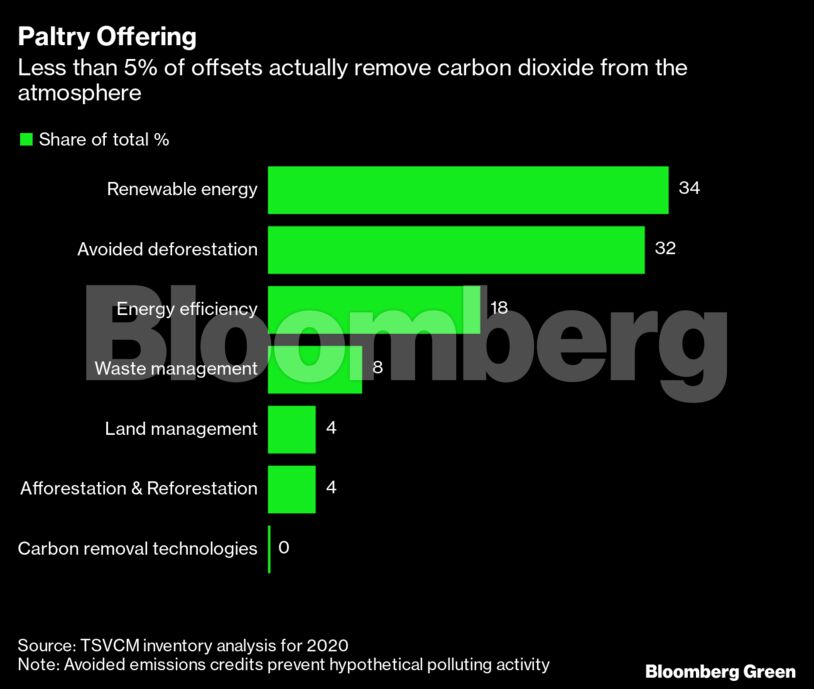

As of now though, the industry is covered by a patchwork of voluntary, private-sector standards bodies that fall far short of joined-up global oversight. Skepticism over the real carbon-removing credentials of projects is also growing, and only a tiny fraction of projects actually remove CO2 from the air.

Read More: BNP Chairman Worries Structured Finance May Add to Greenwashing

“We need regulation,” said Alberto Carrillo Pineda, the founder of the Science Based Targets initiative, a voluntary program for reviewing plans that aim for zero emissions by 2050. Considered among the best available, the standards set by Pineda’s organization limit businesses’ use of credits to offset only so-called residual emissions, those that are left after real cuts to operations are made.

Demand for offsets is soaring as companies race to make “net-zero” commitments — pledging to eliminate emissions from their activities or balance them with an equivalent amount of greenhouse-gas removal. Pineda says investors and consumers increasingly are deciding where to put money based on the plans, yet there’s little to hold companies accountable for the promises they make. Regulatory focus is on “risk and disclosure,” not “ambition and performance.”

Worth just $300 million in 2019, the offset market could climb to $180 billion in 2030, according to the Task Force on Scaling Voluntary Carbon Markets, a body backed by the Institute of International Finance, a financial industry lobby group.

Europe is making the fastest progress toward setting out rules. The European Commission took a first step in December, proposing a framework for certifying carbon removal projects as part of a larger plan to create demand for credits that would be generated by European farmers and forestry companies.

The market’s potential is “significant” but a lack of trust stands in the way, the commission said. “Private schemes apply very different benchmarks and rules to the carbon credits placed on the voluntary markets.”

Compensate, a Finnish non-profit that manages a portfolio of carbon-credit projects, last year reviewed more than 100 certified by leading organizations. It found just 10% met its criteria on ensuring that projects didn’t inflate carbon savings, weren’t already planned and other factors including human rights.

The offset industry is responding. In recent years, standard setters have excluded issuing credits from new renewable energy projects in developed economies, and demanded increased monitoring of projects to ensure they deliver, according to a 2021 report by Ecosystem Marketplace. Specialist rating agencies akin to credit rating companies are being established to provide more guidance.

Even the financial industry isn’t completely equipped to gauge the quality of projects and their role in net zero plans, making such changes critical, says Ana Haurie, chief executive of Respira International, which invests in and brokers long-term projects. While needed, regulation takes time, something the planet and polluters don’t have.

“The cost of inaction may well be higher both financially and in terms of climate strategy,” Haurie said.

For banks, the market represents a way to offset their own emissions and those of companies in which they invest and to which they lend — and earn fees in the process. So-called “financed emissions” exceed banks’ own direct emissions by as much as 700 times, by some estimates.

Developers already are ramping up production, with issuance through November twice that compared with the same period a year earlier, according to data compiled by BloombergNEF.

Amid growing criticism that low-quality offsets are being used as a license to justify ongoing pollution, some corporate actors have started using the label “carbon neutral” in marketing campaigns as a workaround instead. Consumers are told that products have been made “carbon neutral” even though the companies don’t count the offsets toward their official net-zero goals.

The confusion around terminology is “a new door for greenwashing,” said Francois Millet, head of ETF strategy and ESG at Lyxor Asset Management.

Various industry associations for the asset-management industry are currently working on providing more guidance to their members, who manage more than $55 trillion. The organizations have recommended use of credits only when emissions cannot be cut because of financial or technical constraints, according to a Net Zero Investment Framework launched in 2021.

The goal is to deliver more specific recommendations before April, according to the Asia Investment Group on Climate Change, whose members include Amundi SA, BlackRock Inc. and Shin Kong Life. The organization declined to provide more information.

But such industry initiatives aren’t enough, says Jonathan Crook, a policy expert at the not-for-profit Carbon Market Watch.

“Many firms will continue to bend already lax rules and take advantage of the lack of regulation to simply greenwash themselves and their products.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS